MENA PV additions quadrupled in 2018

As anticipated, 2018 was a pivotal year for PV installations in Middle East and North Africa, writes Josefin Berg, Research and Analysis Manager at IHS Markit. Our end-of-year estimates show that approximately 3.6 GW of PV systems were installed in the region in 2018, compared to less than 1 GW in 2017.

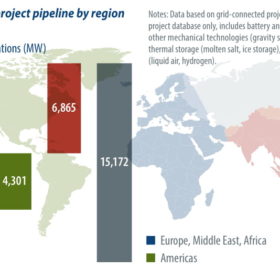

Global battery storage pipeline reaches 15 GW

As data drifts in, 2018 is shaping up to have been a record-breaking year for battery energy storage, writes IHS Markit senior analyst Julian Jansen. Especially for front-of-the-meter projects, which experienced rapid growth. This growth was led by significant activity in South Korea, the United Kingdom, the United States, Australia, and China, which together accounted for 78% of battery energy storage projects commissioned in 2018, according to the Q4 2018 edition of the IHS Markit “Energy Storage Company and Project Database.”

Inverter suppliers go digital

More than 11 million PV inverters will be shipped in 2019 alone, and most of these will be connected to a software platform and controlled by the inverter companies. This creates an opportunity for suppliers to create new models and revenue sources, writes Cormac Gilligan, research and analysis manager at IHS Markit. And indeed, in recent years inverter suppliers have been rapidly developing ‘Internet of things’ software platforms to take advantage of this.

Strategies vary, but the goal remains the same

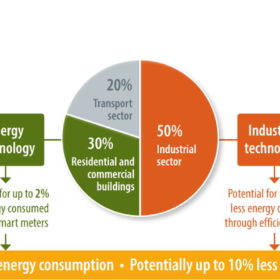

It’s no secret that global energy demand continues to rise, with some estimating an increase of a third by 2040. Meanwhile, writes David Green, Research & Analysis Manager for Smart Utilities Infrastructure at IHS Markit, the energy industry is on the cusp of a 100 year change away from oil and coal hydrocarbons towards renewables and natural gas. Every stakeholder in the industry has a role to play in the energy transition, including within the industrial sector which accounts for 50% of global energy consumption.

Europe makes its comeback

Europe saw the largest upswing of new PV installations over the past year, in particular after the minimum import price on modules ended. Installations grew by 23% in 2018, reaching 12 GW. IHS Markit forecasts the region to surpass 19 GW in 2019. The reason for this revived growth, writes Research & Analysis Manager Josefin Berg, is a combination of the increased cost competitiveness of PV, more initiatives outside of subsidy schemes, and new policy initiatives to meet 2020 and 2030 targets.

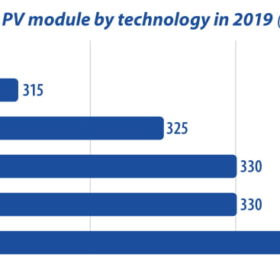

The sun rises on the bifacial module market

With market penetration exceeding expectations in 2018, bifacial technology is set to account for one third of global solar module production by 2022, writes Edurne Zoco, Research Director at IHS Markit. Bifacial and half-cell technologies are rapidly gaining momentum due to their improvements in power output, along with their low implementation barriers and minimal capex requirements.

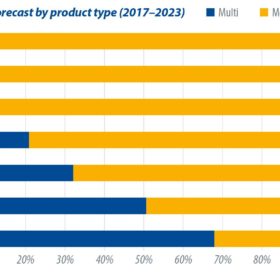

10 GW of utility-scale PV+storage by 2023

In 2019, the United States will become the world’s largest market for grid-connected battery energy storage, writes IHS Markit’s Camron Barati, as solar-plus-storage and peaking capacity requirements drive increased procurement.

Reactivating Mexico’s large-scale sector

The Mexican electric power industry is maintaining its dynamism, despite a collective perception of inactivity stemming from a lack of information from the federal government. And renewables are barely mentioned in the National Development Plan for 2019–2024 drawn up by Mexican President Andrés Manuel López Obrador.

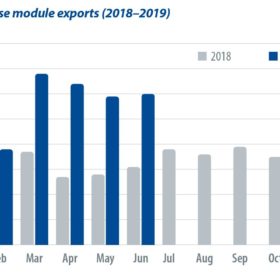

Export analysis

PV InfoLink analyzed the key markets of China’s big module manufacturers, as well as product trends, based on statistics on China’s module exports. According to trade figures, the nation’s module exports totaled 34.2 GW in the first half of 2019, up by more than 90% from the corresponding period of 2018. In a nutshell, overseas demand has been strong in 2019.

Module prices continue to slide

After China’s National Day holiday, demand started picking up at a slow pace, but the anticipated installation rush did not occur as expected, due to land and financing issues, as well as the return of winter. These factors will also delay the timing of more than 6 GW of capacity to the first half of next year. PV InfoLink has thus downwardly revised its estimates for installed capacity in the fourth quarter to 11.3 GW in China and 30 GW globally, bringing this year’s global demand forecast to below 120 GW.