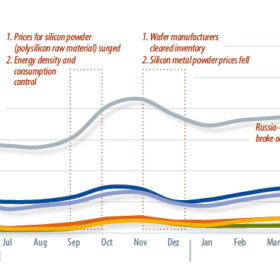

Slow easing of polysilicon pressure

With countries setting net-zero emission targets for 2050-60, renewable energy demand is growing robustly. Amid energy transition trends, PV InfoLink’s Albert Hsieh expects global PV demand to surpass 230GW this year. Strong demand is mainly sustained by China, which released several supportive policies last year, as well as energy transition-driven markets such as the United States. The Russia-Ukraine war is also accelerating Europe’s need to wean itself off its dependence on Russian fossil fuels, and thus renewables demand looks increasingly strong on the continent.

No end to supply/demand imbalance

The solar supply chain problems that began last year with high prices and polysilicon shortages are persisting into 2022. But we are already seeing a stark difference from earlier predictions that prices would decline gradually each quarter this year. PV Infolink’s Alan Tu probes the solar market situation and offers insights.

Europe and US manufacturing look to localize

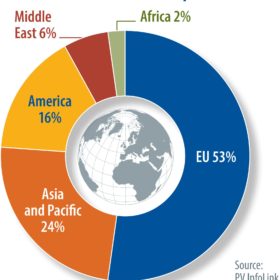

Intersolar Europe saw a marked increase in attendance this year, with robust module order requests and excess inverter demand in the European market. The exhibition was abuzz with recent developments in global trade: the US-China trade war, India’s expansion plans, discussions on expanding manufacturing overseas and “made in Europe” came to the fore. PV InfoLink’s Amy Fang sums up the latest developments as Europe, India, and the United States seek independence in PV manufacturing.

Global module demand to hit 240 GW in 2022

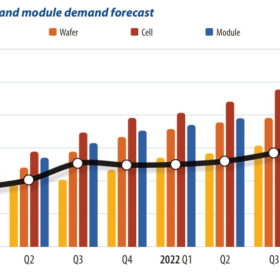

Despite polysilicon shortage-induced high module prices, the market saw strong demand in the usually slower summer season this year, due to the global race to net-zero emissions. Corrine Lin, chief analyst at PV InfoLink, expects demand to reach 240 GW, with China and Europe set to contribute more than 80 GW and 50 GW, respectively. Together with the United States, which has paused the introduction of new solar tariffs, the three largest markets will dominate nearly 70% of global demand.

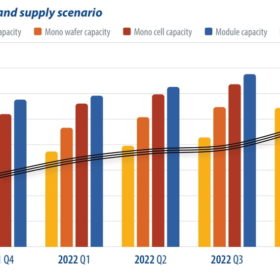

Polysilicon growth lags behind demand

Policy developments worldwide have led to strong growth of renewable energy. Demand from large markets such as Europe, China, and Brazil continues to beat expectations. InfoLink has revised up its module demand forecast to 239-270 GW this year – representing significant growth of up to 34% from last year’s 178 GW of installations. However, analyst Dora Zhao finds that availability of polysilicon could be a major limiting factor in meeting this demand.

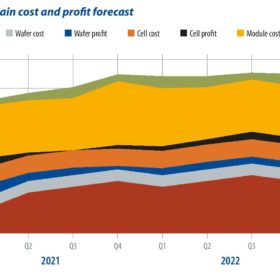

PV prices head for a Q3 peak

Global solar demand is projected to hit 240 GW to 270 GW this year, fueled by the accelerated global energy transition. Customs figures show that China exported nearly 89 GW of cells and modules to the world in the first half of 2022. Europe dominated this demand, importing 43 GW and accounting for nearly 50% of the total. InfoLink’s Amy Fang has also observed strong growth in China’s PV market, with distributed-generation projects contributing to 30.9 GW of new installations in the first half of 2022 – a 138% increase compared to the first half of 2021.

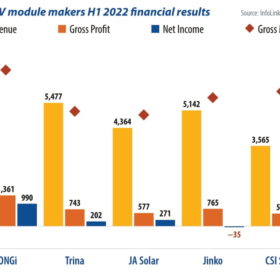

Solar’s big five

The five largest vertically integrated PV manufacturers have seen significant growth in net profit and revenue so far this year. Combined, these five companies shipped a total of 78.6 GW of modules in the first half of 2022, up 48% from the same period last year. Their shipments accounted for 60% to 70% of the market, suggesting increasing consolidation. With first-half financial results filed, InfoLink’s Richard Chen digs into the numbers.

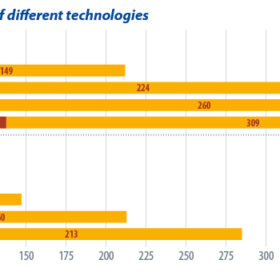

POE’s gloomy outlook

With global industries of all kinds assailed by stories of supply chain shortage, InfoLink analyst Derek Zhao considers what the rise of TOPCon will mean for supplies of polyolefin elastomer (POE) resin, which is preferred over more commonly used ethylene vinyl acetate (EVA) as an encapsulant for the new, higher-efficiency PV cells.

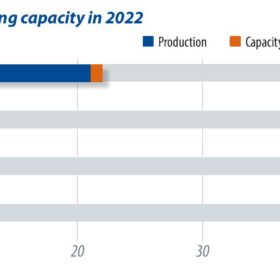

Soaring polysilicon prices drive investment

Polysilicon prices have soared since hitting a low point in 2019, as supply has not kept up with demand. This rise has brought significant investment in the sector and those funds could lead to oversupply in the long term. InfoLink senior analyst Dora Zhao examines the global landscape for polysilicon supplies.

Reality check

Ecstasy to agony summarizes the past year of solar. As technology evolves and materials are optimized every year, we’re witnessing rapid advancements accelerating the transition to a low-carbon economy with the implementation of artificial intelligence applications, writes Denisa Fainis, general secretary of the Middle East Solar Industry Association. Real-time data, advanced analytics, and automation are essential to the digitalization of increasingly decentralized power systems.