Climate targets, PV price trends for 2030 – a viable mix?

More money for climate protection – that’s what the G7 heads of state agreed on at their recent summit in Cornwall, England. It will involve making a whole lot more funds available to expedite the current pace of renewable energy expansion.

Sky’s the limit

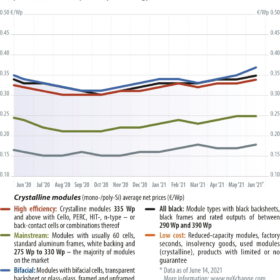

The sky is the limit. Fortunately, this expression does not apply to current prices for PV panels, which have recently declined, following a continuous rise since the beginning of the year. Whether this situation holds, or whether prices drop further in the coming months is hard to say at the moment, writes Martin Schachinger of pvXchange. Polysilicon prices and thus wafer and cell prices could be in for a slight decline. However, a decisive movement in module prices in general is unlikely before the fourth quarter.

PV prices: High today, higher tomorrow

Some time ago, when I lived in the center of Berlin, I was a regular at the farmers’ market to buy fresh fruit and vegetables. One greengrocer advertised his wares with the words “cheap today, expensive tomorrow.” It would almost be desirable if we PV wholesalers could offer our modules with a similar slogan. Unfortunately, no one in the industry can currently claim that solar modules are cheap – quite the opposite. Following a brief respite, prices have climbed again in recent weeks. Since the previous low in September 2020, prices for new, grade-A goods have already risen by an average of 20% to a level not seen since April 2019.

Is there an alternative to ‘made in China’?

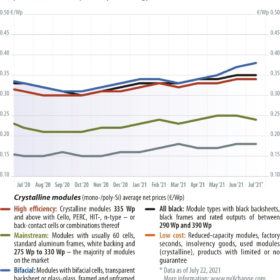

PV module prices are at a level we have not seen since last fall – a fact that is mainly down to very high transport costs for container shipments. This is an insight that was shared in this column last month. This month, we discuss whether and how bolstering local value creation through European cell and module production could lead to an end of dependence on Asia and break the upward cost spiral. But first, let’s have a look at the current price trends.

Module prices set to rocket back to 2019 levels

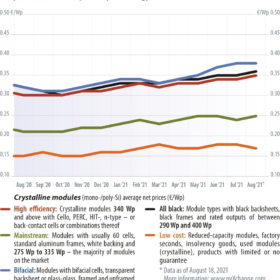

First, the bad news: PV modules will be caught up in the global wave of inflation. After a very brief respite, prices are picking up again for almost all module technologies. But the changes recorded for early October are paltry compared to the price increases still to come, writes Martin Schachinger of pvXchange. As of the cutoff date for this market survey, some manufacturers had already announced even more significant upward corrections for future deliveries. The price adjustments shown in the October index are thus only a tentative start to rises of no less than 15-20% over the price levels that prevailed just a few weeks ago. However, this will probably be the last price correction we can expect at the manufacturer level until the end of the year.

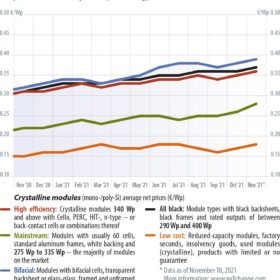

The price spiral winds up

The title of Martin Schachinger’s October market commentary was “Module prices set to rocket back to 2019 levels.” This month, he writes that prices have already reached December 2018 levels and notes that there is no reversal in sight. Prices for all module technologies have once again risen by an average of 3 percentage points since last month.

Fasten your seat belts

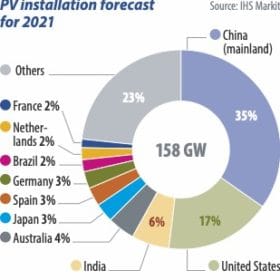

The PV industry is in for a wild ride to add 158 GW in 2021, writes IHS Markit’s Josefin Berg. Delayed projects from this year, together with a generally increased appetite for renewables around the world, leads us to project 34% year-on-year growth in annual PV installations in 2021 – a year when module prices will remain high for at least the first two quarters.

Growth continues despite Covid-19 headwinds

The global residential energy storage market continued to grow in 2020, writes IHS Markit Analyst Michael Longson. Many suppliers were looking to build upon a strong first quarter when Covid-19 hit in March 2020 and slowed the market significantly. However, as a result of several funding packages being introduced and the gradual easing of local restrictions, shipments continued to grow throughout the second and third quarters, enabling strong year-on-year growth for the sector in 2020.

A banner year for US solar

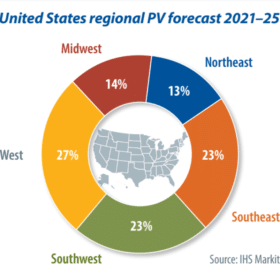

Despite the supply and demand challenges that PV faced in 2020, the U.S. solar market had its largest installation year to date, writes IHS Markit’s Maria Chea. More than 22 GW of PV installations were completed last year, with utility-scale projects representing 77% of that volume. A renewables-friendly administration, an extended ITC schedule, increasingly competitive pricing, and a massive late-stage project pipeline will drive strong growth for the United States in 2021.

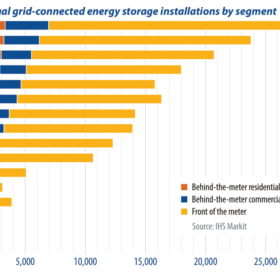

Strong growth ahead for storage

Annual battery storage installations will exceed 10 GW/28 GWh in 2021, following a particularly strong year in 2020, despite the challenges created by the global pandemic, writes IHS Markit analyst Mike Longson. Combined solar and storage will be a core focus for new deployment in 2021, as the front-of-the-meter and behind-the-meter energy storage markets are both expected to grow significantly in the months ahead.