Israel installs 900 MW of PV capacity in 2024

Recent data show Israel added 900 MW of solar PV capacity in 2024. The majority of the newly-added capacity stems from projects operating under merchant power purchase agreements (PPAs).

Israel plans two different tariffs for rooftop solar under net metering

Israel is considering two new tariff rates for selling excess electricity from home solar installations back to the grid. The first will offer a higher rate for the first five years, before dropping beneath the current rate, while the second will link the tariff to inflation. A consultation is open until April 4.

Israel targeting 100,000 new solar rooftops by 2030

Israel’s Ministry of Energy and Infrastructure says its 100,000 Solar Roofs Program aims to add 1.6 GW of new solar capacity by 2030.

Israel awards 1.5 GW energy storage in tender, pricing from $49.41 to $74.20 per kWh

Israel’s storage tender sets prices between $0.0056 and $0.0085 per kW, with kWh figures therefore at $49.41 to $74.20 per kWh.

Israel introduces tool to calculate rooftop solar potential

Israel’s Ministry of Energy and Infrastructure, in collaboration with the Israel Mapping Center, has launched a tool that calculates the potential and expected income from rooftop solar installations on residential, industrial, and public buildings.

Teralight switches on Israel’s largest solar plant

Teralight has activated Israel’s biggest PV project, the 150 MW Ta’anach 1 array, which will produce 310 GWh of energy per year. The facility will be expanded next year with the 104 MW Ta’anach 2 installation, featuring 440 MWh of energy storage.

SolarEdge launches AI-based energy management system

The controller integrates selected third-party products into the SolarEdge EMS ecosystem by connecting to a household’s internet router via the local area network (LAN). It can communicate with inverters, electric vehicle chargers, heat pumps and SolarEdge’s servers.

SolarEdge stock jumps as the company announces more layoffs

SolarEdge Technologies plans to lay off 400 employees globally, its fourth job-cut announcement in the past year. Recent safe harbor agreements and 45X credit sales may help the company on its path to recovery.

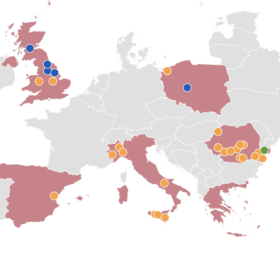

US-backed Econergy secures financing for 92 MW solar farm in Romania

Econergy Renewable Energy has secured financing from Raiffeisen Bank for its 92 MW Parau solar project in Romania, marking the Israeli company’s second such transaction with the bank.

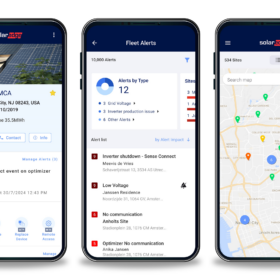

SolarEdge launches mobile app for residential, C&I solar installers

The company’s new mobile app is designed to combine all operations for solar installers, from installations and commissioning to management and servicing, in one streamlined platform.