The race has only just begun

The Australian utility-scale PV and wind industries have just gone through a record two years of construction and commissioning. More specifically, writes Rystad Energy’s David Dixon, utility-scale PV has transformed from a megawatt-scale market to one measured in gigawatts. The resultant boom in utility-scale PV in the country has attracted developers, EPCs and OEMs, from at home and across the globe.

Offgrid goes global

Offgrid solar power has emerged as a vital part of the PV business across the African continent, and is now spreading to other parts of the globe, mainly with solar home systems and microgrids. pv magazine examines the core issues of financing, business models and the quest for user data.

Never a dull moment in the US-solar market

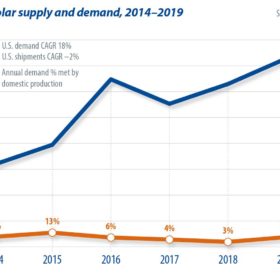

With its trade wars, exclusions from tariffs, reversals of exclusions, and stays of reversals of exclusions – in addition to the repeal of the Clean Air Act and potential changes to the Public Utility Regulatory Policies Act – the U.S. solar market is anything but boring, writes SPV Market Research’s Paula Mints.

Tender reassurance

Walking along Dubai’s Jumeirah Beach Residence area in 2013, there was a sign that read: “Keep Calm, We Still Have Oil.” Despite the United Arab Emirates (UAE) kick-starting the region’s first commercial solar power project only five years earlier, the country remained focused on its black gold – as did its neighbors.

Nothing boring about Japan’s year of the boar

With tenders coming in for large-scale projects, and decade-old generous FIT programs being phased out, new opportunities and challenges are facing Japan’s PV players. Izumi Kaizuka from Tokyo-based analyst RTS Corporation sets out the major market trends for 2019.

What sustainable solar means to Turkey

There is no denying that Turkey is an ideal fit for a major solar market and key player in the PV sector, located on the border between east and west. But while the country has shone as a solar star this decade, writes Eren Engür, Managing Partner at Icarus Energy, it is quickly fading as the government has failed to promote a sustainable solar sector. However, this could be about to change.

The Netherlands: PV’s Iron Throne

While relatively small compared to its more populous neighbors, the Netherlands has a history of punching above its weight. This is certainly true of its solar market in 2019, writes Rolf Heynen from Dutch New Energy Research. And for companies awake to the nuances of its policy settings and market opportunities, The Netherlands could prove a jewel in the European solar crown.

100 GW: PV in its teens

With almost 100 GW commissioned in 2018 (the same level as in 2017), the PV market was stable at a global level, writes Becquerel Institute’s Gaëtan Masson. This hides different market developments, as for example the decline of the Chinese PV market from 53 to 45 GW, and growth in other markets. The global market, exempting China, grew from 41 GW in 2016 to 46 GW in 2017, a rather big jump as it reached close to 55 GW in 2018.

China’s hard change towards grid parity

Each shift in Chinese PV policy is watched by the solar world. And the reforms unveiled in late April and early May have left many scrambling to catch up. While they may reign in unbridled growth, the changes are leaning towards a future of further cost reductions, particularly soft costs, and the golden goal of grid parity PV.

Install, underneath the radar

While they are often not squarely in the industry’s sights, the number of global markets that are heading toward or beyond the gigawatt level for annual installations continues to grow. Encouragingly, these countries are scattered throughout the world. To provide some insights into some of 2019’s ‘next tier’ markets, pv magazine assembled its global team of editors to find out what can be expected today and in the near future.