Manufacturing amid market concentration

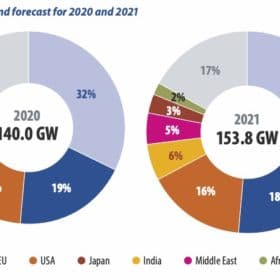

The solar market is expected to grow in 2021, following a year of pandemic-driven supply chain disruptions, exacerbated by explosions at polysilicon plants. PV InfoLink estimates almost 154 GW of module demand in 2021, up by 10% on 2020. Analyst Amy Fang examines the key market trends for the first quarter.

Global PV installations to surpass 150 GW in 2021

Despite pandemic-induced impacts, the PV market was bigger than expected last year. In particular, an installation rush in Vietnam and China took place in December and pushed global demand upward. PV InfoLink estimates that global module demand in 2020 reached 140 GW. Analyst Mars Chang delves into the numbers.

Chinese PV Industry Brief: China could add 65 GW of solar this year as Longi order gives GCL-Poly a much-needed lift

State-owned power company SPIC is all set to contribute to the figures after announcing it wants to add 15 GW of renewables capacity during 2021 and China Glass, fresh from rebuffing Xinyi Glass’ takeover offer, is on the hunt for more manufacturing facilities.

Xinjiang sanctions and the PV supply chain

Due to forced labor concerns, a ban on imports from Xinjiang to the United States appears likely. This could be another blow for polysilicon producers hit by industrial accidents and the threat of floods in the third quarter of 2020. Chinese polysilicon prices have surged more than 50% in a matter of a months. Consequently, wafer prices have skyrocketed, bringing increasing costs to the solar cell and PV module segments. In the face of price hikes, some projects are now postponed until the first half of 2021.

Global PV module demand will reach 143.7 GW in 2021 – PV Infolink

Next year, the global solar panel demand may increase by around 15% and this will be mainly triggered by the completion of projects that were deferred by the pandemic this year.

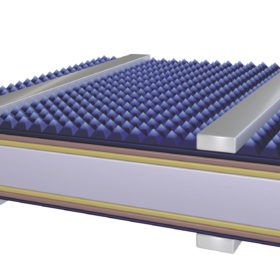

Prospects for bifacial and large-format products

The pandemic and accidents at polysilicon labs in China’s Xinjiang region put PV manufacturers under pressure to maintain production this year, while slowing cell and module R&D. After half-cut and multi-busbar becomes commonplace, manufacturers will continue to explore the high-density assembly methods that emerged last year, as well as n-type cells. But the market is also shifting to large formats, and the share of bifacial products is growing this year. As sizing up modules can bring immediate returns, PV InfoLink’s Amy Fang expects the PV industry to prioritize the development of large formats and bifacial products next year.

China’s Jinergy bets on heterojunction

China reportedly has 10 GW of heterojunction cell capacity already up and running or under construction. Liyou Yang, general manager at Chinese state-owned manufacturer Jinergy that as costs for the technology continue to fall, more manufacturers in Asia can be expected to make the switch.

Bigger and better: Technology

The SNEC 2020 PV Power Expo opened on Aug. 8 in Shanghai. Unlike previous editions, the world’s largest solar trade fair was mostly attended by Chinese participants this year due to the Covid-19 pandemic. While the trade fair used to offer insights into global market trends, volumes were low this year due to a buyer/seller standoff amid rising prices caused by the recent accidents at polysilicon plants in Xinjiang. Also, there was little change in technologies. PV InfoLink’s Corrine Lin offers insights into cells and modules at SNEC 2020.

Consolidation continues for polysilicon makers

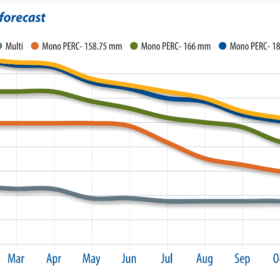

While mono-grade polysilicon prices did not decrease much in the first quarter owing to stable demand, multi-grade fell to record lows as its market share diminished. During the second quarter, writes PV InfoLink senior analyst Cooper Chen, the market saw excessive supply. Monocrystalline manufacturers have been running at full tilt and bringing new capacities online as scheduled, while the pandemic rages on overseas.

Module prices plunge as Covid-19 hammers demand

Some European countries and emerging markets are now showing signs of slow recovery, as the Covid-19 pandemic brought overseas markets to a shuddering halt in late March. However, demand is expected to remain weak through the beginning of the third quarter, writes PV InfoLink’s Amy Fang, as it will take time for overseas markets to snap back. Meanwhile, the Chinese market is again busy with the June 30 installation rush, as the government has left tariff timelines unchanged up to the middle of May.