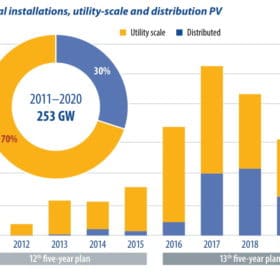

China reaches a tipping point in 2021

This year will be a key period in the development of China’s solar PV market. It is the first year of the 14th five-year plan, the first calendar year after President Xi Jinping announced the 2030-60 carbon emissions commitment, and the first year for utility and commercial unsubsidized projects. IHS Markit expects the solar industry in China to reach another milestone with more than 60 GW of installations this year, advancing the ground for the energy transition and the displacement of traditional energy sources to fulfill the goal of a net carbon future over the next four decades to come.

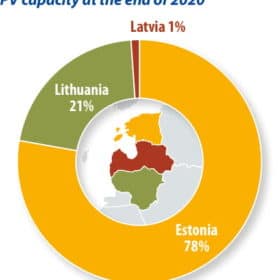

Baltic breakdown

Estonia, Latvia and Lithuania have seen uneven development in PV installations to date, and the three Baltic states are still highly dependent on imports from Russia. Estonia needs to replace aging energy infrastructure, and so far it has led the region in PV deployments. Latvia, meanwhile, has a high level of hydro in its energy mix, and less incentive to build PV. IHS Markit analyst Susanne von Aichberger examines the latest policy developments in the Baltic states.

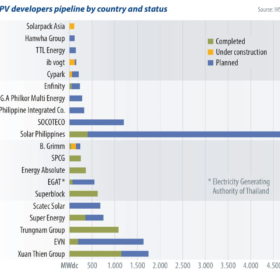

Southeast Asia’s big PV plans – 27 GW by 2025

PV markets in Southeast Asia have picked up over the past two years, driven by the astounding growth of Vietnam. Regional policies, combined with growing demand for renewable power in the manufacturing industry, will result in 27 GW of new PV installations across the region over the next five years, writes IHS Markit analyst Dharmendra Kumar. PV installations in these countries are driven by attractive feed-in tariffs, net energy metering, tariff-based auction mechanisms, and other incentives.

V2G outlook

Multiple drivers are combining to allow battery capacity in electric vehicles to be used as a grid asset through vehicle-to-grid technology, writes George Hilton, senior analyst for energy storage at IHS Markit. Vehicle-to-grid tech could offer low-cost energy storage at a huge scale, but there are many barriers to overcome.

Global tracker shipments reached 45 GW in 2020

The global single-axis tracker market increased shipment volume by 40% year on year to reach 45 GW in 2020. This was despite significant pandemic-related supply chain turbulence that resulted in longer lead times for the delivery of components, the idling of steelmaking capacity in some key markets, container shipping dislocation, and widespread restrictions, particularly at ports. Most notably, this caused the cost of some commodities, such as steel, to more than double between 2020 and 2021. Jason Sheridan, a senior research analyst for IHS Markit, runs through some of the key developments in the tracker market.

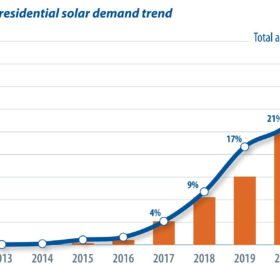

The evolution of residential PV in China

China is the largest residential PV market in the world, and this trend is only expected to strengthen in the next few years. By July 2021, China’s cumulative installed residential PV capacity had reached more than 30 GW, with a total of 1.864 million residential units hosting solar PV systems. IHS Markit’s Holly Hu looks behind these impressive numbers.

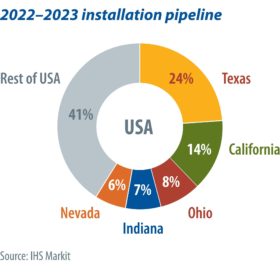

U.S. solar market in flux

Next year will set new records for the U.S. solar market, with 30.4 GW of installations expected. The utility-scale PV pipeline in 2022 is nearly 50% greater than 2021 and 2023, due to the combined effects of pandemic-related supply chain impacts, the solar Investment Tax Credit schedule, and other module procurement challenges. Over the next two years, solar installations will be concentrated in Texas, California, Ohio, Indiana, and Nevada, with large portions of the pipeline being developed by a few key players in each state. IHS Markit’s Eric Wright takes a closer look.

Brazil heads for an installation rush

Brazil’s deployment of distributed generation PV (below 5 MWp) has exploded from a total capacity of 500 MW in 2018 to 7 GW by September of this year. The trigger for this increase, alongside rocketing electricity prices, was the 2019 proposal of law 5829, writes IHS Markit analyst Angel Antonio Cancino. The proposal is expected to pass into law at the end of this year and will gradually introduce grid-access charges for residential and commercial system owners.

Xinjiang sanctions and the PV supply chain

Due to forced labor concerns, a ban on imports from Xinjiang to the United States appears likely. This could be another blow for polysilicon producers hit by industrial accidents and the threat of floods in the third quarter of 2020. Chinese polysilicon prices have surged more than 50% in a matter of a months. Consequently, wafer prices have skyrocketed, bringing increasing costs to the solar cell and PV module segments. In the face of price hikes, some projects are now postponed until the first half of 2021.

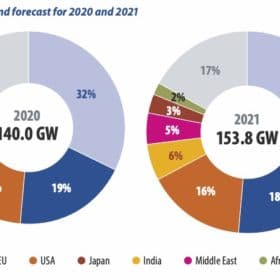

Global PV installations to surpass 150 GW in 2021

Despite pandemic-induced impacts, the PV market was bigger than expected last year. In particular, an installation rush in Vietnam and China took place in December and pushed global demand upward. PV InfoLink estimates that global module demand in 2020 reached 140 GW. Analyst Mars Chang delves into the numbers.