Just as the demand freeze began to tighten its grip, solar supply chain prices plummeted, and supply chain investment tightened in the second half of 2016, an installation boom suddenly occurred in 2017, surprising the overall supply chain. This year, not only have the polysilicon and mono-Si wafer markets witnessed short supply, the cell and module markets also saw a supply shortage during the peak-selling season. Yet the fact remains that there are many uncertainties for manufacturers to accurately judge whether strong demand will continue until 2018. However, there are five possible trends for 2018 that appear clear.

Trade wars will affect the market

As top-tier module manufacturers continued to conduct capacity expansion in Southeast Asia in 2016, trade wars with the U.S. and Europe had their impact eroded. However, the U.S. announced the “Section 201” ruling towards the end of this year, a ruling that could ensure all PV cells that bring damages to the U.S. solar industry (whether or not they were partially or fully assembled into other products) face possible trade barriers in the future.

India is also exploring the possibility of imposing antidumping duties on PV cells from China, Taiwan, and Malaysia. This is another variable affecting the market, and one that brings uncertainty to demand volumes in 2018.

The solar markets in the U.S. and India represented 13% and 11% respectively of the total PV demand this year. If both countries were to impose high tariff rates next year, then we could see annual worldwide demand decline in 2018 for the first time ever.

No more poly or wafer shortages

Since China’s domestic demand increased significantly from 28 GW last year to 44 GW this year, the increase of global demand in 2017 is something that manufacturers could not anticipate. Aside from the unexpected growth in China, emerging markets contributed greatly to the demand growth. India’s PV installation grew 4 GW from last year, and together with the 3.5 GW of total demand growth in Mexico, Brazil, Turkey, Jordan, and Pakistan the global PV market in 2017 grew more than 30% from 2016.

For supplies, polysilicon and mono-Si wafer makers that witnessed the most serious short supply this year may have a lot of expansion plans. Due to the delay in mass production, East Hope saw a polysilicon shortage through to the fourth quarter (Q4). However, the polysilicon market should not find itself facing another period of short supply next year provided the following things happen: (1) East Hope and REC Silicon (Yulin JV) remain on schedule and begin mass production in the beginning of 2018; (2) Many more multi-Si wafer makers switch to use diamond wire sawing, leading to lower polysilicon use, and (3) China does not change the trade barriers for overseas polysilicon too much.

For wafers, it is not just mono-Si wafer capacity that continues to increase rapidly in the second half (H2) of 2017; the switch to diamond wire multi-Si wafers is accelerating. As mono-Si wafer capacity continues to expand next year, and multi-Si wafer capacity will increase following the switch of diamond wire sawing, the wafer sector will exhibit the largest capacity increase in the supply chain. It may even feel the price pressure caused by an oversupply during the off-peak selling season next year.

Diamond and black silicon drive down costs

The use of diamond wire sawing in multi-Si wafers directly lowers wafer costs. There will be thinner wafers, less wire consumption per piece, thinner wires, and increasing yield rates to reduce the costs further in the future. With diamond wire wafers’ more obvious cost advantages, the use of diamond wire multi-Si wafers will increase rapidly. Driven by specialized wafer makers, the annual diamond wire wafer capacity will represent 53% of the total capacity by late 2017, and surpass 80% in 2018.

According to the current production of diamond wire multi-Si cells, about 70% of production used the additive method, 26% used wet etching, and 4% used the dry etching method in 2017. If there are not too many changes to the environmental issues, fewer manufacturers will choose the dry etching method next year because dry etching equipment is too expensive, while more people will use the wet etching method, a method that can increase efficiencies slightly. In fact, wet etching will likely be the mainstream texturing method for diamond wire wafers.

PERC becomes mainstream technology

Despite the serious imbalanced relationship between supply and demand, a large amount of new cell capacities are released into the market every year. The total capacity continues to reflect an upward trend. For high efficiency modules, PERC capacity will increase from 15 GW in late 2016 to 29 GW by the end of this year. It is expected to reach 48 GW by late 2018. Conventional mono-Si cell will be replaced by PERC, and PERC will become a standard part of production line equipment.

Currently, most companies with mono-Si capacities work with manufacturers that are equipped with PERC capability. PERC will be implemented on multi-Si production lines later on as well, leading to higher multi-Si PERC capacities every year. However, mono-Si PERC still has more apparent advantages. Following the lower mono-Si wafer costs and more uses of mono-Si PERC, the ratio of mono-Si to the market demand will keep increasing and reach 50:50 by 2020.

Half-cut modules become mainstream

Leading module manufacturers have increased their investments in new technologies, with half-cut cells being one of the most popular choices.

High efficiency modules not only have the support of China’s “Top Runner Program,” but many main markets have also placed more orders for high efficiency modules this year. In the first half of the year, 60 cell, 290 – 295 W modules ranked fifth in the U.S., Europe, and Australia. Yet, cell efficiency has increased obviously from last year to this year. PERC especially has boosted the total proportion of high efficiency modules. In

H2 2017, manufacturers will push up module power output to a new level from the module side.

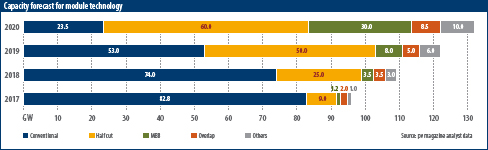

Among all these module technologies, many manufacturers will implement half-cut technology from H2 2017 through to next year because REC Solar went through the half-cut mass production process for a long time and witnessed that it is easier to control the technology compared to other technologies. Hence, half-cut capacity is expected to reach 9 GW by late 2017 and surge to 25 GW next year, becoming one of the mainstream products in the future. Some manufacturers will implement multi-busbar and overlapped technologies. But there are fewer manufacturers that have entered mass production and so it will still take time to emerge. Therefore, overlapped or shingled technology will not expand much next year.

To conclude, although trade wars will indeed bring many uncertainties to the market next year, we can foresee that cost reduction and efficiency increases will always be key to maintaining competitiveness, regardless of how the PV market changes. The technologies for cost reduction and efficiency increases next year are clear now, but the expansion of these new products in different markets will still garner a great deal of attention.

Author: Corrine Lee

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.