Chinese PV Industry Brief: JinkoSolar posts 19% spike in PV shipments in 2024

JinkoSolar says its global PV shipments grew 19.2% year on year to 99.6 GW in 2024, but revenue fell 22% to CNY 92.2 billion ($12.64 billion) due to a decline in module prices.

Where will lithium-ion battery prices go in 2025?

After tumbling to record low in 2024 on the back of lower metal costs and increased scale, lithium-ion battery prices are expected to enter a period of stabilization.

Japan keeps lead in solid-state battery development

While China, South Korea, Europe, and the United States are also engaged in active development of all solid-state batteries, Japan is leading the charge, offering generous subsidies to technology proponents.

Chinese PV Industry Brief: Stable silicon, wafer prices with minor variations

TrendForce says silicon material and wafer prices stayed mostly stable this week, while Longi Green Energy has signed a strategic deal with China Energy Construction for green energy projects.

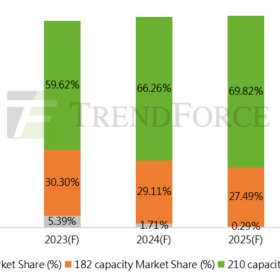

Top PV module manufacturers by shipment volume in 2022

TrendForce has ranked the top six module manufacturers by shipment volume in 2022, with Longi topping the list, followed by Trina Solar and JinkoSolar. JA Solar, Canadian Solar, and Risen Energy rounded out the top six, in a year dominated by large-format modules.

Global energy storage market set for rapid expansion by 2025

Taiwanese analyst TrendForce said it expects global energy storage capacity to reach 362 GWh by 2025. China is set to overtake Europe and the United States is poised to become the world’s fastest-growing energy storage market.

Restrictions for solar on agricultural land may slow PV growth in Taiwan

Taiwan-based TrendForce says the nation added only 410 MW of solar capacity to the end of May, towards this year’s 2.2 GW target. The lower-than-expected deployment volume may be further hampered by new restrictions for PV on agricultural land introduced by the Council of Agriculture this month.

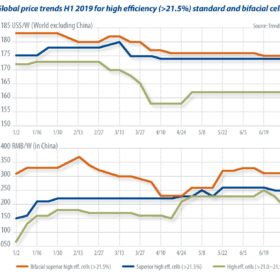

Tendency toward diversification

Looking back at the PV market in 2018, micro module technologies started maturing in development and moving on to mass production, writes TrendForce analyst Lions Shih. Modules are no longer limited to a single design as before, but rather continuing on the path toward diversification in 2019. The situation is spreading into other areas, as may be seen in the upstream silicon wafer and cell segments.

Taiwan’s PV industry to become a GW scale market: The obstacles and opportunities

To keep up with the global shift to renewable energies, the Taiwanese Government has passed the first large set of amendments to its Renewable Energy Development Act since the legislation’s inception in 2009. The amendment bill passed its third reading on April 12, 2019, and was designed to optimize the renewable energy environment, to keep up with the changes to the Electricity Act and to increase civic engagement.

Supply distribution under trade barriers and the trend of market diversification

Despite a number of unfavorable policy announcements, the global PV market still added 101 GW in 2018. It looks likely that this momentum will continue this year, with as much as 110 GW of new capacity expected.