One day before U.S. President Donald Trump exited office, his administration granted a graphite mine the status of “high priority infrastructure project.” The distinction earned the mine, planned in Alaska, a smoother permitting process under rules designed for roads and energy projects. Graphite One, the Canadian company developing the mine, doesn’t call itself a mining company, but a technology company inspired by Elon Musk.

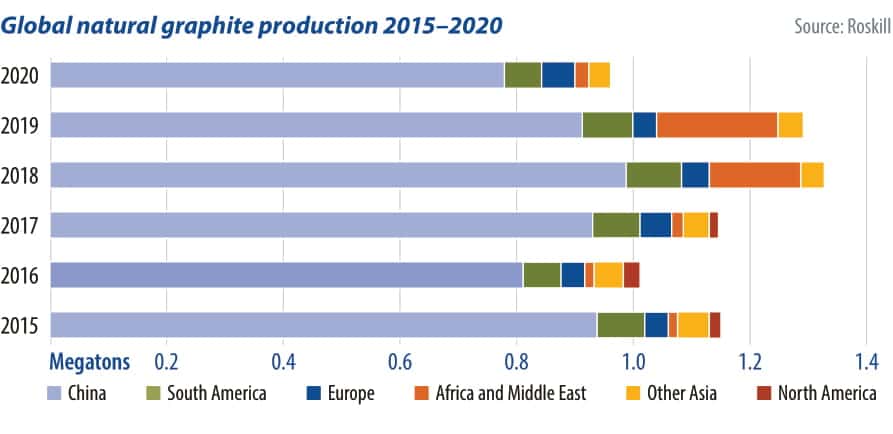

Graphite, scientists and market experts say, will be critical to the clean energy transition for its almost irreplaceable role in the negative electrode of lithium-ion batteries used in electric vehicles (EVs). Long fueled by the steel industry, half of all natural graphite produced is set to end up in batteries by 2030, up from just 20% currently, according to Roskill.

For most EV batteries, no other element stars more prominently than carbon, which appears as the soft crystal graphite. In the negative electrode, or anode, graphite hosts lithium atoms when a battery is charged, and releases them when the EV is powered on. The World Bank predicts that graphite production will need to grow by more than 450% by 2050 in order for clean energy technologies to keep temperatures under a 2 C increase from pre-industrial levels.

For that reason, natural graphite, the kind found in Graphite One’s proposed mine, is on both the U.S. and EU lists of critical materials. As a relatively abundant material, graphite’s scarcity is created by technical and political forces.

“It’s not about availability. It’s about who owns it, who processes it, who wants to be doing business with who, and that’s what it really comes down to,” says Suzanne Shaw, deputy manager for critical minerals at Roskill.

Fueled by the projected growth of batteries and stronger environmental safeguards in China, producers like Graphite One are seeking to diversify the world’s sources. While just one processor of graphite materials exists outside China, more are in the pipeline.

In addition, scientists and companies are looking to alternative innovations and battery constructions to equip batteries with their anodes. While anodes have received relatively little attention compared to cathodes, scientists are increasingly finding that the once “boring” material is the “limiting factor” in achieving safe, powerful energy density.

“Graphite is really hard to beat,” says Dominic Bresser, a battery scientist at the Karlsruhe Institute of Technology in Germany, who wrote about the success story of graphite as an anode material last year in Sustainable Energy & Fuels. After 50 years of research into anode technologies, graphite remains the dominant choice. “If that’s not successful, then I don’t know what is,” he says.

The newly installed U.S. administration announced in February a 100-day review of its reliance on global supply chains for critical materials like graphite. Like many raw materials for batteries, the majority of graphite is produced and processed in China, but the Chinese government is keen to introduce stricter regulations and look elsewhere even for its own supply.

Rapid expansion of the graphite industry is bringing environmental issues to the surface, as well as its concentration in certain parts of the world. Aided by scientists and environmentalists, the industry is trying to address its shortcomings and prepare for a future powered by hunks of graphite in millions of vehicles throughout the world.

Processing projects

The average battery cell in an EV relies on an anode made mostly of natural graphite, but some also include synthetic graphite and silicon. Roskill estimates that 65% or more of all active anode materials in a cell come from natural graphite. Dozens of global projects are seeking approvals to create new sources of battery graphite.

Image: Group14 Technologies

“Anyone who is outside of China is looking to do it in a different way – every single one of them. How different it’s going to be remains to be seen, but they’re all playing up the fact that they’re being more environmentally friendly and then looking to do their own method which they’re keeping under wraps,” says Shaw.

It’s hard to get around the issues with graphite processing for batteries. In the global ramp-up for the World Bank’s 2 C scenario, graphite has the second highest potential to worsen global warming after aluminum. Producers have typically mixed acids into the mined ore to turn the natural flakes into spherical particles, which are more porous to electrolyte and boost packing density. It’s not too different from the graphite in a pencil, but its production creates large amounts of wastewater and air quality issues. Over the past few years, Chinese regulations have forced companies to tackle pollution, spurring exploration elsewhere.

One of the ways companies seek to process graphite outside China depends not on acids, but high thermal energy used to manipulate the graphite flakes. Using electricity to bring temperatures up to thousands of degrees Celsius raises costs, making it difficult to compete.

Synthetic graphite is also used in increasing proportions in batteries for its ability to discharge more quickly and deliver greater power to certain EVs. However, synthetic graphite is produced mainly from petroleum coke, a waste product of the fossil fuel industry. It’s also roughly double the cost of natural graphite, which is already cheap, and producing it also means very high temperatures. “Either way, there’s not a great way around this,” says Shaw.

Many new projects are attempting multi-continental supply chains. Australia’s Ecograf, for example, plans to open a mine in Tanzania. It will then process the graphite in Australia, and then further process and manufacture it in Germany. Syrah Resources, the largest flake graphite producer outside of China, mines in Mozambique. With a plant almost at operational capacity in Louisiana, the company could become the first processor outside of China, although it has faced production issues. Louisiana locals still worry about wastewater disposal and severe air pollution.

Metal mines

Natural graphite mines were once found across the world, before market consolidation moved producers to China. In addition to Graphite One in Alaska, other ventures are now being explored in Alabama, Sweden, Australia, and Canada, as well as new developments in Africa, particularly in Tanzania.

Natural graphite is mined from flake graphite deposits that can be tough to scale up, especially for sale to battery markets, Shaw says. Batteries demand highly pure materials, but graphite deposit compositions are notoriously inconsistent. While most metal mines depend on grade, or the concentration of metals, graphite mines struggle to maintain consistent shape and impurities.

“Ramping it up to commercial levels means getting it tested with the battery sector, and the battery sector is notoriously fickle about what they want in terms of specification,” says Shaw.

It remains to be seen whether global producers will be able to compete with Chinese prices, and whether buyers will consider paying more for more sustainable graphite. Only a handful of companies have been pursuing graphite processing outside China, which could become a “big issue,” Shaw says, if producers suddenly want graphite with great environmental credentials.

Cleaner options?

Bresser, at the Karlsruhe Institute of Technology, has been investigating graphite recovery and reuse. Graphite components can be separated with heat and air jets. Unlike the cathode, which relies on tough, toxic binders to hold particles together, the anode usually uses water-soluble binders that allow for an easier return of the graphite to a state suitable for manufacturers.

“And I have to say the performance is amazing,” he says. “From that point of view, recycling graphite has a chance.” Recycling can make it easier for countries to find domestic supplies of material.

However, natural graphite is a cheap material. Even though an anode takes up the most space in a battery, it only accounts for roughly 8-10% of the cost. Current graphite recycling can’t compete with the price of newly mined material.

Anode producers may close the loop via other products that are headed for the landfill. A team of scientists in South Korea recently discovered a method to turn discarded plastic bottles into graphite, without relying on the petroleum industry for its materials.

Eventually, techniques like this may be used to reduce costs for synthetic graphite as well as recycle landfill. “I think from a sustainability point of view, that’s the way to go,” Bresser says.

Innovate instead

Graphite has long been considered a “perfect anode.” It has a more attractive potential energy profile, compared to other options for inert lithium host electrodes, like hard carbons. As the EV sector expands, R&D is turning its attention to new kinds of anodes.

Silicon, with a specific capacity of 3,600 mAh/g, is roughly 10 times higher than that of graphite at 370 mAh/g, which could reduce charging times as well as battery weight. Produced from quartz, silicon can be cheaper compared to the energy density advantages it brings.

“The main advantage with silicon – decreasing mass by a factor of 10 – comes at the cost of dramatic volume variation,” says Bresser. When a graphite anode hosts lithium atoms, it may swell 8-10%. When silicon does the same, it can swell almost 300%, which is incompatible with EV battery packaging.

A U.S.-based company, Sila Nanotechnologies, says it has designed a unique way to mitigate swelling issues and replace graphite with a silicon dominant material. In January, it raised $590 million, bringing the company’s value to $3.3 billion. It was the largest fundraising achievement in the entire battery supply chain, according to Benchmark Mineral Intelligence.

Scientists are also exploring the possibility of removing the anode. Anode-free cells, in which lithium atoms attach directly to a copper current collector, may last much longer than a typical EV battery with a seven to 14 year lifespan. Carmaker GM recently announced a lithium-metal battery that uses lithium as an anode material and makes up for the cost with higher capacity. Graphene may be a helpful additive for batteries in the future, but it remains too expensive for mass production.

Many of these movements in the graphite market target lower cost and better performance, but attention to environmental concerns is the elephant in the room. “The reality at the moment is the materials going into those green technologies isn’t that green,” says Shaw. “Is ESG going to be more and more of a thing in the years to come? We think yes.”

Ian Morse

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.