Brazilian telecommunications giant Intelbras enters solar business with acquisition of Renovigi

Renovigi is Brazil’s second-largest system integrator and PV product distributor. The company currently operates two production units, in Itajaí, in the state of Santa Catarina; and in Louveira, in São Paulo, where it integrates complete photovoltaic systems which are then distributed among its more-than-9,000 accredited installers.

Brazil may add another 12 GW of PV this year

Of this new capacity, 8.9 GW may come from distributed generation and 3.2 GW from utility scale solar. By the end of December 2022, the country’s installed solar power should reach 25 GW, according to new figures from Brazilian trade body ABSolar.

Brazil introduces new rules for distributed generation, net metering

The Brazilian authorities have introduced new rules to ensure that PV systems below 5 MW in size will still be eligible for net metering tariffs until 2045. A grid fee for prosumers will go into effect from 2023, but the economic profitability of rooftop PV and small solar parks is expected to remain high.

Brazil tops 13GW of installed PV capacity

The country installed around 3GW of new PV systems in the fourth quarter of 2021 alone. Around 8.4GW of the current PV capacity is represented by solar installations not exceeding 5MW in size, and operating under net metering.

Brazil heads for a solar installation rush

Brazil’s deployment of distributed generation PV (below 5 MWp) has exploded from a total capacity of 500 MW in 2018 to 7 GW by September of this year. The trigger for this increase, alongside rocketing electricity prices, was the 2019 proposal of law 5829, writes IHS Markit analyst Angel Antonio Cancino. The proposal is expected to pass into law at the end of this year and will gradually introduce grid-access charges for residential and commercial system owners.

Brazil and Chile could lead charge to affordable green hydrogen

Falling electrolyzer costs driven by economies of scale, increased automation of production and the modularity of such systems will bring green hydrogen to a competitive cost with its fossil-fuel powered variants in a dozen markets by 2030, according to WoodMac.

Brazil introduces new rules for hybrid power plants

The new provisions define clearly what hybrid power plants are and what kind of grid tariffs they should pay. The regulation may be particularly favorable for hybrid wind-solar plants, especially in North-Eastern Brazil, where the grid is not strong enough to support further renewable energy development.

Brazil has imported 7.5 GW of solar modules so far this year

According to a new report from Brazilian consultancy Greener, the Latin American country imported 1,049 MW of solar panels in October alone.

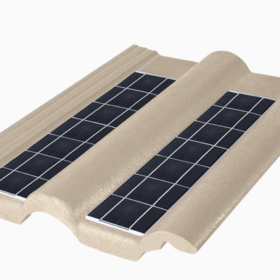

New solar tile from Brazil

Developed by Brazilian construction materials provider Eternit S.A., the tile has a nominal power of 9.1 W and an average monthly generation capacity of 1.15 kWh. It is available in five colors and two versions with a classic or reinforced design.

Solar panels host microbes that may be used for biotech applications

Scientists in Brazil have found that photovoltaic modules may be a repository of specialized microbes in tropical regions. According to them, these micro-organisms may be used in sunscreens, pigments for processed foods, chemicals, textiles, pharmaceuticals, and cosmetics.