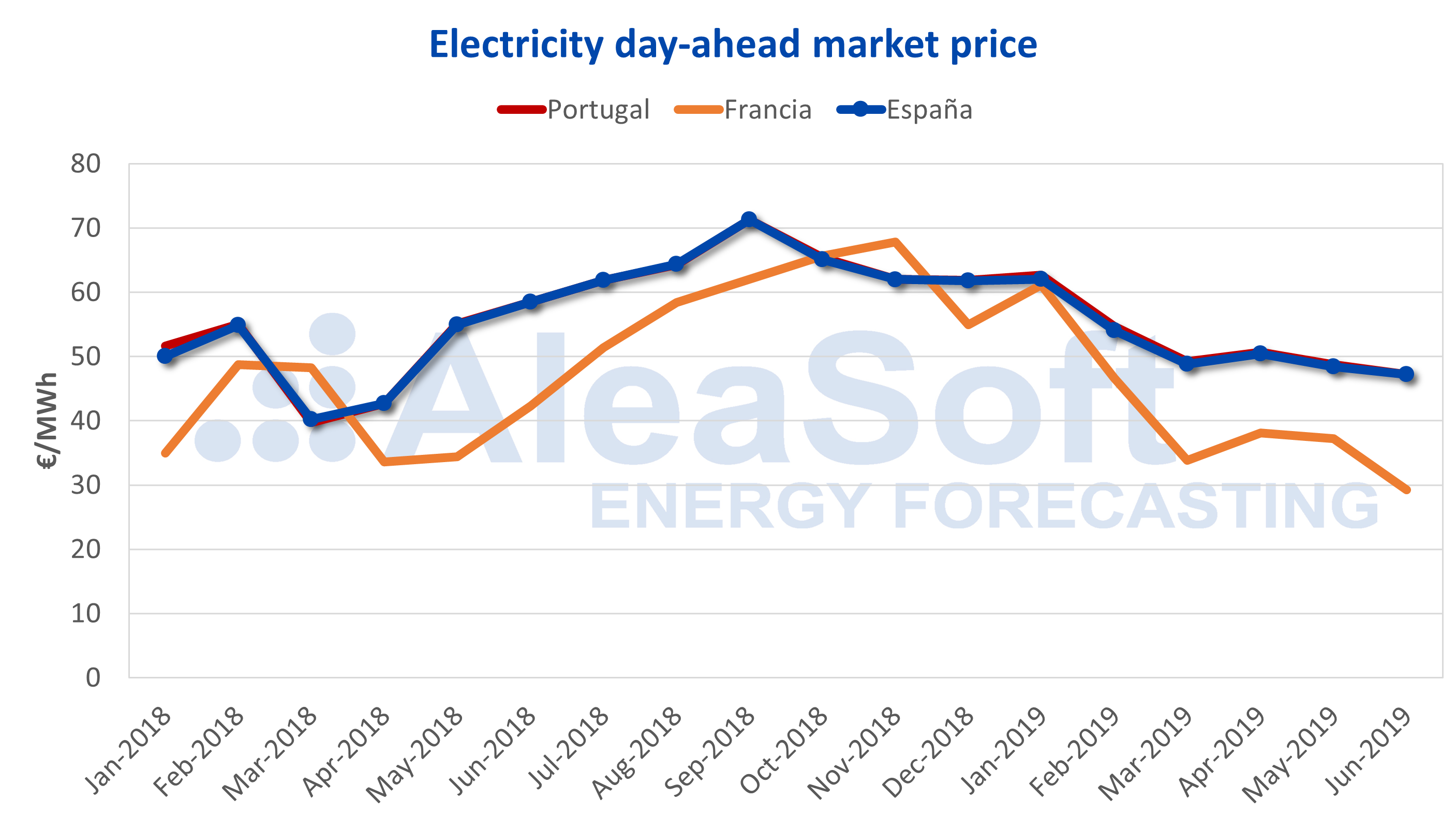

The Iberian MIBEL electricity market registered an average price of €51.80/MWh in Spain and €52.20/MWh in Portugal during the first half of 2019.

Those values represented an important reduction compared to the maximum prices reached last year. The Iberian market prices have not stopped falling since September, when a monthly average of €71.27/MWh was reached in Spain and €71.30/MWh in Portugal. That peak was driven by an upward trend in CO2 emission rights, gas and coal prices. Since then, the price of the main fossil fuels used in electricity generation – gas and coal – have experienced a fall that reduced pressure on the electricity market price, which also clearly trended downward. That was favored by the seasonal increase in renewable energy production. In June, an average price of €47.19/MWh was reached in Spain and €47.21/MWh in Portugal, values not seen since April 2018.

Sources: Prepared by AleaSoft using data from OMIE and EPEX SPOT.

During the first half, and specifically on April 1, a 7% tax on electricity production value (the IVPEE, or tax on generation) was reintroduced in Spain. The reappearance was due to the end of a six-month suspension the Ministry for the Ecological Transition applied in September to slow an escalation in market prices. According to AleaSoft’s estimates, the end of the generation tax suspension had an impact on the market price, increasing it by around 5%.

Regarding extreme hourly prices, the lowest hourly price was recorded in Spain during the early morning hours of March 4 – €3.52/MWh. The highest price was reached in Spain and Portugal on January 15, during the afternoon price peak, and registered a value of €74.74/MWh.

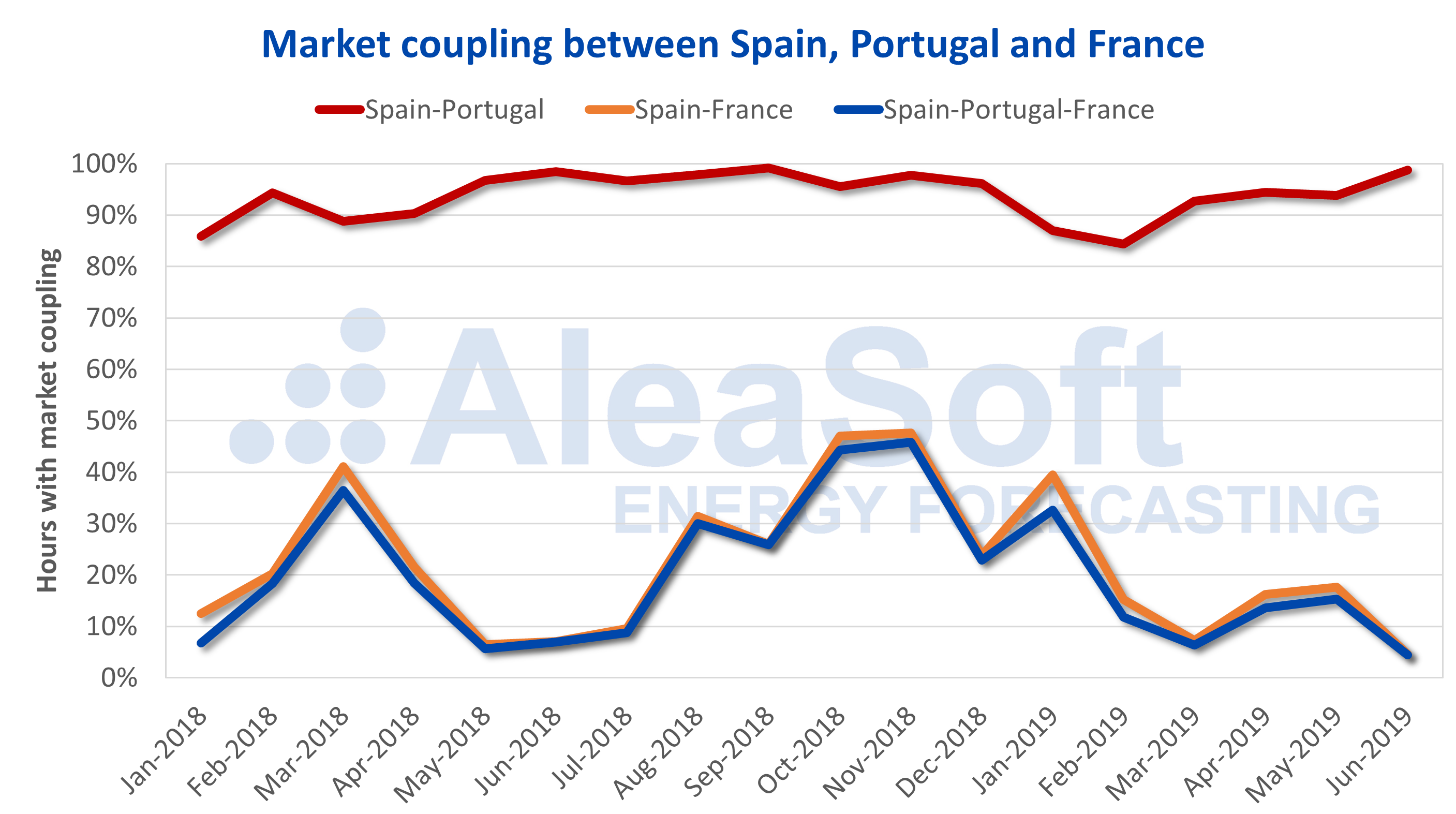

Market matching

In the first six months of 2019, the markets of Spain and Portugal were coupled and recorded exactly the same price for 3,992 hours – 91.9% of the total. That percentage was lower than that recorded during the second half of 2018, at 97.2%, and in the first half, which saw 92.4% correlation.

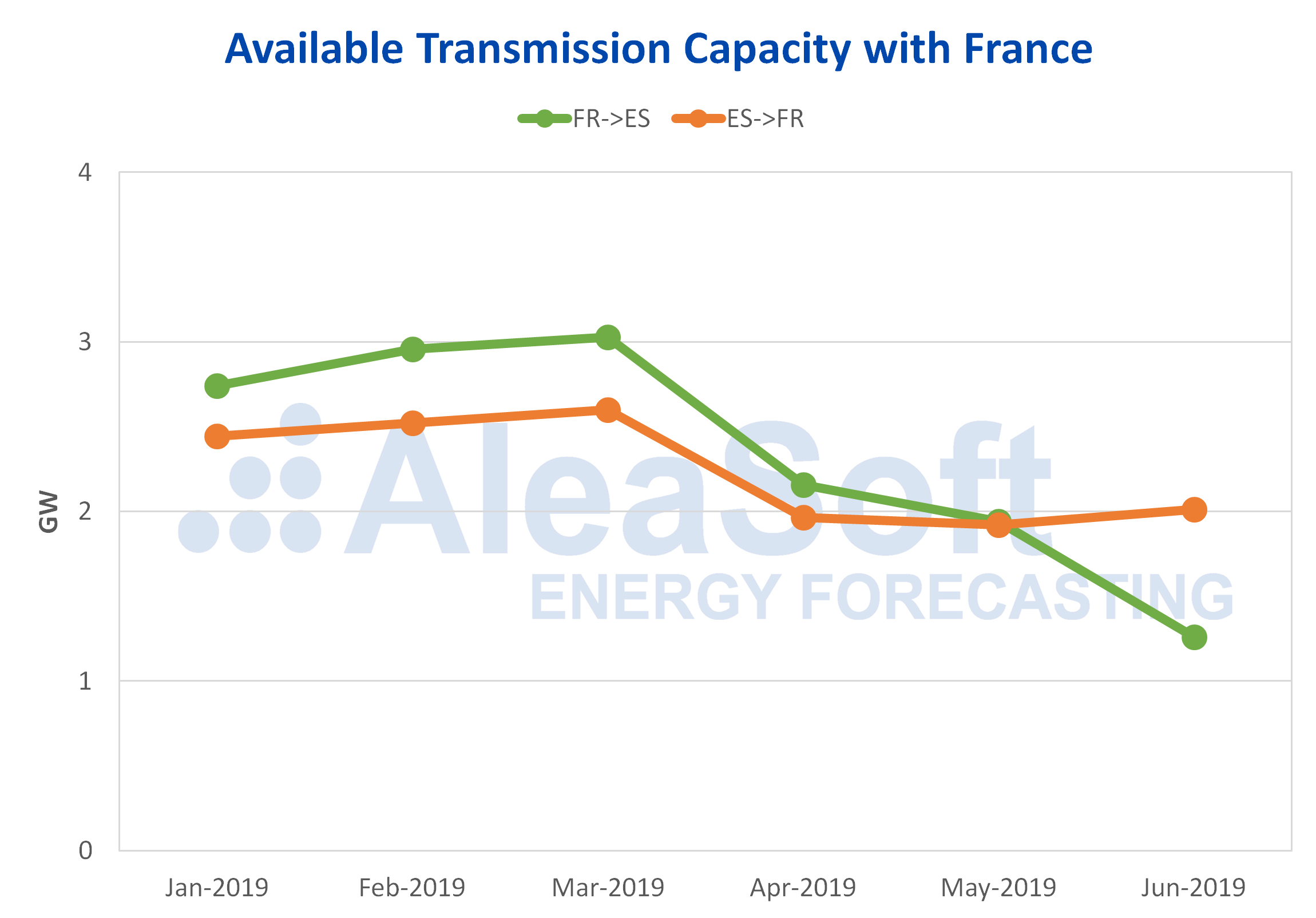

The coupling rate with the French market also fell, compared to last year. During the first half of 2019 the markets matched for just 731 hours – 16.8% of the total, compared to 22.5% in 2018. The coupling with France was affected by restrictions on interconnections to that country which occurred since April, and especially in June, when coupling was only seen in 4.6% of hours.

Total coupling between the three markets occurred in 613 hours in the first six months, 14.1% of the time.

Sources: Prepared by AleaSoft using data from OMIE and EPEX SPOT.

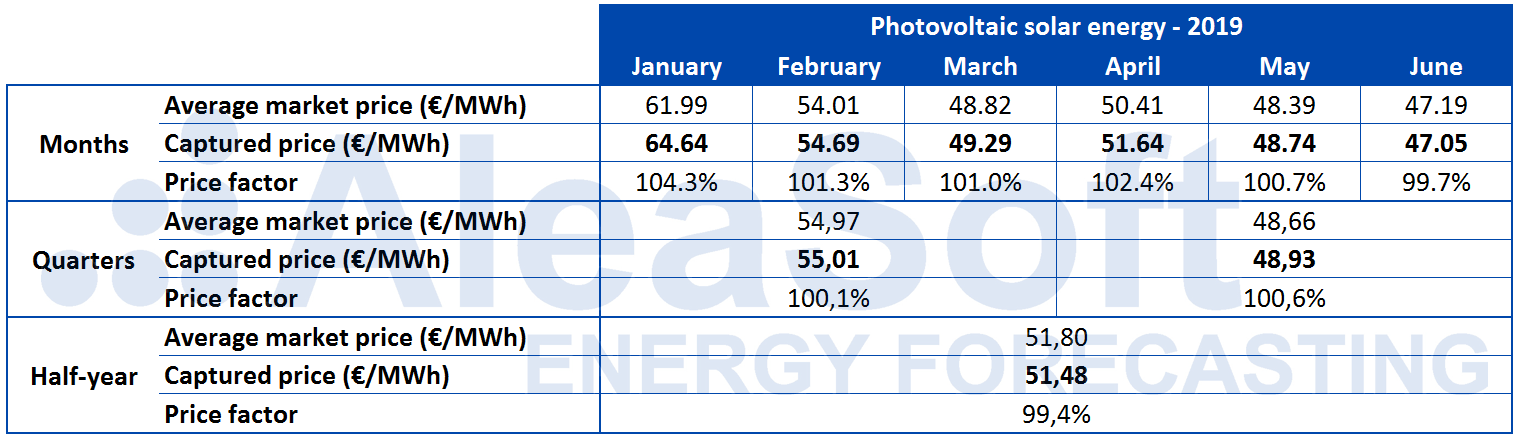

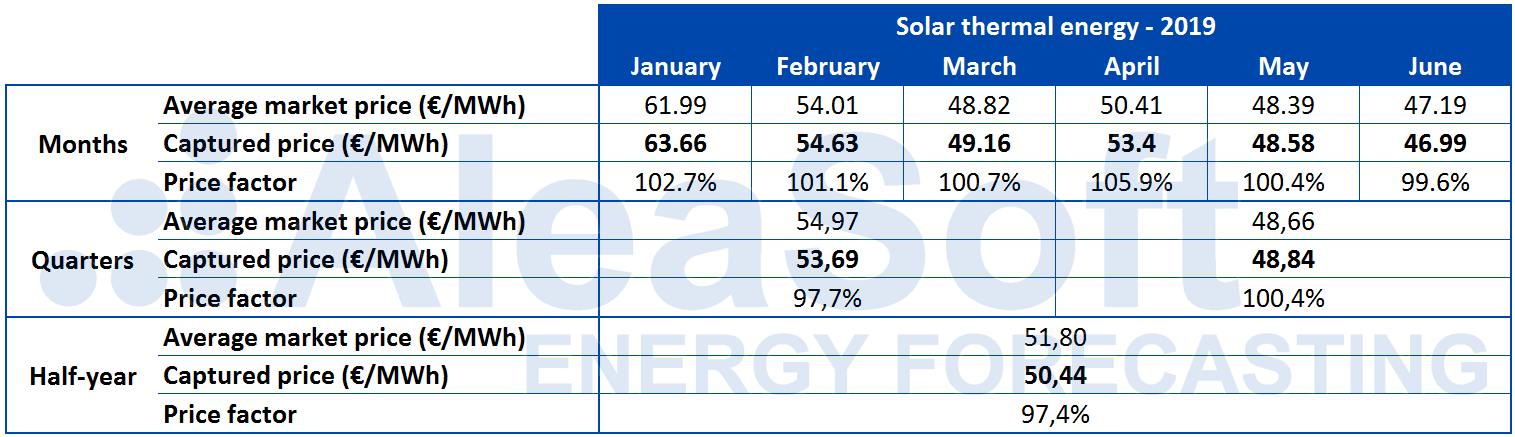

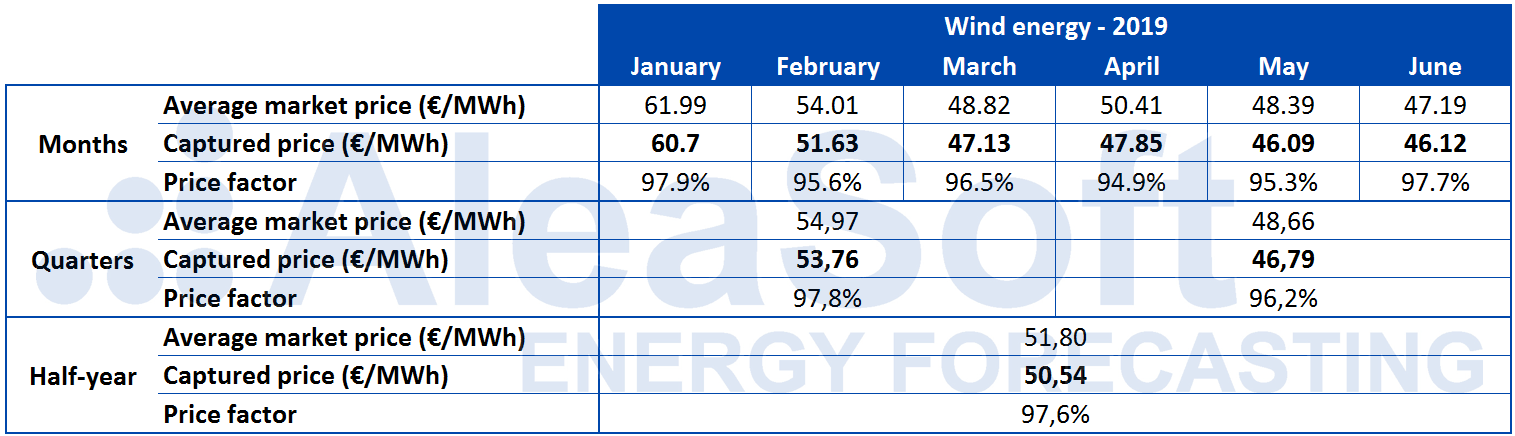

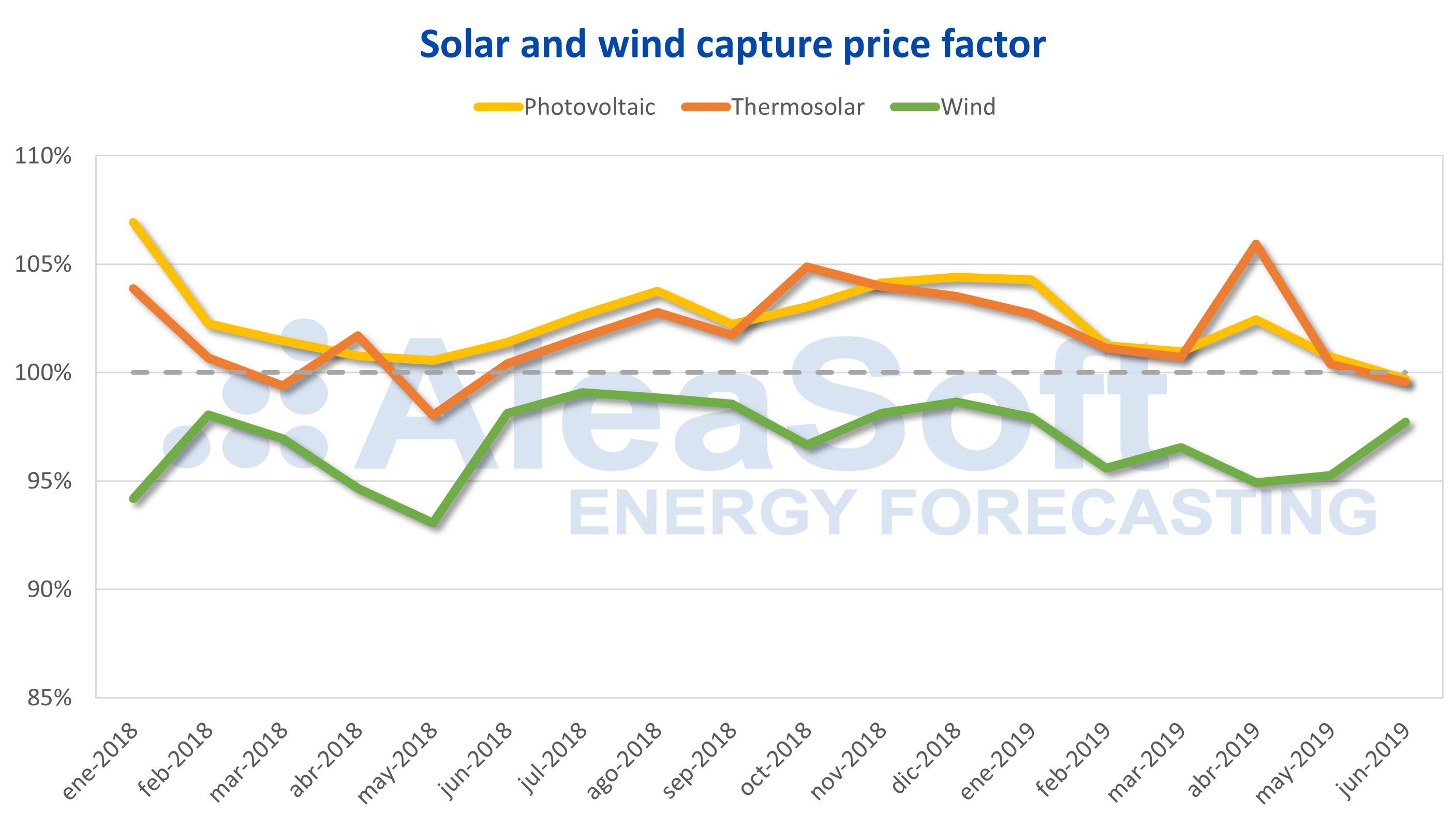

Renewable energies captured price: solar and wind

During the first half, the captured price of solar energy – photovoltaic and solar thermal – was clearly lower than the average market price, compared to both the second half of 2018, and on a year-on-year comparison. For wind, even with a clearly lower price factor than solar, the price remained practically the same as in the second half of 2018 and improved clearly compared to the first six months of 2018.

Sources: Calculations carried out by AleaSoft using data from REE and OMIE.

The solar PV captured price during the first half was €51.48/MWh compared to the average market price of €51.80/MWh, representing a price factor of 99.4%. However, month by month and even for each quarter separately, the PV price factor remained above 100%, except in June when it was just below, at 99.7%. That was because, although PV energy production is concentrated in peak hours with prices usually higher than the daily average, the months in which more electricity was produced from PV – the months with higher radiation – had lower market prices.

In the case of solar thermal, the captured price of the first six months was €50.44/MWh, more than €1/MWh below the price captured by solar PV, which represented a rate of 97.4% of the PV price. In the same way as with PV, month by month the captured price remained above the average market price, although with values below those of PV with the exception of April, when the solar thermal reached a price factor of 105.9%.

For wind energy, the numbers were clearly more modest because the installed capacity of the technology is five times PV capacity, and its depressing effect on the market price was much clearer. At a global level in the first half of 2019, the wind energy captured price stood at €50.54/MWh, with a price factor of 97.6%, clearly below the value of PV but slightly above solar thermal.

In none of the six months in the first half was the price captured by wind above the average market price. The best month was January, with a target of 97.9%, well below the worst month for PV or solar thermal.

Brent, fuels and CO2

The Brent oil futures prices for the M+2 product in the ICE market acquired an upward trend during the first half. On April 24 it reached a maximum six-month value of $74.57/bbl. From that date it started trading downwards and changed course. However, towards the end of June it started to climb settling on July 1 at $65.06/bbl, although it had a 4% decrease on Tuesday, compared to the price quoted on Monday, due to the pessimistic reception of the extension of OPEC+ restrictions. The main factors that influenced the rise in oil prices in the last half-year were the political crisis in Venezuela, geopolitical tensions between the United States and Iran and OPEC production cuts. Members of OPEC+ agreed the cuts would be extended for another nine months, until March. However, the trade dispute between the United States and China is the main factor that caused prices to fall, despite the recent trade truce agreed at the G20 summit by the two countries.

Throughout the first half, TTF gas futures prices on the ICE market for the M+1 product registered a downward trend, with historic low values for the last two years and a 58% decrease in the prices recorded between the first and last session of the semester.

The prices of API 2 coal futures on the ICE market for the M+1 product behaved similarly, falling throughout the first half and registering a 42% drop between January 2 and last Friday. The most competitive gas prices and an excess of supply worldwide throughout the semester were the main factors influencing low prices on this market.

CO2 emission rights futures prices in the EEX market for the reference contract of December 2019 ended the first half with an increase of 3.8% compared to the beginning of the year. Until the first week of April they kept oscillating between €18.80/t and €25.40/t and from April 2, accelerated growth to half-year highs, with a settlement price on April 23 of €27.54/t. After this rise prices oscillated in the €23.70-€27.60/t range. Volatility in the market was strongly conditioned by the Brexit talks.

Electricity futures

The electricity futures of Spain in the OMIP and EEX markets, as well as those of Portugal in the OMIP market for 2020, showed a decreasing trend throughout the first quarter until reaching minimum values on March 18. After that they began to rise in parallel with CO2 emission rights futures until reaching six-month maximum values. After that rise, the price during the rest of the six-month period was maintained, ranging from €53.30/MWh to €57/MWh.

The futures of France and Germany in the EEX market for next year ended the first half with a fall of 3.8% in Germany and 5% in France, with respect to the first day of the period. During the first quarter they traded down and ended the last day of the period 9.4% lower for Germany and 9.2% lower for France. The first week of April rebounded to reach values close to the six-month highs in less than a week. After that rapid rise prices maintained a downward trend for the rest of the half. Electricity futures were strongly affected by the behaviour of CO2 emission rights futures prices during the first half.

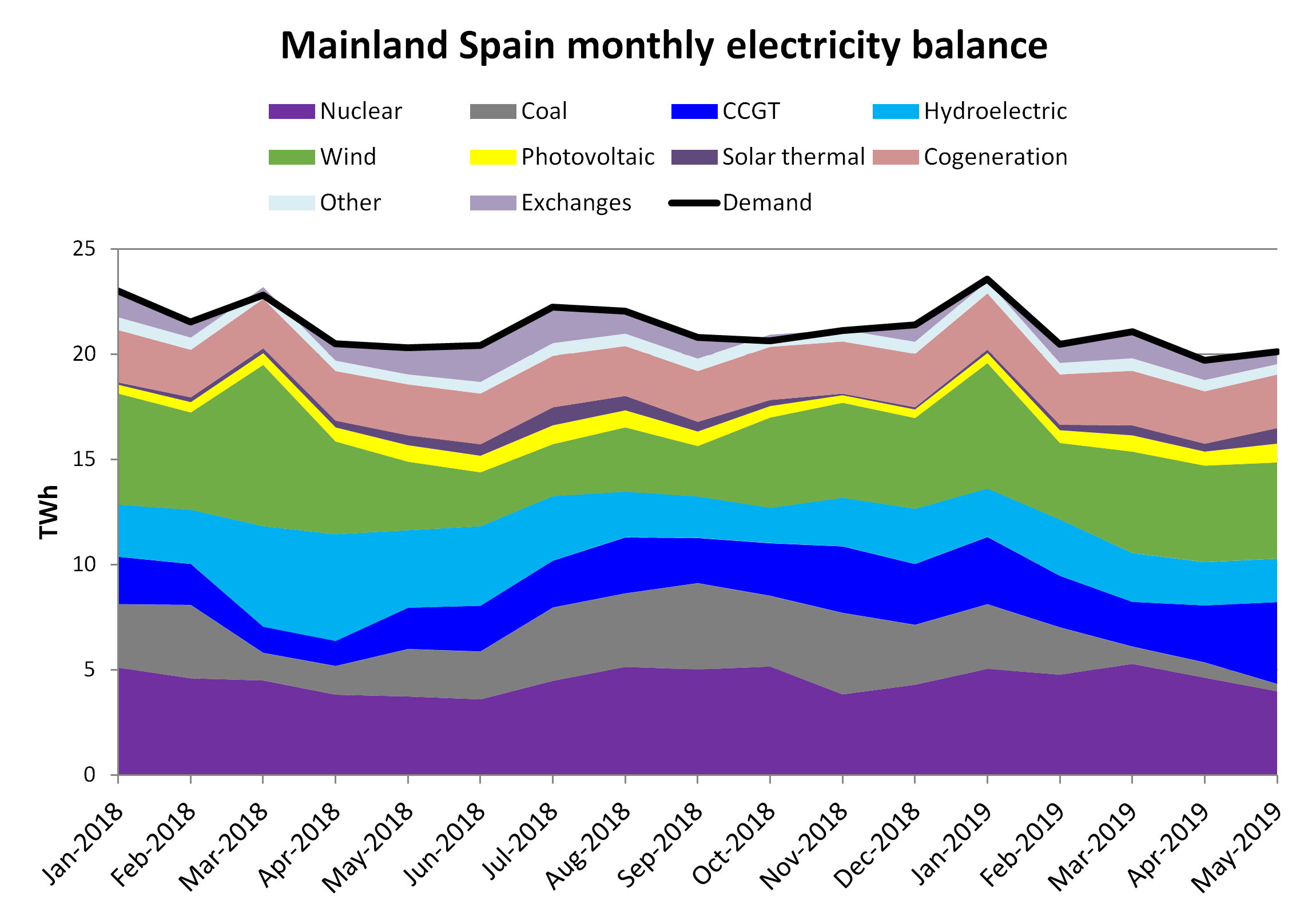

Mainland Spain: demand and production

As mentioned in a recent news from AleaSoft, electricity demand in mainland Spain fell 1.6% in the last quarter compared to the first three months of the year. In year-on-year terms, the half-year decrease was 2.2%.

Wind energy production increased 20% in the first quarter compared to the same period of the previous year. However, comparing the first six months of 2019 and 2018, the decrease was 3.8%.

According to REE data, between January and May 89 MW of wind power were installed in Spain, equivalent to an increase of 0.4% of the installed capacity of this technology.

Sources: Prepared by AleaSoft using data from REE.

PV energy production rose 9% in the second quarter, compared to the same interval of the previous year. Analyzing the first half of 2019 compared to the first half of 2018, the increase was 16%.

Installed PV capacity rose 154 MW from January to May, an increase of 3.5%.

Solar thermal energy production grew 43% in the quarter from April to June compared to the second quarter of 2018. As expected – due to the seasonal increase in solar radiation – compared to the months of January to March production with this technology increased significantly by 1,029 GWh – 111%.

Analyzing the first semester of solar thermal production, it was observed it also increased with respect to the values of the first half of 2018, rising 47%.

On the whole, solar energy production increased in year-on-year terms, by 22% and 27%, in the last quarter and semester respectively.

Production with coal decreased 75% in the second quarter compared to the second quarter of last year. In the six-month interval just ended, the decrease was 44% in year-on-year terms. Installed coal power capacity reduced by 347 MW in the period from January to May – a decrease of 3.6%.

The production of combined cycle plants increased 6,430 GWh, or 120%, in the quarter that began in April, compared to the same interval of last year. In relation to the half-year that ended last week, year-on-year growth was 81%.

Regarding nuclear energy production, there were three scheduled shutdowns. The first was a short stop for maintenance at the Cofrentes plant, from January 19-21. Later, the Ascó II nuclear plant stopped for refueling from April 27 to June 4. And in parallel with the aforementioned stop, the Trillo power plant halted for refueling from May 10 to June 9. To that was added the unscheduled shutdown of Vandellós II from April 5-17 when problems were detected in a valve.

In general nuclear energy production decreased 13% in the last quarter compared to the first quarter. In year-on-year terms, production increased by 19% for the April to March period.

As for the six months that ended on Sunday, nuclear energy production increased 12% compared to the same period of 2018.

In the quarter just ended, hydroelectric energy production decreased 54% on the same quarter of last year – 6,481 GWh. The fall, when analyzing the last semester in year-on-year terms, was 8,760 GWh, or 41%.

Sources: Prepared by AleaSoft using data from REE.

In the recently ended quarter, the average level of hydroelectric reserves increased 1,265 GWh, 12% higher than in the first quarter.

Total hydroelectric reserves recovered by 1,630 GWh in the last half-year, 16% more than the reserves available at the end of the second half of 2018, according to the Hydrological Bulletin of the Ministry for the Ecological Transition. In year-on-year terms, the average values of reserves decreased 4.5% in the first half of 2019.

International exchanges

In each month during the first half, the net balance of electricity exchanges between Spain and Portugal placed Spain as a net exporter. The total net balance of the first six months was 2,692 GWh exported. During the period, exports increased 59% in year-on-year terms.

Sources: Prepared by AleaSoft using data from REE.

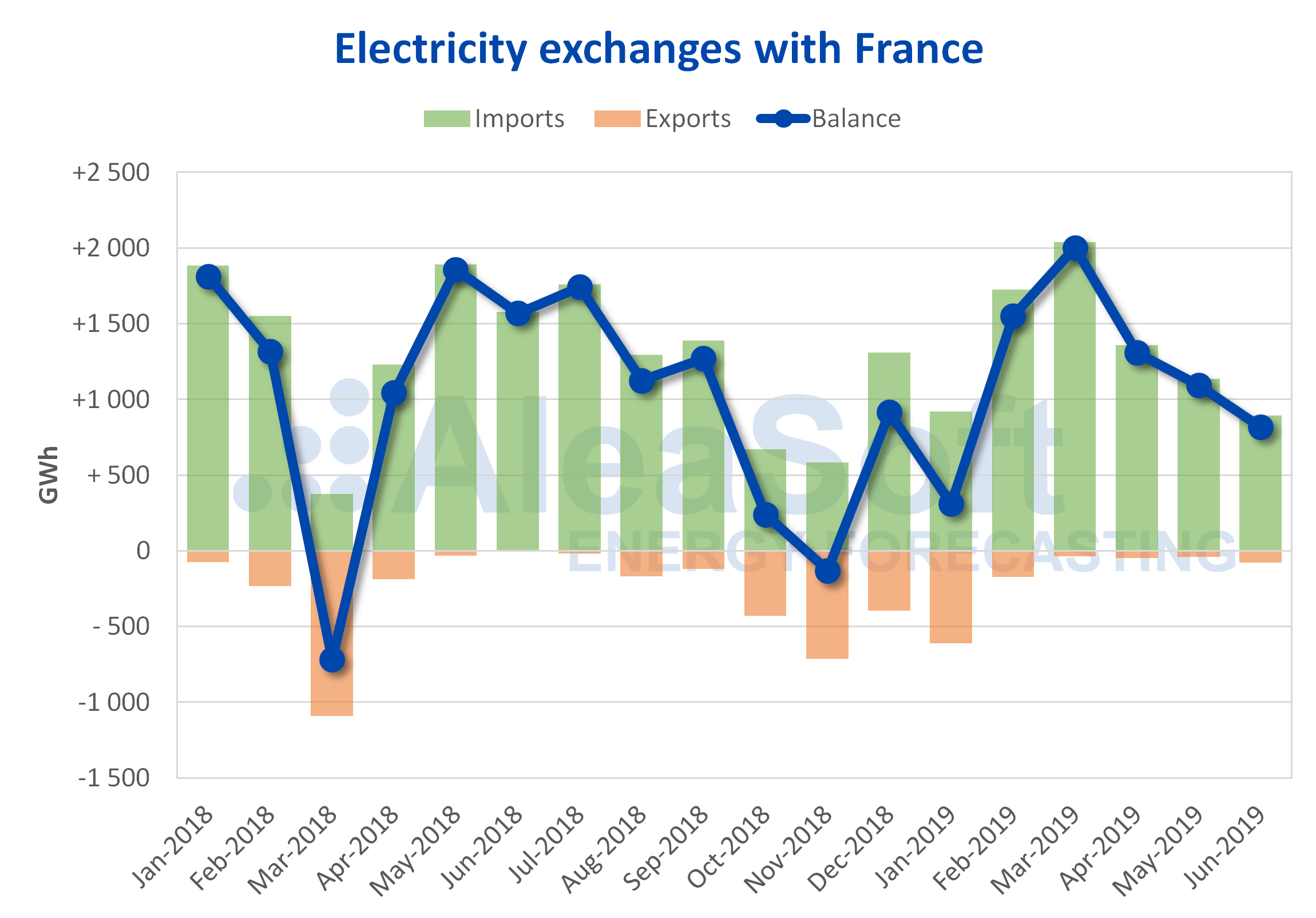

The net balance of electricity exchanges between Spain and France during the first half placed Spain as a net importer, with 7,080 GWh net imported. Between April and June, both imports and exports with the French declined, by 28% and 27% respectively in year-on-year terms, which led to a year-on-year decrease in imports of 5.2% in the same period of the year, and of 39% in exports.

Sources: Prepared by AleaSoft using data from REE.

The available exchange capacity with France was reduced considerably in the second quarter, compared with that available in the first quarter: 39% in the direction of France-to-Spain and 22% in the opposite direction, which favored the aforementioned falls in imports and exports with France in the quarter just ended.