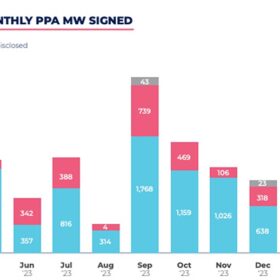

Pexapark says European developers signed 23 PPAs for 944 MW in June

Swiss consulting firm Pexapark says the total capacity of signed power purchase agreements (PPAs) in Europe dropped 36% month on month in June. For the first time, no utility PPAs were recorded, as all deals were corporate.

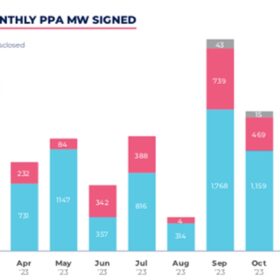

Pexapark says European developers signed 28 PPAs for 1.5 GW in April

Swiss consulting firm Pexapark says the total capacity of signed power purchase agreements (PPA) in Europe in April more than doubled the volume it recorded in March. Meanwhile, all tracked PPA prices rose 1.6% month on month.

Pexapark records 9.8% jump in European PPA prices for March

Swiss consulting firm Pexapark noted a rise in European power purchase agreement (PPA) prices in March, for the first monthly increase since August 2023. It recorded 18 PPAs in March, totaling 718 MW, with solar accounting for 398 MW across nine deals.

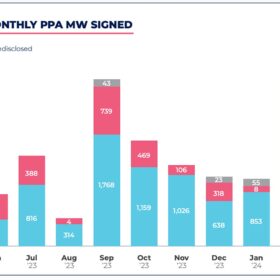

Pexapark says European developers signed 21 PPAs for 916 MW in January

Pexapark, a Swiss consulting firm, says the new year started with “robust activity” for power purchase agreements (PPAs). It says that lower power and commodity prices drove a 12.8% month-on-month decline in all tracked PPA prices.

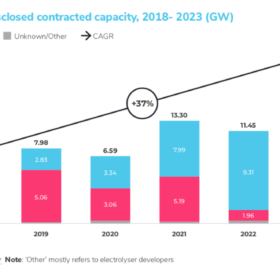

Record number of European PPAs in 2023, says Pexapark

The European market for power purchase agreements (PPAs) reached 16.2 GW in contracted volumes in 2023, up 40% year on year. Pexapark, a Swiss consulting firm, says the result marks a “golden era” for European PPAs, as it predicts the market to surpass 20 GW in 2024.

Co-location, co-location, co-location

Charles Lesser, who leads UK operations at Apricum, and Apricum Project Manager Alexandra Popova explain why the renewables consultancy is predicting a big rise in solar-plus-storage projects in Great Britain.

PPA prices falling across Europe, says Pexapark

Pexapark says power purchase agreement (PPA) prices are falling in Europe, with prices in Spain and Portugal down by 6.4% and 6.2% to €40.90 ($43.99)/MWh and €39.60/MWh, respectively.

Headwinds of the Polish PPA market

Power purchase agreements (PPAs) are growing in popularity in Poland due to high energy prices and the declining appeal of renewable energy auctions. Nevertheless, regulatory changes have created uncertainty and reduced attractiveness.

European PPA market prices fell 15% in December

Swiss consultancy Pexapark says falling energy prices, lower heating needs, and healthy gas reserves have had a calming effect on the European power purchase agreement (PPA) market. It foresees an increase in transactions over the short term.

Weekend read: A game of risk

The rising popularity of “baseload” power purchase agreements (PPAs) has posed questions to solar electricity suppliers in the German market. How can projects that do not generate at night, and with wide seasonal output variation, effectively supply constant power to consumers? More importantly, who shoulders the price risk?