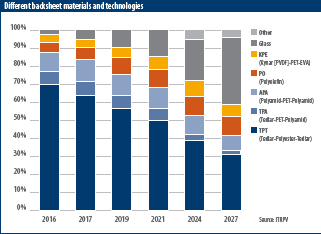

One could think that, with the growing trend towards glass-glass modules, any discussion on backsheet materials for glass-foil modules is becoming less relevant. It would appear, however, that the opposite is the case. In 10 years’ time backsheets will still comprise almost 60% of the market, according to the experts and the 30 companies surveyed for the International Technology Roadmap for Photovoltaics (ITRPV) 2017. And because the industry is expanding, the market for modules utilizing backsheets will even increase, by approximately 70% compared to its current volume, to 363 GW.

According to the report, the backsheet type TPT, which is dominant today, will still enjoy almost 50% market share in 10 years. However, backsheets that use polyolefin (PO) as a core layer instead of the polyethylene terephthalate (PET) used in today’s TPT will experience a sharp rise in market share. They could even account for 17% of all glass-foil modules by 2027, according to the ITRPV report. “As an encapsulation material, polyolefin has been in discussion for several years,” Karl-Anders Weiss, leading the group Service Life Analysis at Fraunhofer ISE, told pv magazine. “For PV backsheets this discussion started about one year ago.”

It was therefore not surprising, that at this year’s EU PVSEC two companies – Isovoltaic and Bischof + Klein – made the claim that their PO-based backsheets are paving the way for the future. These two companies, as well as DSM, argue that their solutions boast significant advantages over PET based backsheets.

For its PO-based backsheet, DSM, a global science-based company active in health, nutrition and materials, is using a coextrusion technology that owes its origins to Suzhou-Sunshine, a company aquired by DSM at the beginning of 2017. The backsheet named Endurance has a top layer of polyamide 12 (A), a polypropylene (PP) based core layer (O), and a polyolefinic inner layer (E). The company says it is already supplying this backsheet to ET Solar, among others. The outer layer, according to DSM, exhibits characteristics of extreme durability. This is in contrast to market players which argue that backsheets using this material suffer from poor performance. According to Jan Grimberg, business director DSM Advanced Solar, such perceptions are born from experience of poor design and unsuited material compositions. Grimberg says that polyamide is well established in demanding industries like off-shore oil and automotive, as well as in applications such as dishwasher cutlery boxes and sun blinds, where it faces long lifetime requirements under extreme temperatures, UV loads, and contact with chemicals. Furthermore, the polypropylene (PP) polyolefin thermoplastic used as core layer heps in providing an excellent moisture barrier to the module, as well as delivering high reflectivity and good hydrolic stability, DSM says. The PP material also brings softness into the backsheet, which results in less mechanical stress inside the module, according to DSM.

Therefore, DSM claims its Endurance backsheets have several advantages over PET-based backsheets. The material is also easily recyclable. “In contrast to PET or fluoropolymer material, cutting waste during manufacturing is 100% recyclable, it can be re-melted due to its thermoplastic nature and compatibility of all layers. Moreover, modules containing our backsheets don’t need costly end-of-life treatment, as they don’t contain halogens or other hazardous materials,” Grimberg says.

Isovoltaic and Bischof + Klein

Isovoltaic and Bischof + Klein are also using coextrusion technology to produce backsheets based on polyolefin material. While DSM is using PP for one of the three layers, Isovoltaic and Bischof + Klein use it, in some modified form, across all layers.

Isovoltaic has almost 30 years of experience in PV backsheets, most of them PET-based, and has developed a new three-layer, coextruded PO backsheet, named Icosolar CPO 3G, which came to market at the end of 2016. According to Michael Edler, head of product development, Isovoltaic is selling these backsheets in module volumes of double-digit megawatt figures to manufacturers in Asia, Africa, the Americas, Europe, India, and the Middle East.

Bischof + Klein uses a five PP layer structure with a different composition of color and additives for its backsheets, and is using a blown film line for production. B+K Backflex PP is currently under testing at several PV module manufacturers, and is expected to go on sale in 2018, says Philip Hülsmann, who handles development of technical films and laminates at the company.

Comparison industry standard

Backsheets fulfill a multitude of tasks in ensuring module reliability. Generally, it is difficult to find the “right” material combination that can optimally perform in all categories.

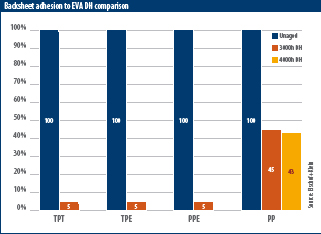

At EU PVSEC 2017 held in Amsterdam in September, Isovoltaic and Bischof + Klein analyzed the advantages and disadvantages of their newly developed PO-backsheets and compared them with those that rely on polyester (PET), which today is the most widespread material. For example, the two companies point to the excellent damp heat (85°C and 85% RH) performance which they say they have found. Isovoltaic also compared the tensile strength and elongation before breakage after exposure in a Highly Accelerated Stress Test (HAST) chamber and damp heat chamber. The tensile strength of its product is almost constant even after 10,000 hours in a damp heat environment, they say. Bischof + Klein, also showed results of tests of backsheet adhesion to EVA after damp heat stress. Its product retains 43% of adhesion to EVA even after 4,000 hours of damp heat testing, and shows no embrittlement even after 5,000 hours of damp heat.

In this way, the companies discussed many of the topics which are relevant in backsheet development. Both say that the PET based backsheets they compared their products to are even difficult to measure for such long periods of time. The core material has proven to be too brittle to allow for damp heat tests longer than 3,500 hours, according to Isovoltaic. In the tests performed by Bischof + Klein the three other different PET products lost almost 95% adhesion to EVA after 3,000 hours of damp heat.

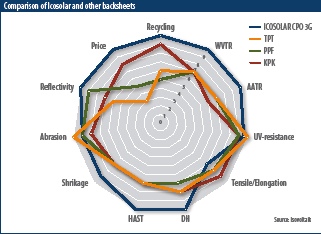

Another category in which PO-based backsheets seem to have an advantage is the reflection of light. Isovoltaic refers to studies showing that the reflection is responsible for 0.54% of absolute efficiency in standard modules. With PO it is possible to obtain 90% reflectivity, the company said.

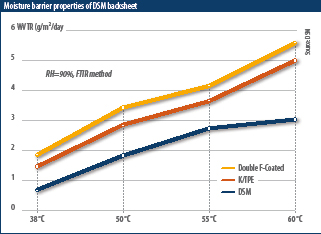

One of the important aspects where the polypropylene (PP) core layer stands out is the water vapor transmission rate (WVTR), which can reach as low as

0.6 g/m2d, according to DSM. In contrast, the tested backsheet with PET core layer has a WVTR value of more than

1.5 g/m2d. Therefore the company concludes that the PP core layer acts as an excellent moisture barrier even at elevated temperatures and writes that it provides for less grid corrosion and longer module lifetime. Testing at 60°C, DSM’s PO backsheet has a WVTR value of less than 3 g/m2d, whereas TPE, KPE, and double F-coated backsheets have values of 5 g/m2d or more (see chart above left).

All three manufacturers noted several other advantages of the PO core layer. These include no hydrolysis under hot and humid environmental conditions; no yellowing due to UV rays; and better safety regarding electrical insulation. However, PET shows some advantages in tensile strength/elongation, and similar behavior in abrasion and UV-resistance, according to Isovoltaic tests (see graph right). In a module configuration where Ethylene Vinyl Acetate (EVA) is an encapsulant, there is the problem of acetic acid (CH3COOH) formation inside the module due to EVA decomposition. Water vapor acts as an intensifier/initiator that may cause failures like PID and corrosion of cells and ribbons. This may affect module stability and reduce the lifetime. Therefore it is important that the backsheets developed by the aforementioned companies seem to have good acetic acid permeability and a low permeability for water vapor.

Of course, reliability comparisons can be made in many ways. To make them fair, it is important to compare backsheets that share the same thickness. This was the case with all three backsheet producers, that compared their products with a PET-based backsheet with a thickness between 300 and 380 µm.

Coextrusion advantages

Also the coextrusion method to produce a backsheet can bring several advantages by itself. In backsheet production it consumes less energy because the coextrusion method is a one-step process. The production of standard backsheets needs more steps, which include preparing different single layers separately, then applying solvent-based adhesives and, after that, lamination of the layers.

Waste is also vastly reduced during production. Therefore, the one-step coextrusion process brings the overall backsheet price below that of other types of backsheet, in spite of the higher base material cost, all companies say. The coextrusion process also has technical advantages, as it does not require the addition of adhesive layers, and so does not result in internal delamination, according to the companies.

Module lamination limitations

Whether PO is used for backsheets or as an encapsulant, the material brings limitations in terms of module lamination. The industry is working to increase throughput by developing more efficient laminators and faster processes. Laminator manufacturers have developed quick lamination processes of less than eight minutes with machines that can go to 180°C and pressures as high as 1.5 bar. Moreover, the EVA encapsulant is improving in new fast cure and ultra-fast cure types. Additionally, polyester-based backsheets such as PPE, TPE, and TPT are improving, so in future process times could be as fast as 5 – 6 minutes, depending on the encapsulant and process parameters used. Only those using Kynar (K) as one of the layers have low melting points and cannot be processed at high temperature.

Even if the temperature resistance of the materials in the lamination process is maybe not so crucial today, it could be more relevant in future. Many manufacturers are still laminating at temperatures around 150 – 160 °C. Isovoltaic and DSM claim that its backsheet can be processed at temperatures of 150 – 155 °C, whereas Bischof + Klein tested at temperatures up to 160°C. Therefore, for the manufacturers operating at 150 to 160°C, PO can have an advantage over other backsheets. But like Kynar (K) or PVDF-type backsheets, PO also has a low melting point and starts weakening and failing at temperatures of 160°C or more. Therefore, it needs further development to keep up with the market in the coming years.

Since faster process times can increase the throughput, they will therefore affect the TCO calculation, where cost per module will reduce. PPE, TPE, and TPT backsheets can easily withstand temperatures of up to 175°C, and the process time can be made faster by reducing the time and increasing the temperature and pressure, as the parameters correlated to each other. Therefore, it will set the process time limits for PO-based backsheets and cannot bring higher throughput, which results in high TCO. However, Bischof + Klein, as well as Isovoltaic, are convinced that the faster process times can be possible at temperatures below 160°C, depending on the encapsulant used. “We believe with a combination of full PO-based encapsulants and backsheets, modules will allow us to further reduce cycle time and save costs [with a lower throughput time and lower capex],” Edler says.

Fraunhofer ISE expert Karl-Anders Weiss is convinced that the new materials will gain market share because they have the potential to be significantly cheaper, and there is a lot of experience of their use in other industries. Nevertheless, they still must prove their stability. “Depending on the application, temperature in the field can be higher than in the established IEC tests,” he says.

How much the promise of the new materials will translate in the field is difficult to assess. There is no real field-testing data for the new material, except the approved lab data. According to Grimberg, it is foreseeable that module manufacturers will hesitate and take time to adopt them. However, all three – DSM, Isovoltaic and Bischof + Klein – agree that it is likely to be a matter of adoption by one of the prominent module manufacturers, and then it would be interesting to note how the market becomes comfortable with the technology. If this happens, the market share of PO-based backsheets could even reach 50% within the decade. SSraisth

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.