China’s PV policy still under discussion

Although the National Energy Administration (NEA) held a seminar to talk about the development of the 13th five-year plan last November, a positive signal for domestic demand, the Chinese government still has not released new official targets for solar, as of February 2019.

Out with the old…

PV demand started weakly at the start of this year, but will show an optimistic upward trend in its second half. Corrine Lin, Chief Analyst at PV InfoLink, examines supply and demand for polysilicon, and predicts that huge new capacities coming online in the west of China will shake up the market, spelling bad news for some international players.

Bifacial module demand continues to grow

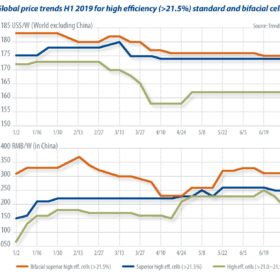

Module technologies such as bifacial, half-cut, multi-busbar (MBB), and shingled are maturing after two years of improvement. Comparing module technologies, we see that half cut has a high degree of maturity in production equipment, high yield rates, and output climbing since the beginning of 2018. From late 2018 to 2019, most companies have expanded or upgraded their portfolios by pairing half-cut technology with MBB technology.

China’s new solar FIT policy

On April 30, China’s National Development and Reform Commission released the “Improving Issues Related to Feed-in Tariffs for Solar Photovoltaic” notice, the first document that confirms the level of FIT payments for solar projects following several consultation papers issued previously this year. The new FIT rates are set to be effective starting July 1.

Looking ahead, post SNEC

In the wake of the 2019 SNEC trade show in Shanghai, PV InfoLink chief analyst Corrine Lin delves into the new cell and module technologies that were exhibited at the show.

Tendency toward diversification

Looking back at the PV market in 2018, micro module technologies started maturing in development and moving on to mass production, writes TrendForce analyst Lions Shih. Modules are no longer limited to a single design as before, but rather continuing on the path toward diversification in 2019. The situation is spreading into other areas, as may be seen in the upstream silicon wafer and cell segments.

PERC cells: From shortage to surplus

After the “June rush” to complete solar projects in China – as well as the commissioning rush in Vietnam, which saw higher-than-expected demand of 4 GW in the first half – the growth of the regional solar market started to slow down in July and August, before anticipated Chinese demand picks up the slack again. With unexpectedly low demand in the third quarter, module manufacturers reacted first by marginally reducing utilization rates. Cell producers then cut production after cell prices collapsed.

Political uncertainties and market speculation

After several years of stagnation, Spain has started to see a revival in its PV market, writes IHS Markit’s Maria Chea. The country’s newfound growth has been due to a combination of tender and private PPA projects, along with decreasing component costs.

A record year for trackers

It was a record year for global shipments of single-axis solar photovoltaic (PV) trackers in 2018, as they increased by more than 40%, surpassing 20 GW globally for the first time, writes IHS Markit senior analyst Camron Barati. While the United States continued to be the largest individual market for single-axis trackers last year, shipments also increased in Mexico, Australia, Egypt, Spain, and other large utility-scale markets.

China’s stagnation is the world’s opportunity

On Oct. 29, China’s National Energy Administration (NEA) released cumulative connection data for the first nine months of 2019, when China installed just under 16 GW. This breaks down as 52% distributed generation projects and 48% ground-mount installations. The figure represents a decrease of 54% for the first three quarters compared to 2018. Numbers for […]