Stocks rally on storage demand

With power outages in two U.S. states this month, many are looking to storage solutions to ensure reliable power supply. This, writes Jesse Pichel of Roth Capital Partners, could prove a short-term driver for storage stocks.

Will China double down?

As the Chinese government finalizes its 14th Five Year Plan – set for release in the middle of next year –expectations are high for a new renewables target and annual PV installations of around 45 GW, writes Jesse Pichel of ROTH Capital Partners.

Riding strong resi growth

Solar stocks have seen significant upside in October, writes ROTH Capital Partners’ Jesse Pichel. The Guggenheim Solar ETF (TAN) increased 9.4% vs. the S&P 500 and the Dow, which increased by 3.0% and 2.8%, respectively. Year to date, the TAN gained 139% vs. the S&P 500 and the Dow, which rose 7.8% and fell 0.2%, respectively.

The Biden effect

Solar stocks continued to outperform the broader market in November, writes Jesse Pichel of ROTH Capital Partners. Tailwinds from the election results drove positive sentiment in the United States, while the end of the exemption from Section 201 tariffs for bifacial products could be bad news for module imports.

A year of change: Part 2

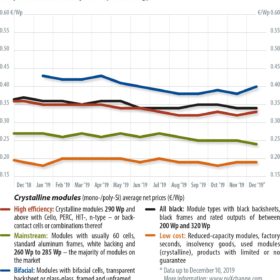

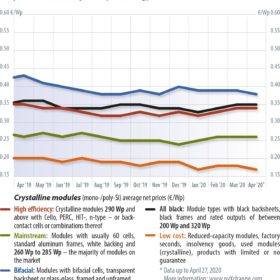

We can look back on an unusually quiet end to 2019, as the final weeks of the year lacked the usual hustle and bustle of the global PV market. As a result, there are no significant price cuts in sight for 2020. Martin Schachinger of pvXchange looks back over the second half of the past year, and what’s to come in the months ahead.

Remove the cap to sure up PV sector

Once again, the future of photovoltaics in Germany is being torpedoed by the delaying tactics of the federal government. Once again, the solar companies that are still in business are facing a severe test. And once again, numerous jobs are being heedlessly put at risk. But why?

The coronavirus wake-up call

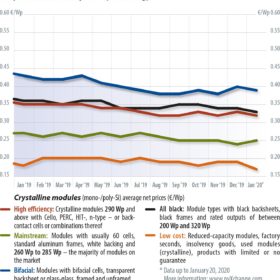

The coronavirus (Covid-19) outbreak is now dominating daily headlines from China to Europe. There is also increasing talk that the long-underestimated and downplayed epidemic, which likely originated in the Chinese city of Wuhan, is having a negative impact on the global economy. Although we may all be suffering from information overload about this terrible news by now, the impact of the virus on the solar industry is, unfortunately, a sad reality, and the full extent of its devastation is just beginning to reveal itself.

Covid-19 beats Fridays for Future

I am not alone in seeing parallels between the threat posed by the virus and the need to advance the fight against climate change. Unfortunately, the only fundamental difference between the two crises is how we deal with them. To contain the spread of Covid-19, heads of state and regional politicians are imposing measures that become more drastic by the day. But when it comes to the climate crisis, hope seems to be the guiding principle. At some point we will come up with something that prevents or reverses climate change; the main thing is to keep the economy roaring and to not make any serious changes.

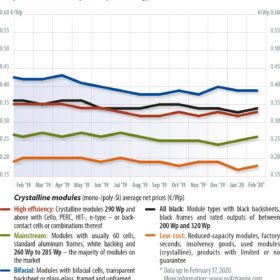

The post-EEG age might come sooner than expected

For years, many in the renewable energy sector has been thinking about what to do with installations in Germany once they drop out of the government’s feed-in-tariff scheme after the 20-year operating period has expired. Of course, the aim is to avoid a situation in which many plants that are well maintained and still in good working order are gradually disconnected from the grid. With a view to a rapid switch to 100% renewable power and reaching the government’s self-imposed climate targets, this capacity must not be lost – and this is something the government also needs to hear.

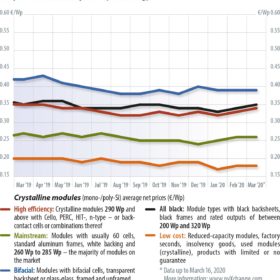

Is size all that matters?

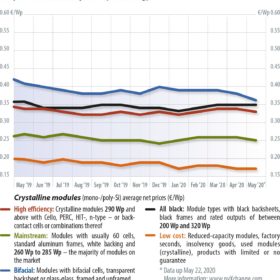

A few months back, Martin Schachinger of pvXchange asked a question: Are bifacial modules taking over the market? Earlier, he had already noted the ongoing shift from full-cell to half-cut modules. And now, both trends seem to have foretold developments that are currently unfolding. While this cannot exactly be characterized as progress, because current developments are being driven by big Asian manufacturers, it certainly warrants a critical eye. Just a few months ago, the consensus was that the 500 W limit could only be cracked, if at all, by adding together both sides of a bifacial panel’s output. Now companies are close to introducing products to the market that have monofacial output of more than 500 W. How was this achieved so quickly?