In early June 2021, the total sustainable debt market reached $3 trillion of issuance – a milestone since its inception in 2007, when the World Bank issued its first “Climate Awareness Bond.” The most recent trillion dollars of issuance was achieved in just eight months, compared to just under two years from the previous trillion dollars, demonstrating the pace at which the market is developing.

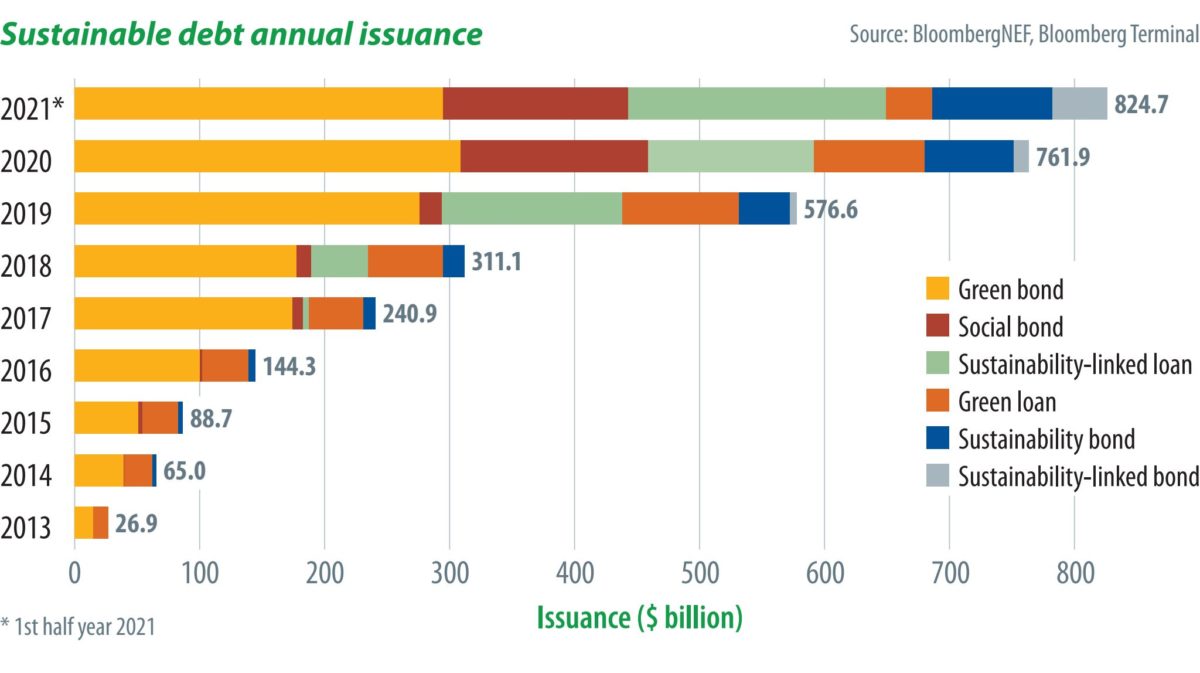

Indeed, almost $825 billion of sustainable debt – borrowing activity via loans and bonds which is used to finance environmental or social improvements – was issued in the first half of this year. This is an 8% increase over the $759 billion issued through all of 2020.

BloombergNEF splits sustainable debt into two main categories. There are activity-based debt instruments, like green, social and sustainability bonds and loans, and there are activity-based debt fund projects, or activities with an environmental benefit or social benefit. They can be raised to finance new projects or refinance existing ones. There is also behavior-based debt, which encompasses sustainability-linked bonds and sustainability-linked loans. Contrary to activity-based debt, the activities performed with the raised money are not what earns behavior-based debt types their “sustainability” label. Behavior-based debt is dubbed “sustainable” when its coupon or any other financial characteristic is tied to a sustainability target for the issuer, requiring them to modify their behavior. This could be a greenhouse gas emission reduction goal, a quota for diversity in the workforce, or many other types of behavior.

While green bonds still represent almost half of the total sustainable debt issuance, other instruments, such as sustainability-linked loans and social bonds, are also gaining interest, accounting for 16.7% and 10.8% of total issuance, respectively. The most impressive surge has come from sustainability-linked bonds, where issuance in the first half of 2021 rose by 282% compared to total volume through all of 2020.

Green bonds require issuers to segregate the funds for environmental projects and activities, meaning they sometimes restrain access to certain issuers in sectors undertaking low-carbon activities. On the contrary, sustainability-linked bonds allow any issuer to raise financing for any purpose and link the repayment of the debt to the achievement of a sustainability target. Sustainability-linked bonds appeal to a larger group of borrowers. Even heavy-emitting issuers such as British Airways and Repsol have turned to this market in 2021.

Greenwashing threat

While the rapid growth of sustainable debt allows market participants to recognize which debt instruments are going to finance green and social projects, there is still little transparency with regard to the additional benefits brought by these instruments. Issuers are not legally bound to publish impact reports or the exact allocation of the bonds.

Even if this practice is now more broadly followed by organizations, the reporting frameworks lack consistency, making it very difficult to compare the environmental or social additionalities brought by the different sustainable debt instruments. Sustainable debt can also be used to refinance existing projects, rather than funding new ones, raising concerns about the actual additional funding that green debt is unlocking for new environmental projects.

The emergence of transition bonds is also raising new greenwashing concerns. They are a sub-category of sustainable debt that was initially created to allow heavy-emitting issuers, which had a difficult time coming to market with green bonds, to raise an alternate form of sustainable debt. They do not bring any pricing benefits to issuers, but instead allow them to signal to their investors that they are allocating some funds to their low-carbon transition, in turn taking advantage of the sustainable investment trend. The existence of transition bonds remains much debated in the market, further fueled by the fact that they lack a clear definition.

Need for regulations

The sustainable debt market is still lacking regulations that would define the conditions of issuance for any sustainable debt instrument, but that may change in the future. Until now, some industry organizations, like the International Capital Market Associations (ICMA) or the Loan Market Association (LMA), have published voluntary guidelines to issue green, social, and sustainability bonds and loans. These principles have brought more credibility and robustness to the sustainable debt market, but they still leave room for interpretation, as eligible green and social projects and activities remain quite broad.

Regulators are now developing new legislations to supervise the development of sustainable debt. It starts with environmental and social taxonomies, which define the conditions under which economic activities and projects can claim to be environmentally and socially sustainable. The European Union was the first to enforce its environmental taxonomy, but since then more countries like the United Kingdom, South Africa, China, and Singapore have been either working on their own taxonomies or are already publishing their first drafts.

Once sustainable activities are defined, it is easier to create legislative frameworks for the issuance of sustainable debt, as is the case in the EU, which published the first draft of its green bond principles on July 6, 2021. The EU intends for it to be a voluntary “gold standard” for green bonds and it will be open for EU and non-EU issuers to use. However, if issuers decide to call their bond a “European green bond” or “EUGBS” then they will have to abide by the European standard. The EUGBS mostly relies on the existing pillars of the green bond principles from ICMA, showing the pre-eminence of this framework.

The creation of rules for the sustainable debt market has historically boosted issuance, as they bring confidence to the investor community and remove the greenwashing risk for issuers.

| Sustainable debt labels and characteristics | ||||

| Debt type | Debt style | Purpose | Market size ($ billion) |

Proportion of sustainable debt |

| Green bond | Activity based | Environmental projects |

1,458 | 45.7% |

| Green loan | Activity based | Environmental projects |

550 | 17.3% |

| Sustainability linked loan |

Behaviour based |

Institutional ESG targets |

532 | 16.7% |

| Social bond | Activity based | Social projects | 343 | 10.8% |

| Sustainability bond |

Activity based | Environmental & social projects |

246 | 7.7% |

| Sustainability linked bond |

Behaviour based |

Institutional ESG targets |

60 | 1.9% |

| Source: Bloomberg NEF, Bloomberg Terminal, Note: Instruments included are from 1996-June 30th, 2021 | ||||

About the author

Maia Godemer is a research associate in sustainable finance for BloombergNEF. In particular, she focuses on sustainable debt, derivatives, and market regulations. She is part of the EU Platform on Sustainable Finance as support for Bloomberg member Nadia Humphreys (also known as the “Sherpa role”). She is also a member of the advisory council to the International Capital Markets Association on green bond and social bond principles. Godemer holds a bachelor of philosophy from Université Pierre Mendes France, as well as an MSc. in management and an MSc. in finance from Grenoble Ecole de Management.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.