A new boom, or the same old?

The Covid-19 crisis has left the solar market relatively unscathed, and in Germany, at least, it looks as if the final hurdles holding back an urgently needed PV boom have been cleared. In the evening hours of June 18, the uncertainty finally lifted, as the German parliament decided to eliminate the 52 GW cap on solar PV. Although the corresponding decision in the second chamber of Germany’s legislature, the Bundesrat, was still pending at press time, this is usually a formality. Still, the industry has reacted cautiously to the good news.

Clash of the titans reloaded

As early as March 2019, information began to emerge on the patent lawsuit that module manufacturer Hanwha Q Cells filed on three continents against its competitors Longi Solar, Jinko Solar, and REC. At the time, the purpose of the lawsuit was not clear and it was still uncertain whether it would even be admitted. Just over a year later, the first verdicts have now been handed down. In the United States, the rulings were against the plaintiff, but in Germany, they came down in its favor. The Düsseldorf Regional Court confirmed a lower court ruling that the competitors had unlawfully used Hanwha Q Cells patented technology. Judges granted Hanwha Q Cells a remedy in the form of an injunction. But what does this ruling mean for the parties concerned, and in particular for their customers?

Hot summer – hotter fall?

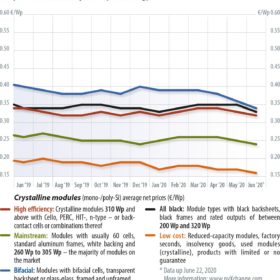

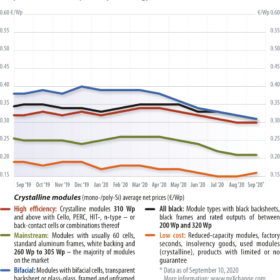

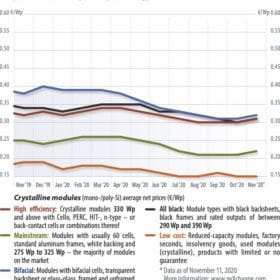

From mid-July to early August, prices fell across the board – perhaps for the last time this year, given recent indications that the slide will soon come to an end. Most PV manufacturers have either announced price increases in the range of a few cents per watt for the fourth quarter, or have already released adjusted price lists. But anybody who thinks that they can still buy cheap modules in unlimited quantities for short-term delivery is in for a disappointment, writes Martin Schachinger of pvXchange.com. This year there has been no summer lull.

EEG 2021: The destruction of renewables

The potential consequences of the unambitious draft Renewable Energies Act (EEG), a bill that was recently proposed by the German federal government, are particularly dire, writes Martin Schachinger of pvXchange. The bill must be met with loud protests to avoid jeopardizing the development urgently needed to attain the country’s modest climate targets. Otherwise, Germany will face the threat of universally dreaded electricity shortages over the coming decade, as well as other completely different catastrophes that will make the current Covid-19 crisis look like a walk in the park.

Will Covid-19 continue to weigh on the PV industry?

As much as 15% of all renewable energy projects in Europe could be delayed or canceled due to the coronavirus crisis, according to a recent warning issued by McKinsey & Company. The pandemic has also had a negative impact on the energy markets themselves, says the consultancy. Persistently lower commodity prices made conventional energy more attractive, and the expansion of renewables less popular.

As low electricity prices chip away at future profitability of PV and wind energy, incentives for investment have failed to materialize. And this, in turn, has deterred project developers from concluding new power purchase agreements. Martin Schachinger of pvXchange examines the ongoing effects of Covid-19.

2020 was off to a good start, and then…

This year’s retrospective kicks off with a line that sounds like it’s right out of a pop song: Last spring, it all felt so right. And yet, what followed was not only one of the hottest years on record, but also one of the craziest in recent decades. This month and next, Martin Schachinger of pvXchange looks back at how European PV markets have developed under the pall of the pandemic and climate change.

A new era of sustained growth

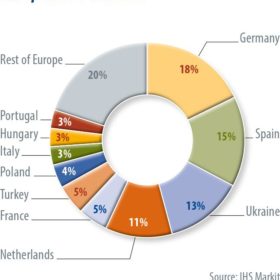

After several years of weak solar demand growth in Europe, compared to the historical highs of 2011, installations are expected to surge by 88% to reach a new installation record of 23 GW in 2019, writes Cormac Gilligan, research manager at IHS Markit. A range of favorable macro conditions have coalesced this year to reignite the market.

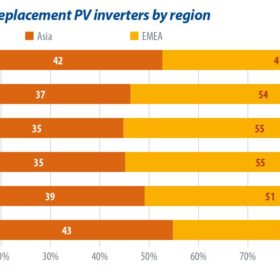

Out with old inverters, in with the new

Global demand for replacement inverters will likely grow by almost 40% to reach 8.7 GW in 2020, as a large and expanding installed base of aging solar PV installations drives deployment, writes Miguel De Jesus of IHS Markit.

Perovskite technology – beyond efficiency records

Technological innovation in PV is taking place in the context of extreme price competition among solar manufacturers, writes Karl Melkonyan, senior analyst for solar demand at IHS Markit. This, he argues, explains the focus on lowering manufacturing costs, increasing efficiencies, and reducing losses at all stages of the manufacturing process.

Decommissioning coal – an opportunity for energy storage?

Coal has underpinned power generation for more than a century as a cheap, reliable and well understood technology, writes IHS Markit analyst George Hilton. Decommissioning of coal generation, in light of global efforts to reduce carbon emissions, will radically change the energy landscape and potentially leave a substantial gap to be filled by energy storage technologies.