Chinese Industry Brief: Risen plans RMB44.65 billion for solar expansion along supply chain

Furthermore, speaking about its joint venture with Trina Solar for the development of 15GW of ingot manufacturing and 15GW of wafer cutting projects, Tongwei said all work will be finished and put into production in H1 2022. PV prices are also seeing declines along the solar supply chain.

Cell and module prices falling in China

Taiwanese analyst Energytrend saw prices for high power products fall over the past week, but so far only in China. That trend could be replicated around the world next week, however.

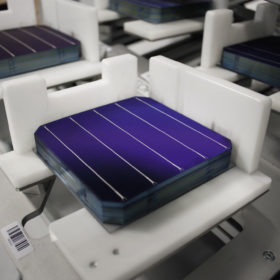

Sharp cell, module distinctions begin to form

The cost effectiveness of solar energy is becoming a top priority in terms of the selection of end market products, writes EnergyTrend’s Lions Shih. The result? A more varied and diverse module landscape alongside mono’s continued rise.

Japan’s METI cuts C&I FIT by 22%

It is official: METI has cut the feed-in tariff for Japan’s C&I solar segment by 22% to roughly $0.13/kWh.

Motech posts record $220.5m net loss in 2018

Motech Industries revealed this week that its annual net loss widened by 124.19% year on year to NT$6.795 billion ($220.5 million), marking its biggest yearly net loss ever.

Taiwan’s URE inks 200-300 MW module supply MoU

United Renewable Energy was the result of a troublesome year for Taiwan’s solar manufacturing market. The company has signed a memorandum of understanding with Asia’s largest independent power producer – Vena Energy – for the supply of modules for projects in Taiwan’s strong development sector.

Energytrend: Stockpiles down, utilization and prices recovering

The Taiwanese market research company has published its latest price trend data for PV modules, cells, wafers and silicon. Across the value chain, rising demand is causing stockpiles to dwindle and utilization rates to rise. Prices are rising in China as well as for high-efficiency products. Module prices have stabilized.

TrendForce forecasts 111 GW of new solar this year

The Taiwanese market research company said the effects of the 5/31 policy shift in China were less severe than expected, and in 2018 the global solar market grew 4.9%, with approximately 103 GW of new additions. This year, the solar demand is forecast to rise another 7.7%.

Obscured policies in Taiwan’s FIT scheme to impact on sustainable development of local solar supply chain

The Taiwanese Ministry of Economic Affairs (MOEA) has announced a 10.17% decrease to next year’s feed-in tariff (FIT) rates for solar PV installations, which is much higher than the average decrease of 4.25% in the global PV industry. This will make 2019 a tough year for Taiwan’s PV industry, with wider-than-expected impacts on the whole market.

Global-PV market: demand increasing – prices largely stable

According to EnergyTrend and PV Info Link, the downward spiral of prices along the PV value chain has come to a halt. Nonetheless, by bringing together the two pieces of recent market analysis, regional and value chain variations can be observed.