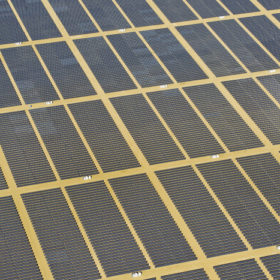

US corporate funding for solar down 24% in 2024

Solar venture capital, mergers and acquisitions, and debt financing funding totaled $26.3 billion in the United States in 2024, says Mercom Capital.

Covid-19 weekly round-up: Solar Solutions show off again but CEOs voice confidence and Spain is moving its green economic recovery up a gear

Plus, solar funding is down and Australian rooftop installers are preparing for tough times ahead as one U.S. utility has warned customers to be alert to scammers hoping to benefit from the pandemic.

Cleantech bosses apparently unbowed by Covid-19

A clean energy and e-mobility executive recruitment firm says 67 chief executives and founders remain relentlessly positive in the face of the public health crisis and expect the global recovery from the pandemic to be led by a green revolution.

First-half solar funding fell by a quarter as Covid-19 bit

The latest PV finance report released by Mercom Capital had solar investment falling almost entirely across the board with the number of new solar funds launched in the last three months offering a rare piece of good news.

Solar industry snagged $27.8 billion in finance for company building, projects in 2019

Mercom Capital has released their annual report for 2019, describing the year as robust and showing company funding of $11.7 billion, up 20% over 2018, on top of announced project deals of $16.1 billion, up 14%.

Solar investment mostly up on venture capital and debt as money pours into large scale projects

Mercom Capital Group’s Q1 2019 Solar Funding & M&A report has registered $2.8 billion in venture capital, public market and debt financing, up from $2.5 billion a year ago. Large scale project financing reached a record $5.58 billion across 43 deals and there were 18 solar corporate M&A transactions.

Solar made up 50% of India’s new power capacity in 2018

The level of new solar capacity – 8,263 MW – however, was 15.5% down from the 9,782 MW added in 2017 owing to safeguarding duty and tax taking a toll on large-scale PV. While utility-scale solar declined 23% year-on-year, rooftop PV remained a bright spot, and registered impressive growth of 66%.

Solar money is all flowing downstream – in the West at least

Mercom Capital’s latest report on financial activity in the solar sector illustrates an increasing flow of capital towards downstream companies and PV projects – as well as a split between China and the rest of the world.

Solar corporate funding rises 15% YoY with $5.3 billion in H1 2018 – Mercom

Despite the uncertainty caused by U.S. solar panel import tariffs, deteriorating trade relations between the U.S. and China, and the looming consequences of China’s PV policy change, the solar industry saw a 15% YoY increase in corporate funding in the first half of 2018, on the back of a Q2 rebound, finds the latest Mercom Capital report.

Report: Venture capitalists fall in love with battery storage

According to a report released by Mercom Capital, venture capital firms showered battery storage companies with money to the tune of US$714 million last year.