At the European Solar Power Summit 2022, held in Brussels at the end of March, the fog of war hung over every discussion. However, Russia’s invasion of Ukraine may have also awoken a sleeping giant in the renewed urgency for Europe’s energy transition. European Commissioner for Energy Kadri Simson opened the summit by noting that the continent was at a “critical” juncture.

“The energy world has changed drastically in recent weeks,” said Simson. “The events in Ukraine remind us of an uncomfortable truth: We are too reliant on Russian fossil fuels. And as long as we continue like this, we are not fully in control of our energy future. That needs to change. This is not a new priority. It is a new sense of urgency. Europe used to be known as a manufacturing powerhouse – one that is guided by our own brand of environmental excellence. We need to bring manufacturing back to Europe and the commission is willing to do whatever it takes to make it happen.”

Simson’s attendance at the summit provided SolarPower Europe (SPE) an opportunity to present the EU Commissioner its official response to the consultation for the upcoming EU Solar Strategy (the Strategy), which closed on April 12.

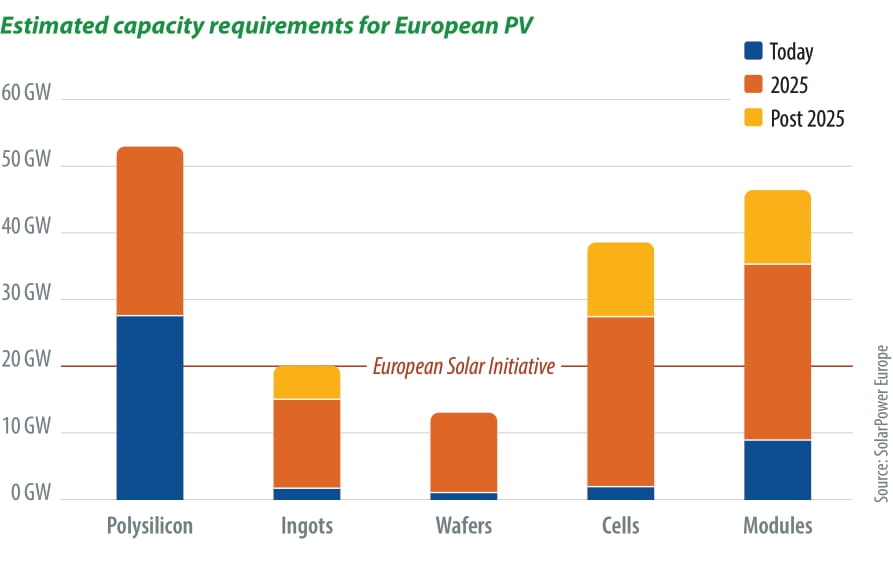

The response, titled “Raising Solar Ambition for the European Union’s Energy Independence,” highlights reinvestment in domestic manufacturing as one of eight key actions recommended for the strategy.

SPE suggests a €2 billion ($2.1 billion) solar fund to leverage private investment, target closing financing on shovel-ready projects within six months, define and implement sustainability criteria to “create a level playing field” among PV products, and eliminate EU trade barriers for better facilitation of raw materials.

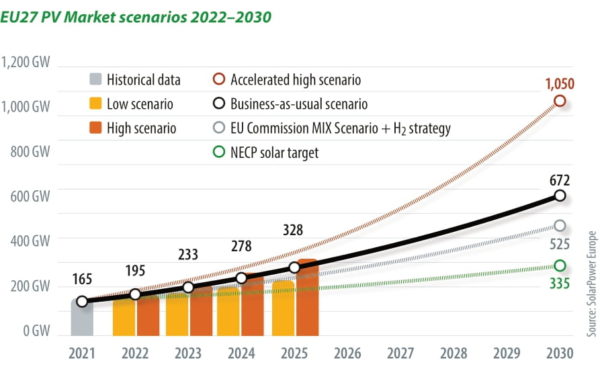

This domestic manufacturing reinvestment, along with seven other actions, would serve as the foundation for an accelerated high scenario of over 1 TW of total EU solar capacity by 2030. Importantly, all now agree the urgency of this ambitious target depends upon the interrelated goals of sustainability and security, upon a reduction in dependency on Russian fossil fuels and a rapid acceleration of sustainable renewables uptake.

As the European Investment Bank’s (EIB) head of renewable energy, Alessandro Boschi, put it, “we are in a unique moment to push for more … there is a sense of priority, because now we are not just talking about energy security but real security.”

Reliance on Russia

When asked how soon Europe should extricate itself from its dependency on Russia, former energy engineer and member of the European Parliament, Emma Wiesner, said “How soon? I would say, ‘yesterday.’ But obviously it is very hard to change pipelines overnight. What is missing from the current discussion in the EU is that we are still financing the war through our energy payments. We (Renew Europe Group) are asking for an import ban as soon as possible, but that is currently missing from European leadership. It will be an enormous challenge for the energy landscape, but we have the means to do it.”

Due to the dependence on Russian gas, an import ban does seem a stretch too far for the EU now, though continual escalations in the conflict in Ukraine could push European policymakers.

Indra Overland, head of the Center for Energy Research at the Norwegian Institute for International Affairs, told pv magazine that it would be a “tough situation for Europe” if Russian gas supplies are lost. But nevertheless, “the invasion of Ukraine qualitatively changes the nature of many arguments and discussions about energy, pricing and what people must accept.” Moreover, indicative of a zero-sum game, Overland noted the reduction in trade relations with Russia necessarily boosts renewable energy’s priority as a dual solution.

The EU has put itself on a mission to cut its use of Russian gas by two-thirds this year, and to cut off the supply completely by 2027, with the commission to provide a detailed plan in May for how the EU can achieve this goal. Of course, one of the primary pillars of this end is accelerating the transition to renewable energy but escaping one dependency might lead Europe straight into another.

Dependency dilemma

The summit’s discussion on sustainable manufacturing was an impassioned one. “We are stepping right into the next dependency here,” said Wacker Chemie AG’s polysilicon division president, Tobias Brandis. This referenced the concern that without a strong and sustainable European manufacturing sector, Europe’s withdrawal from Russian fuel would be, in the words of SPE’s Michael Schmela, simply going “from one dependency (Russia) to another (China).”

As Ian Draisey, head of global purchasing at BayWa r.e., told pv magazine, “the EU will be looking at its dependency for PV on China, and should/will be planning accordingly.” This is another case of sustainability and security interdependence, he said. “If the manufacturers can afford to absorb the raw material shipping costs, then EU manufacturers both lower the carbon footprint for the end user and reduce lead times and transport costs for the installer and distributors.”

One silver lining of the pandemic’s supply chain constraints is that many have woken up to the previously unquestioned gluttony of global shipping. Soltec’s Andrés Ortuño pointed out that 45% of the tracker price is steel, but claimed that in the last two years, the company has bought almost 100% of its steel in Europe for its European projects due to high logistics costs. “This is changing with the Ukraine invasion,” he noted.

Similarly, Meyer Burger’s chief sustainability officer, Katja Tavernaro, told pv magazine that the European solar stalwart has been able to source 80% of its purchasing volume for its mechanical engineering from the region around its Hohenstein-Ernstthal manufacturing site. “We have high expectations of ourselves to create sustainable products,” said Tavernaro. “That’s why we also have to align our supply chain with producing the lowest possible CO2 emissions and creating transparency about processes and the use of materials.”

The European Commission’s director for mobility and energy intensive industries, Joaquim Nunes de Almeida, was clear-eyed; the issue of “security of supply is something that will stay with us for years to come.” And yet, “we cannot replace our dependency on Russian gas for a dependency on China for solar.”

Of course, Chinese manufacturing has its own environmental, social and governance (ESG) concerns, which had been dominating headlines before Russia’s invasion of Ukraine. But despite a modicum of international pressure on certain parts of the Chinese value chain in response to allegations of forced labour, a reduction in dependency on China does not have the same urgency as it does from Russia.

While everyone at the summit was agreed upon the symbiotic relationship of reduction in Russian gas dependence and a boost in renewables, everyone was also agreed that European manufacturing would never be able to compete with China on price. If Europe is to have a competitive advantage, it must be innovation.

Innovation at a price

“We all agree that if Europe tried to compete on price (with China) we would not survive,” said Almeida. This is why Europe must play to its strengths, particularly innovation. This is no secret to European manufacturers.

“We have to be the first mover, the pioneer,” said Salvatore Bernabei, CEO of Enel Green Power. “We’ve finally understood we can’t have dependency … our focus should be innovation.” Brandis noted that Wacker Chemie ships 95% of its material to China, claiming “we have an advantage in technology.” However, he argued this competitive advantage is difficult to solidify because energy costs in Europe are so prohibitively high.

Such is the catch-22 of the current concatenation of crises, Europe needs to build a sustainable manufacturing sector to secure its energy resilience, but a lack of energy resilience means electricity prices are too high and volatile for the task.

The severity of energy costs depends on the part of the value chain you occupy. When it comes to polysilicon, itself already a very serious ESG concern, energy costs are enormous. Brandis said “0.8% of German energy consumption is Wacker.”

A possible solution, Brandis argued, is to follow the lead of the United States, where “they have areas where energy intensive industries can operate at low costs. We don’t expect prices to mirror western China, but we need a decent energy price that is reliable.”

EIT InnoEnergy CEO Diego Pavia argued that while European manufacturing will never be able to compete with China on cost, “the demand side is willing to pay a premium for EU manufacturing.” But there is an “appetite in the market.”

Enel’s Bernebei said European products could be made more efficient, but that would likely require a premium price, but that premium “could be alleviated with a tax credit.” A tax credit would support “manufacturing in Europe to meet a minimum of ESG and be more efficient.”

Grid gripes

Finally finding the urgency to ditch Russian gas and go for renewables is one thing but finding a way for those renewables to reach the grid is another, and the consumer is part of the solution. Wiesner told pv magazine the current system of Guarantees of Origin (GOs) “is a mess,” but cleaning it up only requires a small, albeit significant, tweak.

“It is frustrating that industry and consumers cannot trust the policy scheme that we have,” said Wiesner. “The GOs, they’re still filled with loopholes, even if someone has ‘100% renewables’ (according to their GOs), they could still be dependent on coal power the majority of the day and just buy the certificates.”

The small but significant fix is required in Article 19 of the Renewable Energy Directive, whereby the annual timeframe of GOs would be changed to hourly. This alteration is a representative change known as 24/7 matching. “If you want to claim green and use green electricity for that hour, you need to source green electricity for that exact hour,” said Wiesner. “Now we have the technology (smart meters), regulation needs to advance.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.