Jinko says Hanwha Q Cells lawsuits are without technical or legal merit

The Chinese module maker “categorically refutes” allegations made by its rival that it is using Hanwha’s passivation technology on its solar cells. Jinko added, it does not expect any disruption to normal operations as a result of the lawsuit.

Smart Energy Week in Tokyo: Self-consumption, storage and a plentiful pipeline for now

Though we’re unlikely to see a return to the days of double-figure GW annual installation levels, Japan will stay at the top table of solar. Last week, pv magazine visited PV Expo Japan, part of Tokyo’s World Smart Energy Week, and found plenty of market developments to discuss, along with healthy interest from major players.

Hanwha Q-Cells sues Jinko, Longi and REC for patent infringement

The Korean solar manufacturer has lodged a patent infringement lawsuit against Jinko and REC in Germany, and two more against the same companies plus Longi in the U.S. Hanwha Q Cells claims its three rivals have used its patented solar cell passivation technology to increase the performance of their products.

Hanwha 1.7 GW panel factory is the second US fab to come online this week

Hanwha Q Cells has begun shipping solar panels from its 1.7 GW factory near the Georgia-Tennessee border. The huge facility is the second major U.S. module factory to announce production this week.

If bifacial panels can compete on price the (backsheet) choice is clear

Jinko Solar has launched a new bifacial solar module, with a clear backsheet manufactured by DuPont, to compete with standard glass-on-glass bifacial products, as well to create markets where bifacial might not have previously fit.

China shakes PV world

The solar superpower’s departure from its ambitious PV targets has shaken the industry and put a dampener on share prices. Analysts from U.S. investment bank Roth Capital expect a module oversupply mountain of more than 30 GW as a result of the policy change.

Jinko’s approach to PID-resistant PV modules

Talking to pv magazine, Andrea Viaro, head of technical service Europe for JinkoSolar, explains how the Chinese manufacturer is dealing with PID degradation.

Who is leading the Turkish PV module market?

Turkey recorded its best year to date for levels of solar PV installations, adding 1.79 GW of capacity in 2017. On the back of this, pv magazine takes a look at the most active players in the Turkish PV module market.

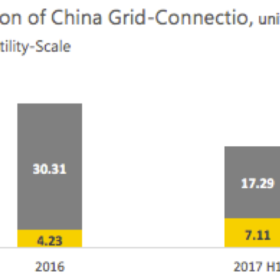

Jinko, Longi neck and neck in H1 Chinese module shipments

Financial reports from PV manufacturers and shipment numbers from the first half indicate high market demand.

Jinko reports further growth

In the second quarter of 2017, the Chinese PV manufacturer shipped around 3 GW of solar modules. However, sales and earnings were not as high as shipments, due to lower selling prices. For the second half of the year, Jinko Solar is forecasting stable module prices and increased profitability.