Panda Green extends deadline for accepting debt restructuring proposal

The indebted developer has been forced to extend the period during which the holders of $350 million of senior notes can decide whether to delay settlement by two years.

State-owned China Huaneng still running the rule over which GCL assets to cherry-pick

The Beijing-owned electric utility is still carrying out due diligence of solar project assets in the GCL New Energy portfolio, having walked away from a full state bail-out of the GCL business last month.

Hanergy: From thin-film solar savior to mass lay-offs at MiaSolé, Alta, Solibro and Global Solar

Unannounced lay-offs with no pay or benefits have left more than 600 American workers, 180 employees in Germany and thousands in China unemployed and in the dark. Some of those affected have told pv magazine their story.

Panda Green bids to postpone looming payment for $350m senior notes

The debt-saddled Chinese PV developer hopes the holders of notes due to mature next month will be persuaded to hold off settlement for two years as it awaits a shareholder vote related to its latest proposed injection of public funds.

Date set for Panda Green state bail-out vote

The Hong Kong-listed, Chinese state-owned solar developer is in a race against time to settle a US$350 million bond which is due to mature on January 25. The bail-out, which will be put to the vote on December 30, will leave the company a further US$125 million shy.

Singyes set for name change

Now Chinese state-owned, the developer appears to want to draw a line under a traumatic two-year period which saw its fortunes reversed in dramatic fashion. Effectively now part of China’s Shuifa construction conglomerate, the proposed new name is intended to reflect the fact.

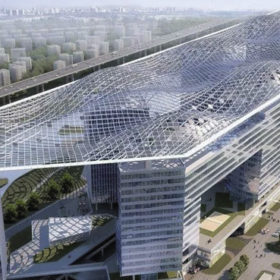

Walking on sunshine

Chinese scientists have developed a PV floor tile they say is suitable for pavements and cycling tracks. The devices were tested on a ‘green deck’ in Hong Kong. The developers say the tiles have demonstrated satisfactory solar energy conversion, anti-slip performance, heat-resistance and strength.

Singyes creditors approve rescheduling of defaulted notes and bonds

There was unanimous approval at a vote on the debt reorganization plan put before creditors in Hong Kong today and now it remains only for the scheme to be rubber-stamped in the territory – and in Bermuda – before the task of rebuilding the soon-to-be-state-owned business can begin.

Panda Green shareholders to vote on latest $225m state bail-out plan

It is back to the meeting room for beleaguered shareholders in the debt-saddled solar project developer, ahead of a proposed shares purchase by a Chinese coal and real estate company.

China walks away from state bail-out of GCL solar project business

The proposed acquisition of a controlling stake in the heavily-indebted PV project business of solar manufacturer GCL-Poly has fallen through, with state-owned China Hua Neng now proposing to cherry-pick the more attractive assets from the unit’s 7 GW portfolio.