While homeowners may feel the impact of rising energy price spikes, for businesses it is an ever-present concern. One Guangdong-based producer of stainless steel and alloy precision castings, which uses around 600,000 kWh of energy a month to run its processes, is just such a business exposed to rapidly rising electricity prices in the China market.

The real crunch for the manufacturer occurred last summer when, due to grid electricity shortages, it was only allowed to operate its factory three days a week, thereby reducing its production by more than half. Given these conditions, the company’s access to a substantial rooftop area made installation of a large solar system a no-brainer.

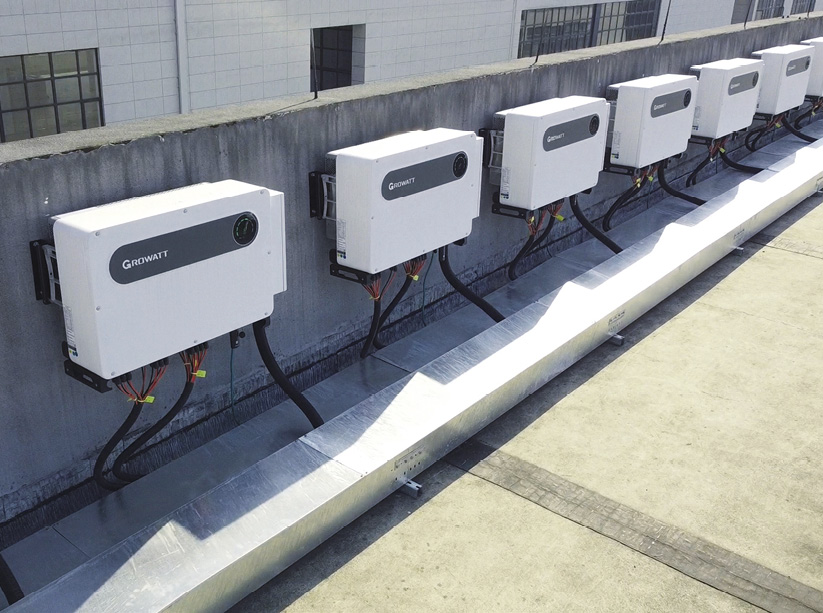

With the assistance of local engineering, procurement and construction specialists, Guangdong Weiyang Technology, the manufacturer, which prefers to remain anonymous, decided on a 2.6 MW system of Longi modules and 21 Growatt MAX 125KTL3-X LV inverters.

“A solar plant this size can generate an annual power output of about 2.8 million kWh, which accounts for one-third of the total electricity consumption of our factory,” the company told pv magazine.

PV value

The Chinese government modestly incentivizes PV installations by reducing limits on energy that a partly solar-driven commercial or industrial producer can draw from the grid. The combined effect of self-generation and a little boost in accessible grid power now allows the casting factory – which also produces metallic, plastic and rubber components, as well as molds for other manufacturers – “to restore production and run on a normal schedule,” said a company representative.

The use of high-quality solar equipment made upfront system costs a little higher than normal, but the owner says it’s worth it. “Longi is an international first-tier brand, and Growatt is both a local Guangdong enterprise providing outstanding service and a global leader in distributed solar inverters – these things provide us certain assurances.”

Engineered for large commercial and utility installations, the new Growatt MAX 125KTL3-X LV three-phase PV inverter features 10 fuse-free maximum power point trackers (MPPT) across 20 strings. It offers ultimate flexibility of system design and installation, taking into account partial shading where it occurs, and accommodates various module orientations, to achieve the highest energy yields. MAX by name and by design, its wide MPPT range of 180 V to 1,000 V means it can start work earlier in the day than many other inverters and finish later in the afternoon, maximizing daily output.

In this case, the solar installation is split across buildings, with conventional solar installed at an inclination on some existing roofs and building-integrated photovoltaics (BIPV) used on three buildings.

The owners of the casting business inquired as to whether part of the installation might use a building integrated PV (BIPV) solution to enable extra warehousing space above the factory floor. Waterproof BIPV effectively creates a second roof on three of the buildings, which provides the company with storage in the space between the old and the new roofs.

“It was a special challenge,” said Zhanheng Lin, Guangdong Weiyang Technology’s project manager of the BIPV component. “It took a lot of time and communication between the project design team and the construction team.”

Self-generation

Aside from sometimes running into overtime to meet its quarterly production schedule, the manufacturer generally operates during the day – a production schedule that coincides with the available solar resource. Its solar system is intended to run on a self-generation for self-consumption basis, however surplus solar energy – as generated on holidays or on occasions when the manufacturer’s power consumption is lower than usual – can be exported to the grid.

“In southern China, the grid purchases electricity generated from solar at a relatively high price, currently CNY 0.453 ($ 0.071)/kWh,” said the manufacturer.

The combined effect of the feed-in tariff (FIT), the overall reduction in high-cost electricity purchased from the grid, and a restored production schedule, is that the company expects the sizable system to pay for itself in around five years.

Lin says that such C&I system sizes are not unusual in the southern manufacturing hub of Guangdong. He told pv magazine that 2.6 MW is considered medium-sized in the region, since many other companies have already switched to solar.

The third quarter of 2021 also marked the moment when Guangdong and several other provinces raised electricity prices by as much as 25% during peak hours. Shortages of coal to feed China’s coal-fired generation plants, combined with pressures to meet government emissions reduction targets are said to be behind the electricity rationing imposed on the country’s manufacturers.

Widespread rationing is designed to encourage the C&I sector to go off peak or go solar. “Given the current high electricity price and a power supply limited by the grid at peak times during summer, solar plants installed for self-consumption pay off even without government subsidies,” Lin said.

Our manufacturer has its own carbon-reduction ambitions, and says the 2.6 MW rooftop solar installation will reduce its annual emissions by about 2,700 tons of carbon dioxide – icing on the cake for a company that is essentially back in business after several challenging months.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.