Green bonds lead sustainable funding past $1tn mark

In the past 12 years, green bonds have raised nearly $800 billion for investment in clean energy and other sustainability projects and companies are now pegging bond interest payments to their environmental performance.

Fitch predicts a decade of corporate renewable power procurement growth in the US

Growth in U.S. solar and wind generation capacity will average 7.9% and 3.9%, respectively, between 2022 and 2028 according to Fitch Solutions, who projects almost 120 GW of solar power to be deployed in that period. Corporate clean energy buyers are to be a large part of the trend, and to accelerate deployments during the period.

Global renewables investment fell in the first half of this year

While Spain, Sweden, Ukraine and Brazil attracted more funds than last year, China’s transition to an auction-based procurement system and slow performance overall in Europe saw worldwide backing decrease. BloombergNEF does expect investments to ramp up in the second half, however.

Shell and Total join fossil fuel companies bidding for a piece of Europe’s PV renaissance

With Europe set to return to solar power levels last seen during the PV boom seven years ago, a wave of mergers and acquisitions is taking place as the oil and gas majors splash the cash to buy the expertise needed to participate in PV’s new dawn.

BNEF: Cheap finance is key to PV deployment in the developing world

While solar is lauded as a cheap energy resource in OECD countries, the cost of financing PV projects in developing nations has impeded progress. Development banks and the Clean Technology Fund they finance have played a key role in providing access to cheap financing for clean energy projects in many markets.

US solar installations grew in 2018 despite tariffs

Clean energy analyst BloombergNEF says the U.S. installed 11.7 GWdc last year – 15% more capacity than earlier estimated – as well as 292 MW of batteries. Despite new solar and wind growth, and coal closures, however, emissions still rose from 2017 levels on the back on increased gas use.

US leads as the volume of corporate clean energy bought smashes record

Companies in the United States accounted for more than 60% of the clean energy deals signed by corporations worldwide last year, according to BloombergNEF. A proposed renewable portfolio standard for Chinese business, though, could turn the picture upside down in a year’s time.

Green power certificates and curtailment will be key to China’s grid parity solar ambition

Analysts have welcomed the measures ushered in by Beijing to encourage the development of PV projects without central subsidies, but with the obstacles the policy aims to address having dogged Chinese solar for years, more detail is required.

Solar investment slid on the back of cheaper modules and China setback

The world again saw more than $300 billion of clean energy investment in 2018, according to BloombergNEF, and although wind narrowed the gap on solar, plunging module prices skewed the figures as PV capacity additions rose 10 GW.

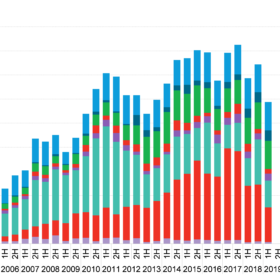

New products contribute to another record year for sustainable finance

BloombergNEF figures show financial vehicles linked to environmental and/or social benefits amounted to $247bn worldwide in 2018. The US led the way, almost entirely because state-backed mortgage provider Fannie Mae issued $19.8bn worth of green home loans.