Germany’s latest update to its clean energy legislation aims to boost solar from the currently installed 60 GW to 215 GW by 2030. This would require an average of 22 GW of newly installed capacity per year. To achieve this, feed-in tariffs will see a further rise. Monthly degression will be put on hold until the start of 2024 and replaced by semiannual degression from then on. On July 1, 2022, the EEG levy, an electricity tax, will finally be abolished. The resulting drop in the price of electricity will then be passed on to consumers. In future, the feed-in tariff will be financed through the federal budget. The new law puts an end to the mandatory cap on effective active power feed-in of 70% of installed PV capacity, at least for systems up to 25 kW.

In addition to improvements in feed-in tariffs, bureaucratic hurdles will also be gradually eliminated. To this end, the Buildings Energy Act (Gebäudeenergiegesetz, or GEG) and some passages in the Energy Industry Act (Energiewirtschaftsgesetz, or EnWG) will be amended and the tendering mechanism modified. Tax law will also be streamlined, especially for small to medium-sized plants. Cover-to-cover, the new act is nearly 600 pages.

PV development

Once the initial enthusiasm has subsided, anyone familiar with the current market situation will ask: How is the rapid expansion of renewables supposed to succeed at all? We are struggling with a growing shortage of skilled workers and poor availability of critical components. The required annual average of 22 GW of new PV per year is four times the installation figures of 2021. The target does not even take into account European and global demand. We are now highly dependent on China for the supply of materials along almost the entire supply chain, from solar cells and modules to inverters, power-management, and battery units. But China also has its own rapidly growing market, which may exceed 100 GW this year.

The PV market in the US is growing continuously, and solar installations there command much higher prices than here. It is no secret that scarce goods always go where they can be sold most profitably. Europe ranks relatively far behind, thanks to low prices relative to other countries, and high shipping costs. The fear is that the rapid switch to renewables, especially to PV-based generation systems, could fail due to lack of access to the necessary components. Many politicians are likely not aware of this yet, but a rapid strengthening of the European solar industry without external or government help is almost impossible.

For the switch to renewables not to be doomed from the outset, supporting measures in labor-market and industrial policy are urgently needed in addition to the updated legislation. Access to foreign skilled workers, and even more so to venture capital, must be made easier. The fact the European Parliament has approved greenwashing of investments in nuclear power and gas-fired power plants, and waved through the new taxonomy sends the wrong signal. This is how money from pension funds and other investment capital keeps flowing into fossil-nuclear power generation and why it is lacking for the rapid development of an energy economy that is independent of Russia and China.

In terms of upstream component manufacturing, Europe is a desert – up to 95% of the materials for cell and module production now come from Asia. And various global political developments could prove an acid test for the solar industry. Without products from China, we would have zero chance of implementing the energy transition in the foreseeable future.

Strong demand

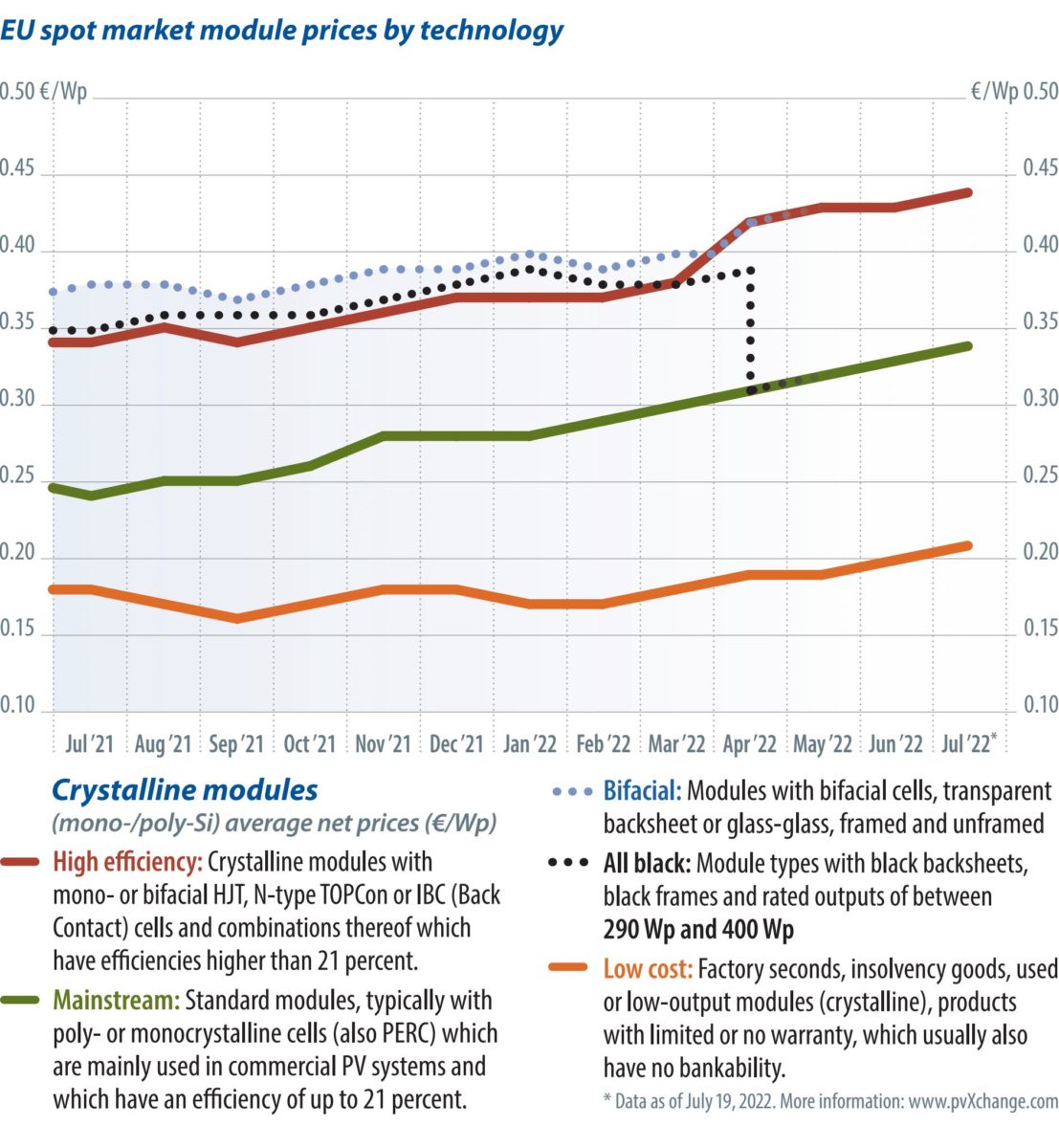

Things are still going relatively well for many in the solar industry, with demand outstripping supply. Over the past few weeks, prices for solar panels even seemed to have stabilized, as many projects have stalled due to delays in the delivery of other components. However, the delays seem to be behind us now and prices are picking up again. Rising polysilicon prices and the return of a weak euro are partly responsible for this. The dollar is now at parity with the euro, which makes imported components much more expensive. In the past, this could not always be passed on to the buyers, which is causing headaches for many manufacturers. Now, completely different standards are being applied to new supply contracts.

Some manufacturers are already calculating future prices for Europe based on the assumption of a dollar that is worth more than a euro. No one can predict whether the unfavorable exchange rate trend will reverse or worsen. Others don’t want to commit at all and are building all kinds of sliding price clauses into their contracts, thus creating flexibility in offer prices. This makes it very difficult to negotiate contracts for large-volume purchases, as it is rarely possible to build the same flexibility into plans for PV projects and use them as a basis for financing negotiations. Large safety reserves have to be planned, which quickly makes projects appear not economically viable. Thus, at the moment, all signs point toward a legal framework that is more D.O.A. than life-giving.

About the author

Martin Schachinger has a degree in electrical engineering and has been active in the field of photovoltaics and renewables for more than 20 years. In 2004, he started his own business and founded the internationally known online trading platform pvXchange.com, where wholesalers, installers, and service companies can purchase solar panels, standard components, and inverters that are no longer manufactured but are urgently needed to repair defective PV plants.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.