German PV equipment suppliers export 99% of their products

First-quarter figures from German engineering association the VDMA showed that, while orders picked up after a slow end to last year, almost all PV production equipment produced in the country is shipped abroad, with China the leading destination.

Vietnam overtakes Australia for commissioned utility scale solar following June FIT rush

Norwegian consultancy Rystad Energy has placed the Australian and Vietnamese solar markets side by side and found the Southeast Asian country left its rival trailing in terms of commissioned utility scale PV capacity. A staggering 4.46 GW of connected PV capacity in Vietnam at the end of June came as a surprise to many.

‘Anti-dumping duty on coated steel will impede solar growth’, Indian ministry warned

Citing the risk to solar projects, lobby group the National Solar Energy Federation Of India has asked the Ministry of New and Renewable Energy to exclude flat steel products coated with alloy of aluminum and zinc from anti-dumping duty.

Vietnamese market momentum attracts another 100 MW

The capacity is made up of two 50 MW projects, one of which made the deadline to connect before Sunday and benefit from Vietnam’s generous feed-in tariff. Though the fixed payment has now expired, the market could continue to develop thanks to high energy demand and excellent irradiation.

Cost of developing renewables in Southeast Asia put through new mapping tool

Using an application based on resource data and country-specific techno-economic inputs, a report has analyzed the costs of developing utility scale renewables in Southeast Asia and found abundant, cost-competitive potential.

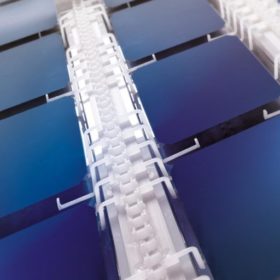

Shortage of polysilicon for mono-Si wafers lifts prices

Analysts have observed rising demand amid rumors of stock shortages. Meanwhile, the price of mono cells fell further, although not far enough as far as the big beasts of the PERC module jungle are concerned.

Jinko supplied 351 MW plant in Vietnam

The Chinese manufacturer revealed it had supplied the modules to one of the largest PV facilities in the APAC region outside its homeland.

JinkoSolar delivers 258 MW for PV-wind project in Vietnam

The Chinese manufacturer has supplied 258 MW of monocrystalline PERC double glass modules to Trung Nam Group. It claims the project is one of the biggest solar-wind installations in the Southeast Asian country.

Solar could bring 200,000 jobs to the UK by 2030 – but only with government backing

As the solar industry digests yesterday’s announcement by Theresa May of a net zero carbon ambition by 2050, developer Solarcentury says Downing Street is hugely underestimating the role PV can play in achieving that milestone.

New solar cheaper than coal in Vietnam within three years

A study of the relative costs of generation using coal and PV has focused on Vietnam as a case study as the nation is dependent on costly imports of seaborne coal. Analysts paint a straightforward picture explaining why a planned 32 GW new coal pipeline should be shelved.