Whether it’s smartphones, power tools, electric vehicles, bicycles, toothbrushes, or home storage systems, lithium-ion batteries have become a common feature of modern life. But the sourcing of the required raw materials, like cobalt and lithium, has been under close scrutiny against a backdrop of environmental degradation, child labor, and poor occupational safety standards.

With millions of tons of lithium-ion batteries already installed, one way of circumventing both end-of-life and raw material challenges is effective recycling. The quest for cost-effective lithium-ion battery recycling, however, is not aided by battery design and volatile market prices for raw materials.

Not enough batteries

Currently, there is an estimated 1.5 million tons of lithium-ion batteries installed, with that figure expected to grow to four million tons over the next five years – primarily driven by the growing EV and stationary storage sectors.

Some alarmist commentaries have suggested that only 5% of lithium-ion batteries are recycled. But Hans Eric Melin, director of research at consulting firm Circular Energy Storage, dismisses the figure. The exact number cannot be reliably estimated because of existing second-life applications and a lack of thorough reporting, he says. “You are not required to report to anyone that you are stopping to use your phone,” he explains.

Circular Energy Storage attempted to calculate how many batteries have reached end of life each year, based on sales figures from 10 years ago. Additionally, the team requested information on recycling volumes from all 50 companies active in the field throughout the world. In 2018, about 200,000 tons of lithium-ion batteries had reached end of life. In that same year, 97,000 tons were reported as having been recycled – the biggest volume in one country being some 67,000 tons processed in China. Melin claims that most of the gap was probably used in second-life applications. Laptop batteries are routinely repurposed in power banks, for example.

One of the main reasons Melin believes the recycling rate is very high is the high prices commanded for lithium-ion battery raw materials. Recycling them results in a positive value stream. That means that recycling companies will pay for the batteries they process. Globally there is a bigger capacity for battery recycling than there is available battery waste, and the shortage cannot be attributed to batteries lying idle, nor in landfill sites, Melin asserts. From Europe and North America, most consumer electronics containing the bulk of lithium-ion batteries end up in China.

Only 15 years ago, China produced almost none of the lithium-ion batteries on the market, while today it accounts for around two-thirds of production. Chinese battery start-ups at the time had concerns about obtaining the cobalt and lithium required for production, Melin explains. As a result, these companies started buying end-of-life batteries from all over the world, to recover the metals. During these nascent stages of production in China, all of the cobalt used came from domestic recycling. Today that figure has dropped to about 20-30% as cobalt demand has outpaced supply from end-of-life batteries.

Still today, most battery recycling companies are materials companies. Their business models are based on selling cathode sulfates, precursors, or cathodes to battery manufacturers. Within this industrial segment, the active companies see battery recycling as a resource stream, rather than a purely environmental exercise.

GEM is the world’s biggest recycler of lithium-ion batteries. It recently entered into a supply agreement for 13,000 tons of cobalt over three years with mining company Glencore. “If you are in the cathode-selling business, recycling material has a price advantage over virgin material acquisition, but you can only recycle what is available,” Melin explains.

Not all batteries are equal

Once the modules have been removed from the battery packs, there is the question of whether to shred them, which results in the battery materials ending up mixed, or whether to find an automated method to disassemble individual cells. There is potential for “direct” recycling – to put recovered materials directly into new batteries. This could be carried out with some intermediate rejuvenation of the materials. And, indeed, it can make more sense to do so rather than refining the critical elements in the batteries back to their precursor materials, where the value in the cathode morphology is lost.

Developing the cathode or the precursor material increases material costs and requires significant amounts of energy. It is possible, however, to recover the cathode morphology or its precursor composition. In so doing, lengthy and costly purification steps can be circumvented. This makes sense, as the cathode virgin materials would be sold to cathode producers only for them to recombine them again. One challenge, however, is the different cathode chemistries on the market.

There are several lithium-ion battery chemistries on the market today, all of which contain varying quantities of valuable materials, and their cathode morphologies are not always in demand. The battery of a 2019 Nissan Leaf with a weight of 294 kg and its lithium manganese oxide (LMO)/nickel cobalt manganese (NCM) cathodes contains very little lithium, and the LMO cathode zero cobalt. The new battery costs $6,500 – 8,500, of which only $400 can be retrieved in the form of pure metals from the cathode. By contrast, an NCM battery with the same weight would yield minerals worth $4,000.

| Material | USD/kg | NCM111 | NCM523 | NCM622 | NCM811 | NCA | LFP | LMO | LCO |

| Casing | |||||||||

| Steel | 0.29 | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% |

| Aluminum | 1.8 | 10% | 10% | 10% | 10% | 10% | 10% | 10% | 10% |

| Current Collectors | |||||||||

| Aluminum | 1.8 | 5% | 5% | 5% | 5% | 5% | 5% | 5% | 5% |

| Copper | 6.0 | 7% | 7% | 7% | 7% | 7% | 7% | 7% | 7% |

| Anode material | |||||||||

| Graphite | 1.2 | 18.1% | 18.1% | 18.1% | 18.1% | 18.1% | 18.1% | 18.1% | 18.1% |

| Cathode material | |||||||||

| Manganese | 2.4 | 6.1% | 5.5% | 3.6% | 1.8% | 19.4% | |||

| Lithium | 70.0 | 2.3% | 2.3% | 2.3% | 1.9% | 2.3% | 1.4% | 1.2% | 2.3% |

| Cobalt | 30.0 | 6.5% | 3.9% | 3.9% | 1.9% | 2.9% | 19.3% | ||

| Nickel | 12.0 | 6.5% | 9.7% | 11.6% | 15.4% | 15.6% | |||

| Aluminum | 1.8 | 0.4% | |||||||

| Iron | 0.4 | 11.3% | |||||||

| Value $/ kg | 5.42 | 5.02 | 5.19 | 4.77 | 5.32 | 1.97 | 2.26 | 8.30 | |

| Source: Circular Energy Storage | |||||||||

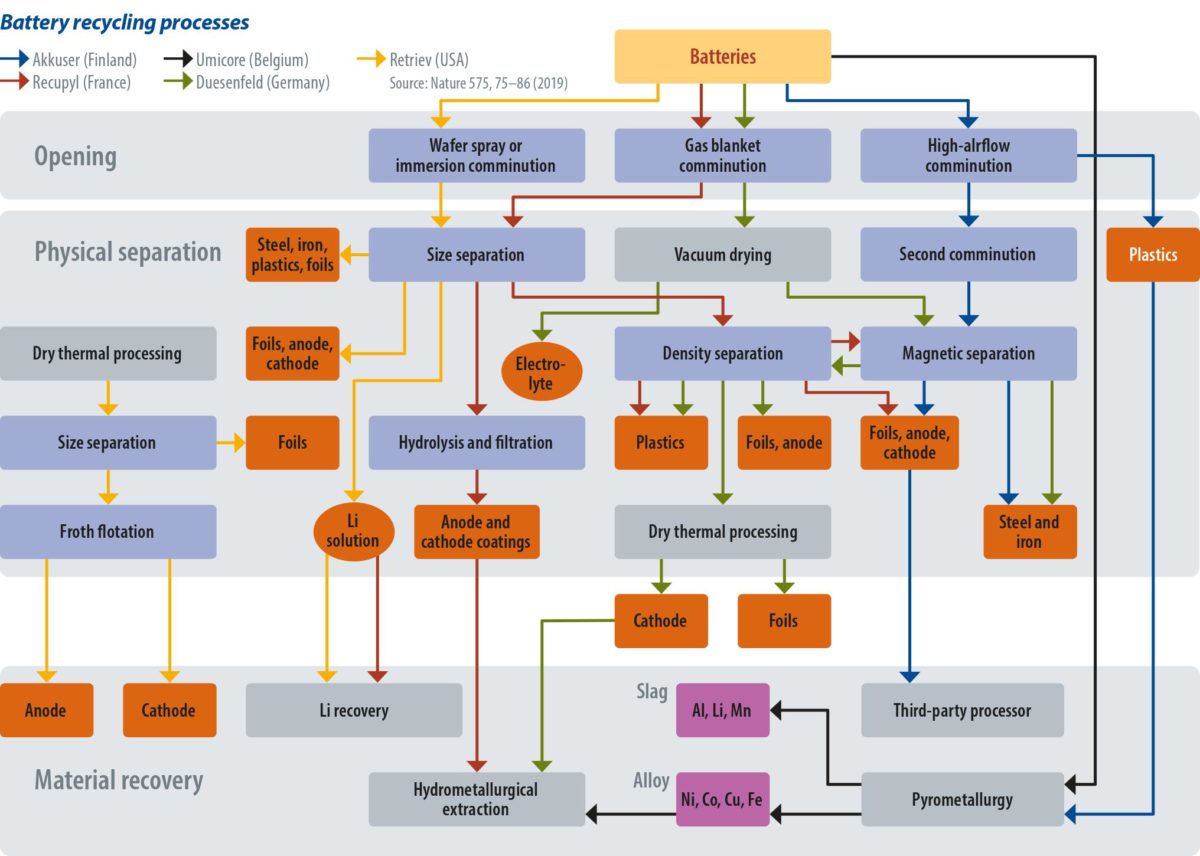

There are different techniques for recovering raw materials, recently set out in the paper “Recycling lithium-ion batteries from electric vehicles,” published in Nature. The lead author of the paper was Gavin Harper, from the University of Birmingham. Harper and his team set out the techniques and their efficacy.

One widespread, but rather simple technique is to shred the batteries and then cycle the material through sieving and magnetizing, and then further separation via hydrophobicity. This allows steel housings and copper and aluminum contents to be recovered. The result is a lithium-rich solution, along with coated electrodes and electrode powder. Separating this further will leave a fine powder comprising metal oxides and carbon, called “black mass.” The metal oxides can be chemically separated, but what complicates the job are the polymeric binders. They must be dissolved, which can take hours per batch. The process is mostly used to recover aluminum, steel, and electrode foils, which are largely made of copper. The “black mass” still containing valuable materials is then often used for road paving, though there are companies recovering valuables from “black mass” as well.

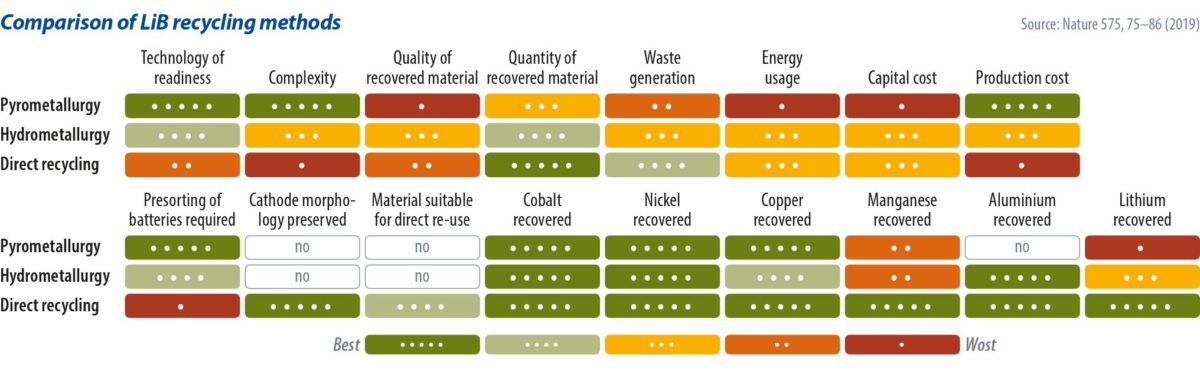

Another option is pyrometallurgy – a somewhat cheap and widely used process. Pyrometallurgy sees batteries fed into a furnace to burn the casings, binders, and polymers, which are not of value in the recycling process. The battery’s metal oxides are reduced to an alloy of copper, cobalt, iron, and nickel. In a later step, this alloy can be separated using hydrometallurgical processes. Lithium, aluminum, and manganese are captured in a slag, from which point it is highly uneconomical to recover further materials – again, the slag is often used in road paving. The advantage of pyrometallurgy is that the batteries don’t have to be opened, eliminating the need for passivation. The quality and quantity of the recovered material in the pyrometallurgy process, however, is far from ideal.

Cathode morphologies

Of the two processes to recover cathode materials, hydrometallurgy is much more advanced in terms of material recovery, though it is also considerably more expensive and complicated. Batteries require passivation, meaning that they must be fully discharged – usually in a brine of halide or alkali salts, and then opened under an inert gas atmosphere like carbon dioxide or argon, to avoid explosions. The batteries are then mechanically taken apart, and the parts containing the precious metals are submerged in acid. The most common reagent is H2SO4/H2O to leach the minerals off the cathode material. Cobalt, nickel, lithium, manganese, and other materials form oxide, carbonate, hydroxide, or sulfate combinations.

Once the metals are contained in the leached solution, manipulation of its pH allows the recovery of the minerals through several precipitation reactions. “Cobalt is usually extracted either as the sulfate, oxalate, hydroxide or carbonate, and then lithium can be extracted through a precipitation reaction forming Li2CO3 or Li3PO4,” Harper and his team explained. It is also possible to use a process in which electrode materials are ground with chlorine compounds, to retrieve cobalt, as it produces water-soluble cobalt salts. Most current processes aim for reagent recovery, because the metals that can be extracted can be of sufficiently high purity for the resynthesizing of new cathode combinations, or in entirely new applications. Such processes allow for the recovery of about 70% of the cathode value, depending on its cobalt content. If the cobalt content drops in the battery chemistry, the recycling economics are notably affected. This is also why nearly all the cobalt is recycled – around 14,000 tons per year.

The way the economics work largely dictates how battery recycling companies position themselves. At present, NCM batteries gain progressively more market share and are expected to replace older chemistries such as lithium cobalt oxide (LCO) or lithium ferrous phosphate (LFP). There is little economic value in performing the highest recycling standards on LFP batteries, simply because it delivers so little raw material value.

Trying to capture the value of the cathode morphology is also problematic due to limited demand for LFP cathodes. Hence, most recycling operations are involved in NCM cathode production, and ideally want to source NCM batteries. With the recycling value of LFP very low and its cathode not in demand, Melin says that batteries with this chemistry could be at risk of ending up in landfill. Only in China are they recycled for their copper content. The high cost of cobalt has also resulted in the development of new chemistries with progressively less cobalt. NCM 111 batteries, introduced in 2008, contain 6.5% cobalt, while newer NCM 811 chemistries contain only 1.9% cobalt. This ever-changing landscape, and the tendency to move away from the use of cobalt and lithium, is the seed of market insecurity among recyclers.

Closing the loop

Despite the challenge posed by changing battery chemistries, improved recycling practices could allow the retrieval of materials in their virgin form. But this has to be preceded by new battery design aimed at enabling cost-effective recovery of materials.

“It is clear that the current design of cells makes recycling extremely complex and neither hydro- nor pyrometallurgy currently provides routes that lead to pure streams of material that can easily be fed into a closed-loop system for batteries,” the Harper team noted.

Regulation can also play a role. Melin notes that in Europe, a redraft of the battery directive is underway. For him, the new draft should capture the various chemistries available, and account for the fact that batteries will most likely be shipped elsewhere before they are recycled. Lastly, he says, a rethink is required in which end-of-life batteries are considered less as waste, but rather as a resource stream.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.