Manufacturing amid market concentration

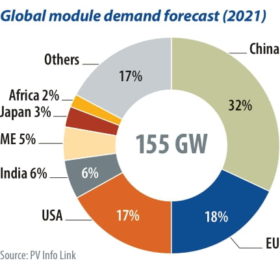

The solar market is expected to grow in 2021, following a year of pandemic-driven supply chain disruptions, exacerbated by explosions at polysilicon plants. PV InfoLink estimates almost 154 GW of module demand in 2021, up by 10% on 2020. Analyst Amy Fang examines the key market trends for the first quarter.

Solar and silver price hikes

The PV industry has experienced several rounds of price increases since the second half of 2020, from polysilicon to materials such as PV glass and films. Between July 2020 and February 2021, prices quoted for 3.2 mm and 2 mm glass surged by more than 60% per square meter. Prices for EVA and POE encapsulant films skyrocketed by more than 40% and 10%, respectively. Prices for silver paste also rose 7%, and have since remained stubbornly high. PV InfoLink Chief Analyst Corrine Lin examines the impact of silver’s recent price turbulence on PV cell manufacturing.

Price trends amid polysilicon shortage

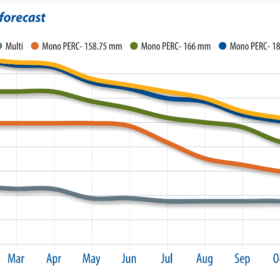

Recent financial statements from the big module manufacturers indicate that higher prices for polysilicon and PV glass since the third quarter of 2020 have dealt a severe blow to profits in the module business. Module manufacturers have gradually scaled down capacity utilization since the Lunar New Year, as demand has been weaker than expected, given the absence of China’s usual June 30 installation rush, as in past years. In April, Tier-1 module makers further cut utilization rates to 55-70%. PV InfoLink’s Corrine Lin examines the price trends that are developing in 2021.

N-type development

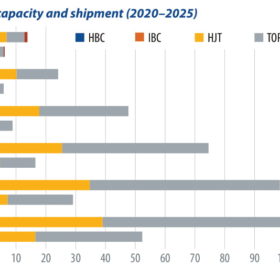

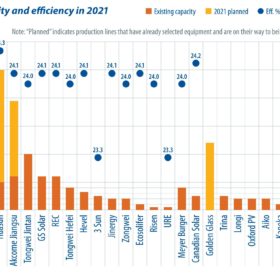

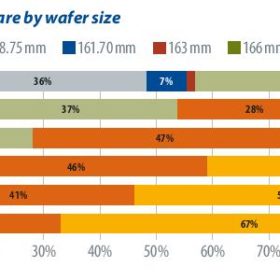

This year, PV cell manufacturers will face the challenge of transformation. Apart from adjusting the ratio of production for different-sized cells, some manufacturers are turning to next-generation opportunities, shifting investment from p-PERC to n-type technology. PV InfoLink Analyst Amy Fang discusses the issues facing n-type cell development this year.

Post SNEC: Market demand and technology trends

Every year, the SNEC PV Power Expo marks a turning point in the direction of solar market trends, and 2021 was no exception. Corrine Lin, chief analyst at PV InfoLink, was at the show to soak up the latest trends at one of the first big events to go ahead since early 2020.

Post-SNEC storage

China’s battery manufacturing industry is growing robustly in line with the rapid expansion of the electric vehicle market. The stationary storage sector currently lags behind developments in leading markets such as the United States and Europe, but strong growth is expected between now and 2030, driven by supportive policies. Fang-Wei Yuan, a senior analyst at InfoLink, examines the latest developments in China’s energy storage industry and looks at the announcements and product launches made at the Shanghai SNEC exhibition back in June.

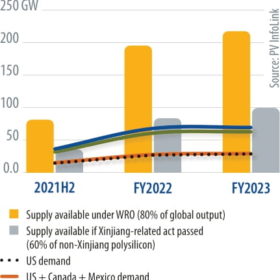

Polysilicon amid international trade disputes

Polysilicon capacity is unable to catch up with rapid capacity expansion in the mid and downstream segments, writes Corrine Lin, chief analyst for PV InfoLink. New polysilicon capacity requires big capex investment and a lead time of more than two years to complete construction and reach full operation. With unbalanced capacity between the upstream and downstream segments, polysilicon prices have been rising since the second half of 2020, with prices for mono-grade polysilicon surpassing CNY 200/kg ($27.40) in June 2021, up more than 250% year on year.

Supply, demand, and a foreign policy shakeup

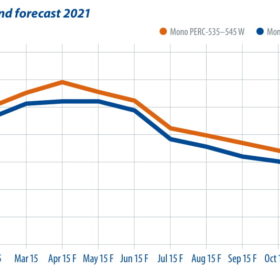

As the solar market enters the busy season in September and October, module utilization rates are reaching 70% to 85%. However, structural shortages remain in the supply chain, with polysilicon supply running short in the face of high demand, writes PV InfoLink analyst Amy Fang. Prices, which were expected to stabilize, rose again in the second half. High module prices will cast a shadow on demand in the fourth quarter, prompting module manufacturers to postpone delivery for some orders from the second half into next year.

Looking past PERC

While the adoption of large-format wafers has driven a wave of capacity expansion for PERC, existing manufacturers and new entrants continue to evaluate TOPCon and HJT. An increasing number of HJT pilot lines and gigawatt-scale capacity expansion projects are appearing, as manufacturers see the advantages of fewer process steps, higher efficiency ratings, and better yield rates. The localization of equipment is also a driving factor. PV InfoLink’s Derek Zhao offers an update on the latest developments and process routes for HJT.

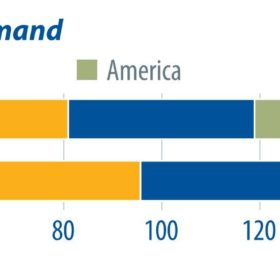

A 200 GW year in 2022

Structural imbalances in the supply chain and the energy intensity and consumption controls that China imposed in late September have caused prices for most PV module materials and components to continue to rise. Shipping fees and PV plant construction costs also remain high. PV plants in many regions will therefore be postponed until next year, but it remains unclear when module prices will start to fall. Despite these challenges, the global race to cut carbon emissions continues, and InfoLink’s Corrine Lin forecasts a bright future for PV deployments in 2022.