Private PPAs for renewables reach 5.4 GW in 2017, BNEF says

Last year’s result surpassed by more than 1 GW the results registered in 2015 and 2016, when the combined capacity of this market segment reached 4.4 GW and 4.3 GW, respectively.

WFES: ISA signs letters of intent for $5bn financing, nine solar projects across five member states

This week’s World Future Energy Summit (WFES) saw a letter of intent inked at the International Solar Alliance’s (ISA’s) pavilion to secure financing of up to US$5 billion with India’s YES Bank by 2030. The organization also signed deals for nine solar projects across five ISA member countries, including in the UAE, Saudi Arabia, Nigeria, India and Spain.

BNEF releases 2018 clean energy predictions

BNEF has released its top 10 clean energy predictions for 2018, including at least 107 GW of solar PV installs. China will lead, but Latin America, Africa, Asia and the Middle East will notably up the ante. India will install less RE than in 2017, but will see fossils outpace RE for the last time; and China will see distributed grid connected solar leading the market. Li-ion prices are also declining, while EV sales grow.

EBRD poured €4.1 billion into green financing in 2017

The European Bank for Reconstruction and Development drastically increased its climate financing last year, with the €4.1 billion invested in the green economy representing 43% of the bank’s entire activity last year.

China drags global clean energy investment to $333.5bn in 2017, finds BNEF

Despite approximate 25% fall in solar costs per MWh against 2015, last year saw more than $333 billion invested in clean energy, with global solar deployment figures topping 53 GW, finds new Bloomberg New Energy Finance report.

8th IRENA Assembly: Utility scale solar LCOE falls 73% since 2010

All forms of renewable energy will be cost competitive with traditional generation sources by 2020. This was one of the key findings in the latest report from the International Renewable Energy Agency (IRENA). It was delivered yesterday at IRENA’s 8th annual Assembly in Abu Dhabi.

The weekend read: The science of soil

Soiling and solar: No two solar plants are ever the same, and the conditions that can impact energy yield can literally change with the wind. Soiled solar modules had long been considered a minor nuisance for the sector, but as understanding of how soiling affects output improves, so have techniques and technologies to tackle the persistent problem of dirty modules.

BREAKING: US regulators terminate coal, nuke bailout proceeding

Federal regulators have rejected orders from Energy Secretary Perry to design open-ended subsidization of coal and nuclear power plants, and are initiating a new proceeding to look into reliability matters.

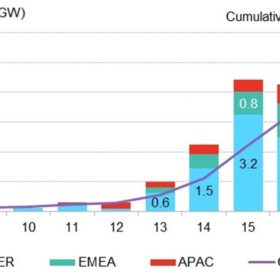

Solar corporate funding rebounds in 2017 (w/ charts)

Venture capital, debt, securitization and project finance were all winners in 2017, as were solar stocks. However Mercom Capital warns that the pending Section 201 ruling could cause significant damage to the sector in 2018.

India’s AISIA opposes safeguard duty on imported solar panels and cells

The All India Solar Industries Association (AISIA) says the proposed safeguard duty will be counterproductive for the solar industry, and has called for differential anti-dumping duties for specific countries to be imposed, including China.