Risen shines: Manufacturer starts work on 2.5 GW cell and module factory

The Chinese manufacturer is forging ahead with a new gigafactory despite a regulatory decision last year which halted its plans to raise a significant chunk of the costs by issuing convertible bonds. Risen expects to be back on the upswing when it confirms its first-half figures.

China’s new solar FIT policy

On April 30, China’s National Development and Reform Commission released the “Improving Issues Related to Feed-in Tariffs for Solar Photovoltaic” notice, the first document that confirms the level of FIT payments for solar projects following several consultation papers issued previously this year. The new FIT rates are set to be effective starting July 1.

2019: A year for critical adjustments

Since the PV module market has already witnessed intense industrial concentration over the past few years, the top 10 manufacturers didn’t change significantly as 2018 unfolded, writes PV InfoLink Chief Analyst Corrine Lin. On the cell side, the decline of Taiwanese cell makers has Chinese cell makers filling the top three spots this year.

PV InfoLink publishes H1 2018 global PV cell/module shipment ranking

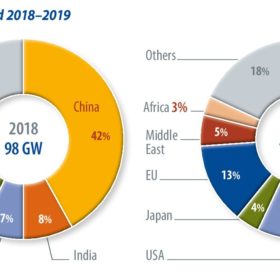

PV InfoLink has released its latest solar PV module shipment ranking for H1 2018. Chinese manufacturers continue to dominate the market, while monocrystalline module shipments increased sharply. Overall, it forecasts total PV demand of 83 GW in 2018.

PV Info Link: Mono-cSi cell price drops below multi

According to PV Info Link, the price for monocrystalline cells in China fell below that of the usually cheaper multicrystalline products. However analysts expect it to be a blip, with multi prices expected to fall and mono to be supported by the Top Runner Program, now China’s main source of demand for the rest of 2018.

Module prices continue to fall

The latest reports from analysts at PV InfoLink and EnergyTrend show prices continuing to fall, though at a slower rate than was immediately seen after China’s 31/5 announcements. High efficiency mono-PERC modules fell to around US$0.32/W, while multicrystalline module prices held steady at between $0.26 and $0.29/W.