The production surplus and unbridled consumption, constantly fueled by clever marketing and artificial demand generation, is driven by a promise of growth – no, by compulsive growth – without which the globalized economic and financial system would cease to function. Unfortunately, we are increasingly faced with the realization that this has given rise to massive social distortion and resulted in the radical exploitation of the planet along with the destruction of the habitats of so many living creatures.

With all the unrestrained growth, one area has been criminally neglected, at least over the past ten years: renewables. Following a brilliant start at the beginning of the 2000s, governments hit the brakes from 2010 onwards – mainly out of fear of losing control over the energy transition – and unfortunately succeeded in keeping the sector as small as possible. “Don’t need that (yet),” they claimed. “It doesn’t work … too expensive, anyway!”

Now, all of a sudden, everyone – politicians, businesses, the media, and the proverbial “man in the street” alike – realize that we need renewables, and as quickly as possible. But now the train has all but left the station. The collapse of the European solar industry and the exodus of skilled workers was simply shrugged off. Now we’ve been left holding the bag and have to figure out how to make the most of our very scarce resources. We have to relearn how to deal with scarcity and how to economize – old knowledge and ingenious concepts are in demand.

We in the industry are being called on to perform an unimaginable feat of strength. Due to the failures of past decades – not only of previous governments in Germany, but around the world – the catching up needed to transform the economic system and introduce renewable energy has now become so great, and the time remaining so short, that we really ought not to have a moment’s peace. The urgency seems to have been recognized, in Germany at least, where the Minister of Economics and Climate Protection, Robert Habeck, recently presented realistic expansion targets in line with the goals called for by environmental and industry associations long ago. The only thing missing is a coherent implementation concept.

As 2022 moves forward, the first thing to note is that we are still in the midst of a global health crisis that is increasingly affecting supply chains. The advance of the Omicron variant is leading to personnel-related downtime in production and logistics. At present, entire cities in China are again being sealed off to prevent local spread. However, if the Chinese government’s zero-covid strategy does not work, which is the fear with this aggressive virus, the population and economy still have a lot ahead of them. We can only guess what this will mean for the supply of goods to the rest of the world. In Europe, the on-time flow of goods is hampered by a shortage of truck drivers, which is causing shipping costs to skyrocket.

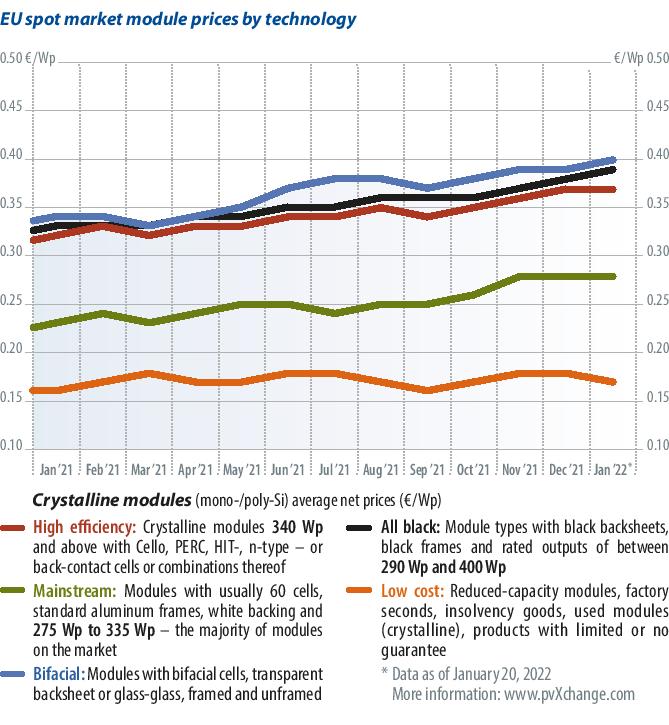

The year is still young, and demand for PV components has not yet taken off. On the price front, little is happening as many manufacturers are still sorting themselves out. For the remainder of the year, prices are expected to fall again – both in the semi-finished and finished products sector. But this may be a bit too optimistic. If the political course is set as quickly as some ambitious statements suggest, we could be in for an unprecedented boom in demand. In Germany, measures such as an increase in the feed-in tariff, significantly higher tender volumes, a solar construction mandate for non-residential buildings, tax relief and a general reduction in red tape for construction projects are just a few of the options on the table. There are also numerous initiatives in the international arena to increase the annual expansion of PV systems, power storage systems and charging infrastructure to the desired, and indeed necessary, level.

And now we come to the variables that the optimists are not taking into account, the manufacturers and suppliers, not to mention the planners and installers which were left out of the equation. In order to adhere to the urgently needed expansion path outlined by Habeck in his recent public statements – the so-called “photovoltaic booster” includes an increase in PV expansion of around 50% per year – we need more raw materials, more national and international production and transport capacities, and more skilled workers in the areas of planning, installation and service. But where is all this going to come from? In a free market, a shortage would cause prices for components and installation work to rise again quickly. In this respect, market and price developments this year are once again par for the course; that is, unpredictable.

Unfortunately, we have too little of everything to cope with the upcoming boom, except perhaps bureaucratic hurdles, doubters and naysayers. What we need now is to roll up our sleeves and get started! Let’s deal creatively with the shortages. Let’s get faster and more efficient. Let’s optimize and digitalize our processes. Let’s say goodbye to redundant structures and paralyzing regulatory hurdles. Let’s finally demand that politicians set a smart course. Let’s train new skilled workers or get them from other, dying sectors of the economy. Let’s reestablish production in Europe, and thus increase local value creation. Let’s shorten distances and save CO2 in the process. Let’s improvise where necessary and say goodbye to self-doubt. There’s no time for defeatism; we have to seize the day.

About the author

Martin Schachinger has a degree in electrical engineering and has been active in the field of photovoltaics and renewables for more than 20 years. In 2004, he started his own business and founded the internationally known online trading platform pvXchange.com, where wholesalers, installers and service companies can purchase solar panels, standard components and inverters that are no longer manufactured but are urgently needed to repair defective PV plants.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.