Chaos with no end in sight

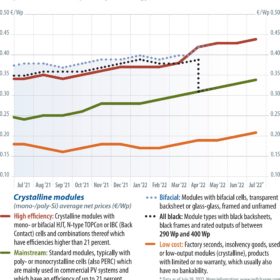

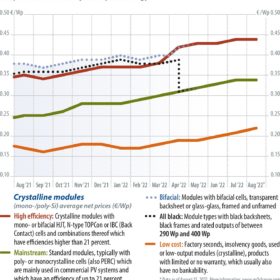

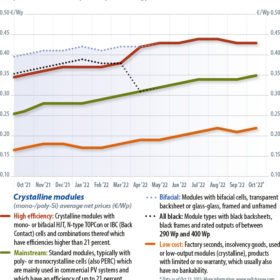

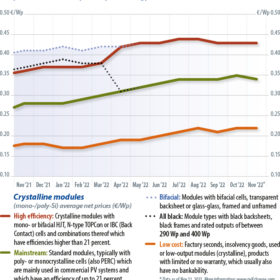

We in the solar industry are used to our share of craziness. For us, business as usual is more the exception than the rule. We are used to coping with all sorts of imponderables – chaos as usual. Companies that have mastered this from years of training will probably be able to navigate their businesses through these troubled times. Martin Schachinger of pvXchange finds that it has been a long time since the PV market has been as crazy as it is now. Prices are rising steadily across the board, but not for solar panels.

Germany’s revised EEG: New life for PV or dead on arrival?

It has been a few weeks since Germany passed the long-awaited “Easter Package,” the latest iteration of the Renewable Energy Sources Act (Erneuerbare Energien Gesetz, or EEG) which includes far-reaching changes intended to accelerate renewables adoption in Germany. On the whole, writes Martin Schachinger of pvXchange, the praise outweighs the criticism because the act contains numerous improvements and makes life easier for future investors and operators – in theory, at least.

Test and measure

PV plants have to serve their purpose fault-free for a very long time, often under difficult conditions. Regular plant inspections are therefore a basic requirement for economical operation. Having dealt previously with visual inspection systems at the module level and their importance, Martin Schachinger of pvXchange and Falko Krause of GME Clean Power now shift their focus to more thorough, measurement-based inspections.

Big profits slow development

Prices for solar modules ticked slightly downward in September for the first time since February, writes Martin Schachinger of pvXchange. One reason for the dip is the shortage of inverters and poor availability of electronic components, which is slowing the pace of expansion. Plant builders have warehouses full of PV panels, but are limited in how many they can install because they lack critical system components. These installers have plenty of modules for the time being, which is why they are trying to delay pending deliveries as much as possible. This has left wholesalers and manufacturers sitting on some of their products, which they then have to try to bring to market elsewhere, sometimes at a discount.

Supply security through solar-wind hybrids

Energy supply stability dominates political and public discourse these days. Although there is broad consensus that we have to complete the transformation to a carbon-free energy supply within the next few decades, there is still some debate about how to get there. Solar and wind are thought too erratic to serve as a foundation for 100% supply security. And because electrochemical power storage systems are far too expensive and will never be powerful enough, anyway, many still dream of a future built on hydrogen or a breakthrough in nuclear fusion. But these scenarios are not without their insurmountable hurdles, according to Martin Schachinger and Volkmar Tetzlaff.

A penny saved is a panel spurned

Module prices have finally stabilized, and a slight downward trend has even started to set in. Whether this will continue depends mainly on how demand shapes up over the next few months. The softening of prices reflects a gradual build-up of inventories, which should be drawn down again by the end of the year, if possible – even if it means slashing prices. But for other PV system components, the situation is quite different, writes Martin Schachinger of pvXchange.

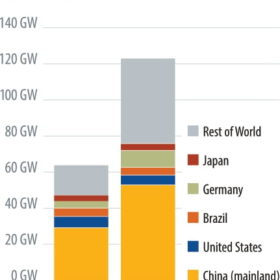

A perfect storm for PV

The supply chain disruptions that started in the second half of 2020, with the economic opening after Covid-19’s initial waves, reached new highs in 2021. Edurne Zoco, IHS Markit’s executive director for clean technology and renewables, sees five main drivers for the disruptions of the industry throughout 2021. However, forecasts remain bullish, with more than 200GW of new PV installations expected this year.

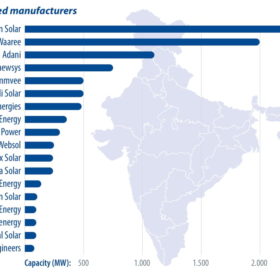

India’s solar manufacturing wave

India installed 14GW of new PV in 2021. This year, utility-scale developers are pushing to import modules and build inventory for 2022 installations, before a basic customs duty goes into effect in May, with a 40% duty for module imports and 25% for cells. PV module distributors are also expected to build their inventories to save on duties and have enough supply for the C&I segment in 2022. After assessing the country’s current demand, project pipeline, and module availability, IHS Markit’s Dharmendra Kumar forecasts 18GW to be added in 2022.

Strong drivers, unprecedented challenges

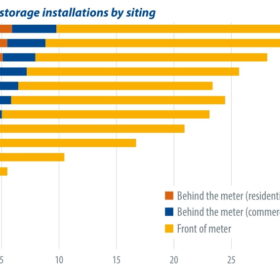

Nearly 300GW of renewables were estimated to have gone online globally in 2021. Renewable energy installations worldwide are increasing rapidly and as this happens, there is greater need for a wide range of energy storage applications like ancillary services, capacity firming, and energy arbitrage. Jackson Cutsor, senior analyst at IHS Markit (now part of S&P Global), expects new opportunities for energy storage to go hand in hand with renewable energy, and for the industry’s rapid rate of expansion to continue.

Distributed gains

High module prices are expected to cause a shift in solar demand from the utility-scale segment to the distributed-generation PV space, while residential and commercial and industrial consumers are expected to be less price sensitive, writes IHS Markit analyst Siqi He. In 2022, distributed PV will account for more than 40% of global solar installations.