Flood-related blackouts strengthen case for new REIPPPP round in South Africa

The nation has been plagued by extensive power outages again with debt-riddled utility Eskom blaming heavy summer floods for taking out extensive parts of its coal-fired power generation fleet.

Is Eskom turning to solar?

The South African utility has issued a 20-strong tender for 50 kW solar inverters and mounting structures, to be used in four power plants. Although it is unclear whether the tender marks the energy company’s first step into solar energy, the procurement follows the recent publication of South Africa’s Integrated Resource Plan. Eskom is reportedly developing a renewables-linked large scale storage project which may explain the need for inverters.

South Africa proposes voluntary reduction of tariffs awarded in first three REIPPPP rounds

Power purchase agreements may be voluntarily renegotiated by extending the 20-year deals or enabling independent power producers to add more efficient PV components, thus increasing plant generation capacity.

Renewables generation cheaper than coal for many power companies – but not yet for Eskom

An investor tool examining the coal fleets of major global power companies has offered up analysis which flies in the face of arguments solar and wind generation could help turn around the debt-saddled South African utility.

Five takeaways from the Africa Energy Forum 2019

At the 21st AEF, held last week in Lisbon. pv magazine had two journalists on the ground and here reports on five key findings.

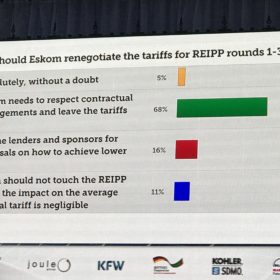

‘PPA deals signed under the opening three rounds of the REIPPPP must be renegotiated’

A representative of South Africa’s energy regulator said deals signed between 2011 and 2013 must be subject to lower tariffs to ease the financial crisis at national utility Eskom. The suggestion failed to convince delegates at an Africa Energy Forum panel discussion in Lisbon, however.

Globeleq acquires 53 MW solar portfolio in South Africa

Globeleq bought the solar plants — which are part of a bigger portfolio that includes wind farms — from an affiliate of Brookfield Asset Management. It said that in the coming weeks it will also reach financial close on another 66 MW solar installation, pushing the PV portion of the acquired portfolio up to 119 MW. It currently holds 238 MW of combined solar and wind capacity in South Africa.

South Africa’s carbon tax could lift its PV industry

The nation appears ready to join the ranks of global solar protectionists but any fears about its energy transition may be dampened by the introduction of one of the world’s first true carbon levies – provided emitters are not afforded too many loopholes.

South Africa considers petition calling for tariffs on imported solar modules

The complaint was submitted to the country’s International Trade Administration Commission by domestic module maker ARTsolar, which points out South Africa does not have anti-dumping duties to protect its manufacturers.

An argument for renewables, and for a new utility paradigm

In late January 2019, California’s largest investor-owned utility Pacific Gas and Electric (PG&E) declared bankruptcy for the second time, causing anxiety for investors, ratepayers, employees, PPA holders, elected government officials and, lest we forget, fire and gas explosion victims. Judge Alsup, who is overseeing PG&E’s probation from its felony conviction, lambasted the company for violating its probation. “To my mind, there’s a very clear-cut pattern here: that PG&E is starting these fires,” Alsup said. “What do we do? Does the judge just turn a blind eye and say, ‘PG&E continue your business as usual. Kill more people by starting more fires.”