Asian buoyancy floats solar

Global floating PV installations are set to jump by 143% from 2019 to hit more than 900 MW of annual capacity additions this year, according to IHS Markit’s Floating PV Report – 2020. Growth has been driven in recent years by a surge in the number of floating PV systems installed in countries such as China, South Korea, Japan, and the Netherlands, with total global installed capacity reaching about 1.5 GW at the end of 2019. IHS Markit Research Manager Cormac Gilligan and Senior Analyst Chris Beadle examine how these countries have taken the lead, with developers building large quantities of floating PV, while also installing pilots to better understand the technology and test its capabilities and cost-effectiveness.

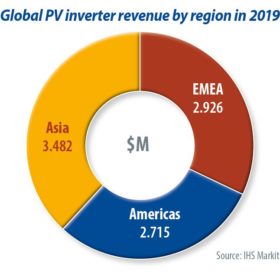

Record shipments push global solar PV inverter market past $9 billion in 2019

The PV inverter market achieved record shipments in 2019, writes IHS Markit’s Miguel de Jesus, driven by booming shipments in key markets such as the United States, Spain, Latin America, Ukraine and Vietnam. Revenue rose rapidly, surpassing the $9 billion mark in 2019 for the first time.

Emerging markets and innovation: Twin pillars of the solar tracker market

Global solar tracker shipments reached new record levels in 2019, exceeding 31 GW, up 55% year on year. Exceptional demand in the United States – as well as multiple gigawatt markets in Brazil, Mexico, Chile, Spain and Australia – helped propel the market to new heights, writes Cormac Gilligan, associate director at IHS Markit.

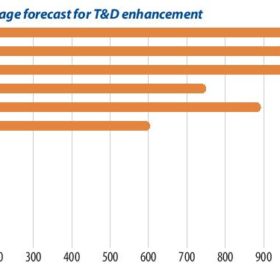

Energy storage and network reinforcement

As renewables penetration increases, transmission and distribution (T&D) infrastructure will require significant reinforcement. Battery storage is becoming a key alternative to traditional ways of reinforcing network infrastructure, because it is fast to deploy, can provide multiple services, and often comes at a lower capital cost. IHS Markit analyst Oliver Forsyth delves into the additional value streams that strengthen the case for grid-connected batteries.

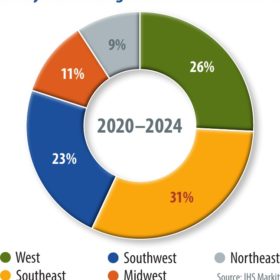

Texas will outshine California in 2020

The Covid-19 pandemic continues to cast a cloud on industries around the world, but the U.S. utility-scale solar segment is still growing, writes IHS Markit solar analyst Maria J. Chea. Around 3 GW of solar PV is set to be installed this year in Texas alone, but opportunities also abound across several other southern U.S. states.

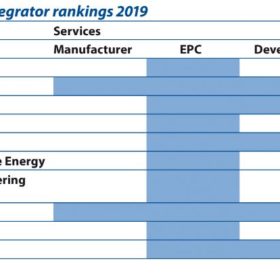

Reshuffle at the top, as new markets arise

A new wave of consolidation and some reshuffling is underway among market leaders in the solar EPC space, writes IHS Markit’s Josefin Berg. In 2019, the 30 largest EPC providers globally installed 28 GW of non-residential PV, representing 26% of the total market. This increase from 21% in 2018 stems mainly from a growing concentration in the Chinese PV market, as well as integrator concentration in rapidly growing markets like Spain and Vietnam.

Reform meets opposition

Since President Andrés Manuel López Obrador’s election at the end of 2018, renewable energy in Mexico has faced an uncertain regulatory environment. The current government is focused on restoring the power and influence of Mexico’s state-owned energy companies. But it is now at a crossroads, as the previous administration aimed to open the segment up to foreign investment. Maria Chea of IHS Markit examines the policy decisions the government has taken this year and how these have soured private investor sentiment. These changes will likely weigh on utility-scale PV procurement in the country through 2024.

Acquisition activity in Europe remains heated

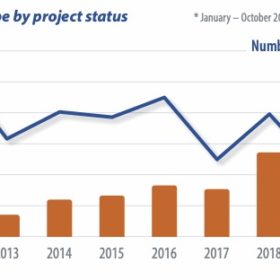

The European solar market saw around 11 GW of projects, and pipelines change hands in 2019. The positive trend is expected to last, as investors remain optimistic about the future of the industry. Project acquisition activity is seen as a key indicator of financial health in many sectors, including the PV market. It reflects optimism among investors and points to a particularly high degree of liquidity, writes IHS Markit analyst Martina Assereto.

Transitioning to larger wafers

Since 2017, 156.75 mm M2 wafers have been the standard. However, improvements in cell efficiency appear to have hit a bottleneck, making wafer size a hot topic among manufacturers once again. In the second half of 2018, 158.75 mm G1 mono wafers were introduced to the market. Corrine Lin of PVInfoLink argues that while G1 will likely become the mainstream format over the next two years, 166 mm M6 wafers and 210 mm M12 wafers are presenting new options for manufacturers.

2020 module market forecast

According to PV InfoLink’s database, JinkoSolar topped the 2019 rankings for global module shipments with around 14 GW – far higher than any of its rivals. Notably, this is not the first time Jinko has secured the No. 1 spot; it has avoided slipping from the top as many of its predecessors did in the industry’s earlier years. The company is followed by JA Solar and Trina Solar (each shipping more than 10 GW), and then Longi, Canadian Solar, Hanwha Q Cells, Risen Energy, Suntech, Astronergy, and Talesun.