Final thought: Consumer-led solar boom

By Gerard Reid, co-founder and partner, Alexa Capital.

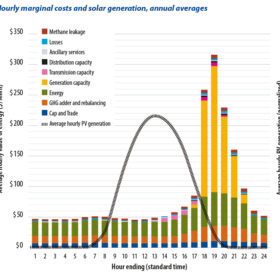

Regulator could prove solar’s NEMesis

The latest attempt by the California Public Utilities Commission, the US state’s regulator, to update net-metering rules seems to be again solely motivated by the desire to kill off rooftop PV, as energy economist Ahmad Faruqui reports.

New funds, support for Central Asian renewables

Developers have been eyeing the potential for large-scale solar development in Central Asia for a number of years, but a significant project pipeline has been slow to materialize. Fortunately, conditions are now improving, as Amsterdam-based pension fund investor ILX is partnering with the European Bank for Reconstruction and Development (EBRD) on a new fund, according to the EBRD’s head of loan syndications, Christian Kleboth, and Gianpiero Nacci, a director on the EBRD’s Green Economy and Climate Action team.

From south to north

European traders have sought to source green energy from sunny North Africa for many years. While most efforts have floundered, the current geopolitical environment and the rise of green hydrogen could make it a reality. Efforts to export green hydrogen from Africa to Europe are underway, but it will not be simple.

The next bottleneck

Europe needs to build a solar industry across the entire value chain, including glass, argues Erich Merkle, the CEO of GridParity and a member of the Solar Glass Alliance. When people talk about the PV value chain, they often forget solar glass, which is the heaviest component, accounting for up to 80% of the weight of a standard PV module.

Independent, intelligent distributed energy

Energy drives our cultural and economic progress, and in the long run, humanity itself relies on sustainable energy sources. We are moving towards a future where renewables account for a dominant share of the world’s energy supply, and we know current efforts to tackle climate change are insufficient. Yet, a growing number of investors, businesses and citizens are making changes to the way they live, operate and invest to accelerate the energy transformation.

From trend to transformation

There are three main drivers behind the continuing growth of solar today: the economics of energy, the energy crisis driven by the war in Ukraine, and a growing global focus on green and net zero initiatives. What matters is that these three drivers change the dynamics of investment – there is a growing body of capital looking to align with low-carbon, net-zero initiatives. Yet as the debate rages about operational versus overall sustainability, what is the future of solar for ESG finance?

Final thoughts: Now the race begins

Tim Buckley, Director, Climate Energy Finance

Poland and the price cap

While it was energy auctions in 2016 that kick-started Poland’s solar sector, many developers have since moved outside the support scheme thanks to rising energy prices. Piotr Mrowiec, associate partner at Rödl & Partner, examines how the EU’s new cap on renewable energy revenue will affect the attractiveness of large scale clean energy projects in the country.

Final Thought: Start of the ‘bifacial nPV’ era

Radovan Kopecek, Managing Director Advanced Cell Concepts, ISC Konstanz