Brent, fuels and CO2

Brent oil futures prices for May in the ICE market have stabilized in a price range of $65-67/bbl since February 15, when it had risen to $66.22/bbl, surpassing the range in which it had been since January 9 – when it had had values of $60-62.50/bbl. If international tensions do not deteriorate and OPEC does not adopt new restrictions on production, the price of Brent oil for the coming weeks should resume the path between $62.50/bbl and $60. AleaSoft considers $60/bbl market equilibrium for the beginning of spring. In the longer term, AleaSoft estimates the price will not have a clear upward or downward trend, based on the latest estimates of the International Energy Agency, which foresee an increase in production in the United States and an increase in demand worldwide, albeit with a slightly slowing tendency.

The TTF gas futures on the ICE market for April settled on Friday at the lowest price in a year – €16.73/MWh, a value not reached since mid-March 2018. In the coming days it could achieve stability around €16/MWh and then continue with the seasonal downward trend corresponding to spring, with higher temperatures and lower demand. However, AleaSoft advises monitoring the political situation in Algeria, because the emergence of problems in the supply of gas to Europe could stress the market and trigger price increases.

In the last year, the evolution of API 2 coal future prices for April on the ICE market has remained aligned with the TTF gas futures prices for the same period. However, since February 7, the futures for April in the case of API 2 remained stationary at around $73/t while gas in that period had a slight negative slope. In the case of coal, it is also expected that with the highest temperatures in the coming days a gradual decline in prices will begin.

Analyzing the last three years of the evolution of CO2 emission rights futures prices for the reference contract of December 2019 in the EEX market, the figures can be divided into three periods. The first started in February 2016 and ran until the beginning of June 2017, with prices oscillating in a band between €5 and €6/t. In that first period, electricity market prices were very low in Europe during the first part of 2016, taking advantage of the very low CO2 emission prices.

In the second, 15-month period – that began on June 1, 2017 with a price of €5.20/t, and reached €25.56/t on September 10 – the price of CO2 multiplied by five. That rise was transferred to electricity market prices because they are based on a marginal price.

From September to date, prices have been oscillating in an average range between €18/t and €24, although in some cases the level dropped to €16/t and in others it reached €25. In the last three months, the CO2 emission rights prices were between €19 and €25/t, keeping the balance between €20 and €22/t AleaSoft considers the stability value for the coming weeks.

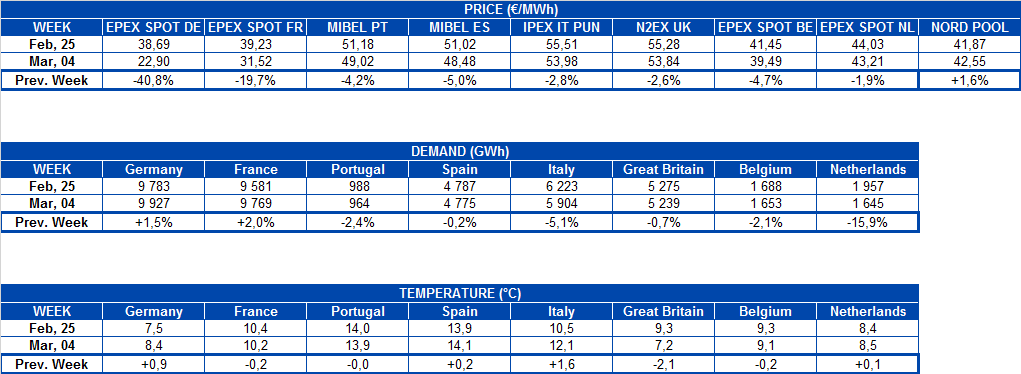

European electricity markets

In the second week of March, a similar pattern to the previous week was present and AleaSoft considered it can be quite stable in the period from March 1 to next Wednesday. In general, the temperature was stable since the end of February while demand had a very slight decrease during the same dates.

Regarding the prices of the main electricity markets, a set of bands are observed. The N2EX market in Great Britain reached around €55/MWh maintaining this trend in the future. The Italian IPEX market had a similar average value but with greater oscillation, ranging from €45/MWh to €60. The MIBEL market in Spain and Portugal oscillated between €40/MWh and €55 with a tendency to stabilize at €45/MWh in the coming days. The EPEX SPOT markets of the Netherlands and the Nord Pool of the Nordic countries moved between €40/MWh and €45 with a tendency to stabilize below €40.

In the EPEX SPOT markets of France and Germany, prices were lower, in a range between €10 and €40/MWh in the case of Germany, and €20 and €40/MWh in France. AleaSoft estimates a trend in the coming days between €30 and €35/MWh for both countries.

For the next few days, it is expected temperatures will drop but, in general, that will not have much impact on demand at European level, maintaining stability in the first half of March. For the second half of the month, temperatures will gradually rise and demand will continue the seasonal decline.

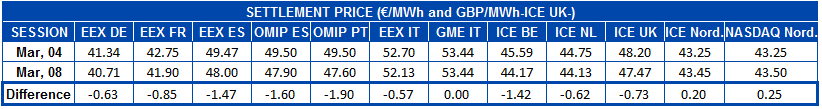

Electricity futures

On Friday, futures prices for April in most European markets had decreased compared to their price four days earlier. The price drops ranged between €0.57/MWh for Italy on the EEX market and €1.90 for Portugal on the OMIP market. However, the futures of the Nordic countries for the next month rose during the week, both on the ICE market – with an increase of €0.20/MWh – and the Nasdaq, where they rose €0.25.

In the OMIP Spain, OMIP Portugal and ICE UK markets on Thursday, the lowest price seen so far this year for April was reached – at €47.83/MWh, €47.53 and €47.15, respectively. Also, on the EEX market, Spanish futures for next month reached a low of €48/MWh on Friday.

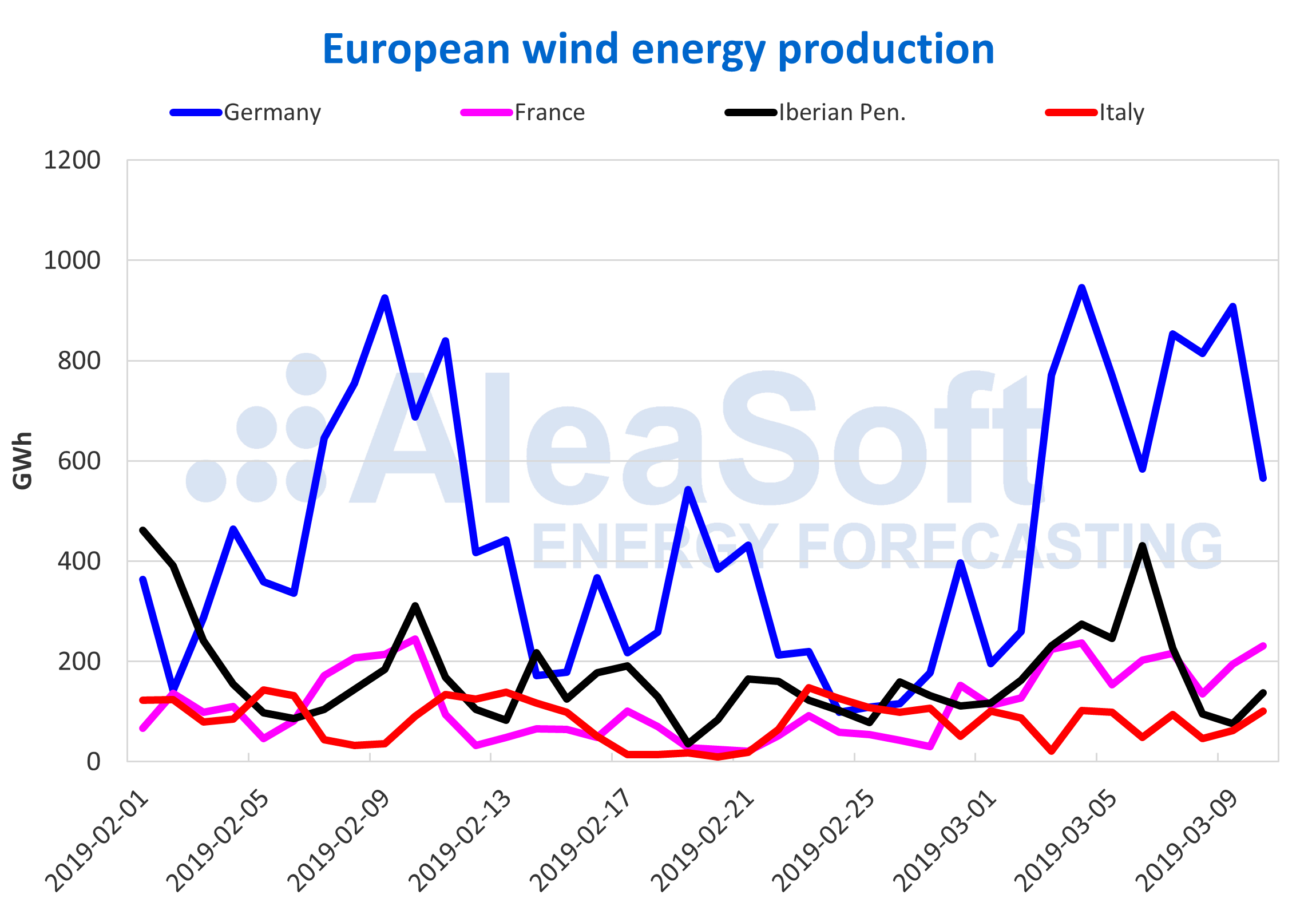

Wind and solar energy production

Wind energy production in early March was much higher than in the second half of February, more than twice so in the case of Germany and France, 57% more in the Iberian peninsula, and 20% higher in Italy. That change in wind energy production was the main cause of the considerable drop in prices in Germany and France in early March. It was also the cause of the decline in Iberian market prices, although not as pronounced as in Germany and France.

For the next week, AleaSoft foresees wind energy production will decrease in general at European level, with the possible exception of the Italian peninsula.

Sources: Prepared by AleaSoft with data from ENTSOE, RTE, REN, REE and TERNA.

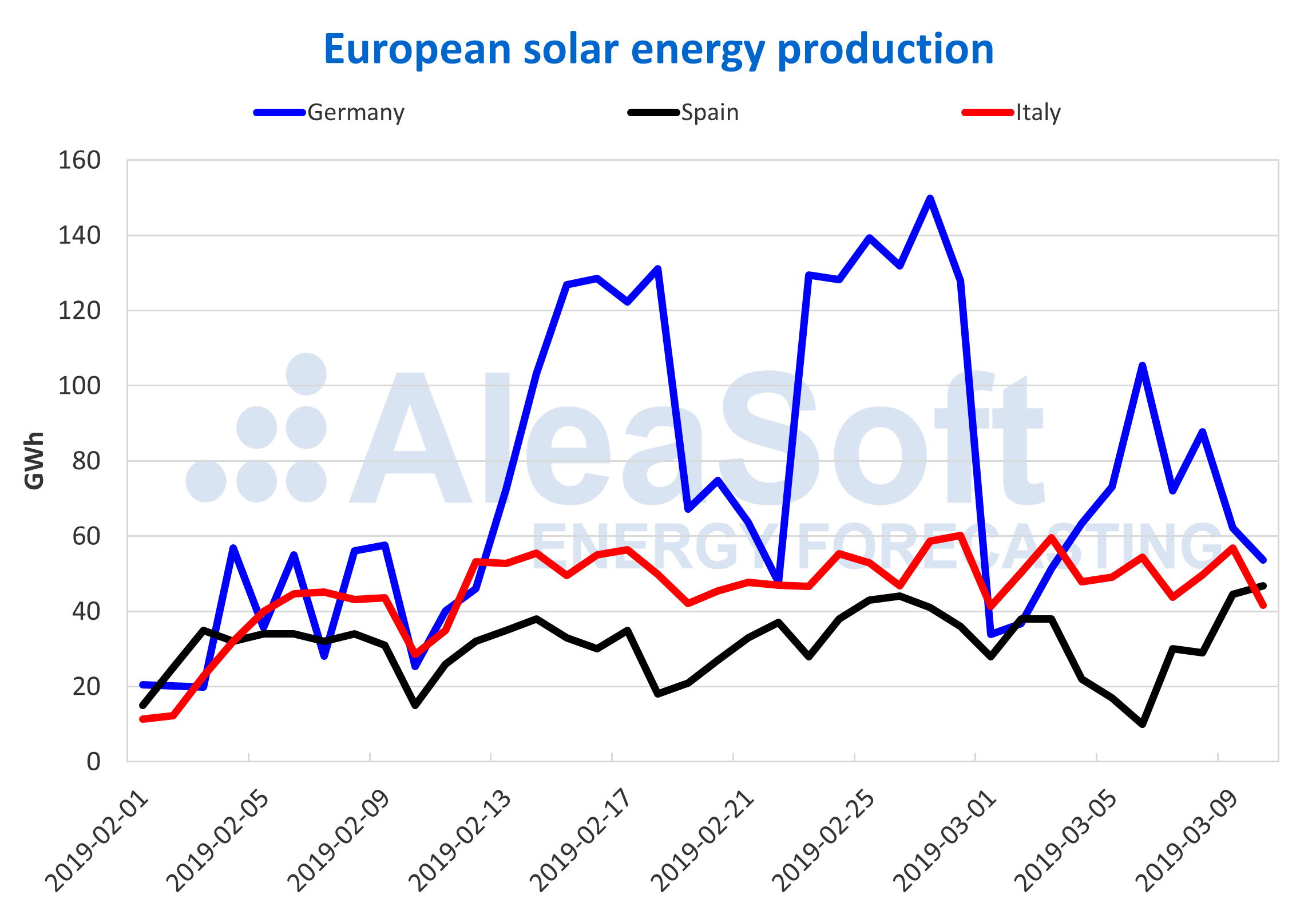

Solar energy production, which includes both PV and solar thermal, dropped last week, around 25% in the case of Germany and Spain and around 7% in Italy. For the next week, it is expected the trend will reverse and production values will approach the levels seen at the end of February.

Sources: Prepared by AleaSoft with data from ENTSOE, REE and TERNA.