Developing countries biggest installers of renewables – BloombergNEF

In a new report, BloombergNEF notes a significant uptake in renewable energy in developing countries, which are clearly outperforming OECD countries. The trend is due to reductions in equipment costs and new business models that enable access to capital. Still, many emerging markets are also the biggest installers of new coal capacity. India and China alone, are said to account for 81% of newly added coal-fired power stations.

Solar, wind cheapest source of new generation in major economies – report

Solar and/or wind are said to be the cheapest source of new energy generation in all major economies, apart from Japan, finds BloombergNEF. It adds that China’s utility-scale PV market has contracted by over a third this year; and that battery costs are set to drop a further 66% by 2030, driven by EV adoption.

What’s in store for storage? $620bn

The rise of batteries will attract that headline figure in investment up to 2040, say analysts, as exponential growth in EV ownership, falling stationery system costs and the needs of the world’s grid-poor regions combine to boost lithium-ion technology.

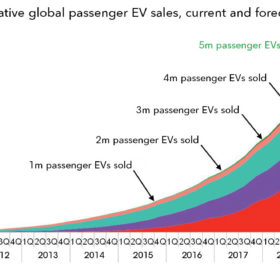

Global EV sales hit 4 million, soaring market sees next million in May 2019

While it took 60 months to reach the first million electric vehicle (EV) sales, in late 2015, it took the fourth million just six months. China is driving this development. Meanwhile, as first generation EVs batteries are reaching their end-of-life, interest in second-life use cases is growing. The volume of retired EV battery packs is set to be 108 GWh by 2029 – representing a third of the expected storage capacity market at that time.

Batteries material market set to grow 9% until 2022

A report by Technavio suggests the global market for battery materials could grow 9% annually in the next four years. Analysts point to the increasing installation of storage systems with PV as a key driver. pv magazine has covered previous reports predicting significant growth in PV and storage systems.

Odyssey surpasses $500 million mini-grid pipeline

Odyssey connects stakeholders along the mini-grid value chain to streamline development and financing processes. Reportedly over 275,000 connections would be achieved if the full pipeline is realized, and recently, it experienced a significant boost in a very dynamic mini-grid market.

Milestone: Over one trillion watts of wind and solar installed

A BloombergNEF analysis states that global wind and solar PV installations have reached a trillion watts, for the first time. While this milestone took the industry 40 years, the second trillion watts are expected to be installed in five years, in 2023, with the help of storage. The investment costs required to install one trillion watts are also expected to half.