South Korean government reassures domestic PV industry

The country’s Ministry of Trade, Industry and Energy (MOTIE) has provided new market share figures for the domestic PV sector that contradict recent media claims that Chinese manufacturers have been aggressively ramping up their local presence at the expense of Korean module makers. The government has also confirmed plans to prioritize PV projects made with low-carbon, high-efficiency modules.

Scientists analyze toxic gases released from burning thin-film, PET-laminated modules

Scientists from China’s State Key Laboratory of Fire Science have analyzed the combustion behavior of flexible PET-laminated PV panels. They found toxic gases including sulfur dioxide, hydrogen fluoride, hydrogen cyanide and a small amount of volatile organic compounds are released when such a PV system burns.

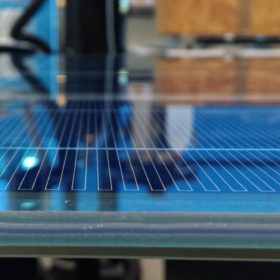

Kaneka tests bifacial heterojunction modules in Japan

The Japanese chemical company has supplied panels for a PV system on the roof of a 7-Eleven store in Kanagawa prefecture.

European Utility Week: ‘The confidence is coming back’

The energy transition is becoming ever more apparent among power companies, as was evident at the European Utility Week event last week in Paris, which showcased the hopes and fears of energy companies. Rebranding next year to ‘Enlit’, the organizers aim to reach the whole energy industry.

Tunisian module maker Ifrisol to increase capacity to 750 MW

The manufacturer plans to add 350 MW of manufacturing capacity at its two sites in Tunisia by next year. The ramping up is due to new orders from India and other foreign markets.

Canadian Solar bags 500 MW panel order from Spain

The modules will be used by U.K. developer Solarcentury for its Cabrera and Talayuela Solar projects in southern Spain.

US brings Turkish PV modules under Section 201 tariff regime

U.S. President Donald Trump has removed Turkey from the list of developing nations that are exempted from Section 201 tariffs on PV cells and modules.

AE Solar inaugurates 500 MW module factory in Georgia

The German solar module manufacturer has commissioned its European module factory in Georgia. The manufacturing facility can be readily expanded to about 1.2 GW and the first 500 MW phase should be fully operational in the course of the next month.

India slaps anti-dumping duties on solar EVA sheets

India’s Directorate General of Foreign Trade (DGTR) has concluded that duties ranging from $537 to $1,559/metric ton will be needed to offset the impact of imports of solar ethylene vinyl acetate (EVA) sheets from China, Malaysia, Saudi Arabia and Thailand. The harshest duty — $1,559/metric ton (MT) — has been imposed on sheets supplied by all Saudi manufacturers other than Saudi Specialized Products.

Astronergy closes German module factory

The Chinese manufacturer first announced plans to close its manufacturing facility in Frankfurt (Oder) at the beginning of this year. About 40 people who worked at the factory will now shift over to a transfer company.