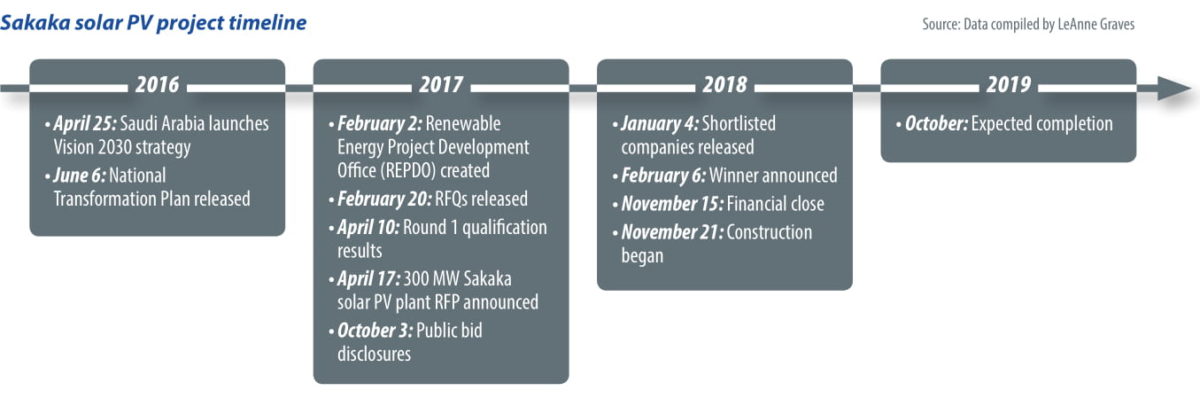

Saudi Arabia’s first utility-scale solar photovoltaic project, known as Sakaka, began construction in November 2018, and it heralds a new energy era in the kingdom. The wheels began moving in 2016 with Saudi Arabia’s Vision 2030 strategy, a plan to pivot the kingdom away from its long-term reliance on oil. Saudi Crown Prince and Deputy Prime Minister Mohammed bin Salman (MBS) is credited with creating the vision, which has evolved into something much more comprehensive since those early days.

However, the country was up against memories of how an earlier plan from 2010 had failed to materialize – so why would this be any different? The biggest reason was that this was the first time that the kingdom’s renewable energy strategy had been directed by the government. Described as the “risk-taker,” MBS set forth a strategy aimed at increasing its renewable energy capacity three-fold with an initial target of 9.5 GW by 2023 (known as the National Renewable Energy Program). Another difference was that incremental targets were released under the National Transformation Program (NTP) of 3.45 GW by 2020, an investment that would require between $30 billion and $50 billion.

Progress continued just two months later with the creation of the Renewable Energy Project Development Office (REPDO), a team falling under the energy ministry’s umbrella tasked with overall responsibility for the execution and delivery of the program. The division included members from every major energy entity in the country: Saudi Aramco, Saudi Electricity Company, Electricity and Cogeneration Regulatory Authority, and King Abdullah City for Atomic and Renewable Energy. REPDO oversaw the tender process and immediately began work, with the Sakaka power plant as its first undertaking.

Companies began preparing for the 300 MW Sakaka solar power project after the request for proposals was announced in April 2017. By the time bids were announced six months later, eight consortia had submitted bids. But in January 2018, the shortlisted bidders only included two companies: ACWA Power and Marubeni. REPDO said at the time that each bid had been “subjected to a detailed evaluation of material compliance to RFP requirements, including the 30% local content component for round 1 NREP projects,” and that the companies were invited to participate in future projects. This was the first time in the region’s solar tendering process that the lowest price consortium was not selected, and it piqued the interest of those that were previously wary of stepping into Saudi Arabia’s renewable energy sector.

That was the point when the Sakaka solar power plant had begun moving rapidly. The next month, the ACWA Power-led consortium with Al Gihaz Holding, was awarded the 300 MW project and a financial close was met in November totaling $320 million. A project company was created, Sakaka Solar Energy Company (SSEC), with ACWA holding a 70% stake and Al Gihaz the remainder. Through the project company, the 25 year build-own-operate power purchase agreement was signed with Saudi Power Procurement as the offtaker.

Domestic content

The first round of projects, which includes Sakaka, must have local content of at least 30%, which is not difficult for the chosen developing consortium, as both ACWA and Al Gihaz are Saudi firms. In addition, the chosen O&M provider, NOMAC, is also from the kingdom (and previously worked with ACWA on the Noor solar projects in Morocco).

Then ACWA decided to try something new in the region: string inverters. Historically, utility-scale plants on flat land have primarily specified central inverters. However, string inverters provide a different set of benefits. String solutions provide more flexibility than central. And unlike one central unit, repairing or replacing a rogue string inverter is far less complicated and has much lower impact on the entire system.

ACWA chose to use Huawei as the sole supplier of inverters, using its FusionSolar 1500V Smart PV Solution which includes the SUN2000-90KTL string inverter and FusionSolar Smart PV Management System. This set solution will increase the energy yield by up to 2% while totaling the same capital expenditure required for central inverter systems. Huawei said that the decreased cost associated with operations translates to a lower levelized cost of electricity. Paddy Padmanathan, CEO of ACWA, said that string inverters are stable, with a shorter delivery time that could shave 10% off the overall total construction costs.

The Sakaka project is expected to be complete in October, providing enough electricity to power 45,000 homes in the Al-Jawf region, while offsetting 430,000 metric tons of carbon dioxide per year. And according to Padmanathan, the project could provide a blueprint for more string inverters being adopted throughout the region.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.