Sharp cell, module distinctions begin to form

The cost effectiveness of solar energy is becoming a top priority in terms of the selection of end market products, writes EnergyTrend’s Lions Shih. The result? A more varied and diverse module landscape alongside mono’s continued rise.

Everyone’s talking about higher module prices …

… but at the moment all we are seeing in Central Europe is higher temperatures. The current weather on the continent — with humid, stormy heat in the northeast and damp, cold air in the south and southwest — is not exactly the ideal recipe for brisk activity in the PV industry. On the contrary, following a hectic first quarter, a kind of inertia seems to have taken hold. Project planners and installers are reorienting themselves, assessing what the market will bear and feeling out prices.

Distributed generation growing in Latin America

In the early years of the 21st century, distributed generation systems in Latin America were mainly installed off-grid in remote rural areas, writes Maria Chea, solar analyst at IHS Markit. As the El Niño phenomenon and high oil prices continued to exacerbate high electricity prices and power shortages, governments began to turn their attention to distributed generation, including PV systems, to assuage strains on their national grid networks.

Germany’s PV cap must go – now

Last month’s column pointed out the transregional causes and trends that could lead to a year-end rally, the associated module and inverter bottleneck, and an inevitable increase in prices. This month, Martin Schachinger of pvXchange homes in on the German market to show what consequences unwise action – or rather, inaction – by the federal government could have for the further, urgently needed expansion of photovoltaics.

Safety is paramount

When Sony first commercially introduced lithium-ion batteries in 1991, the industry recognized their potential to revolutionize portable electronics. Ever since, there have been countless efforts to improve the technology, with many researchers focusing on energy density and longevity, in line with demand from emerging applications such as electric vehicles (EVs) and on-grid energy storage. Julian Jansen and Youmin Rong of IHS Markit discuss the effect of safety concerns on this rapidly growing global market.

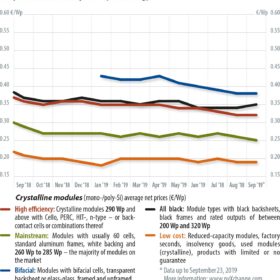

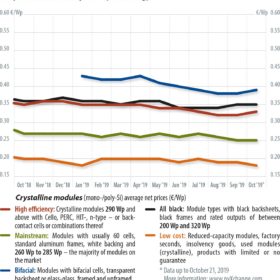

Are bifacial PV modules taking the market by storm?

Bifacial modules are taking over the market – at least, that’s the impression you get if you believe producers of cells with both an active front and an active back for power generation. At Intersolar Europe 2019, held earlier this year in Munich, exhibits of this kind could be found at the booths of nearly every major module manufacturer.

The missing piece…

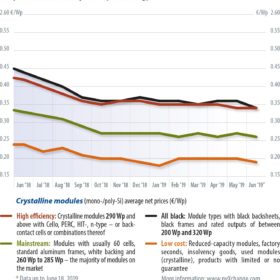

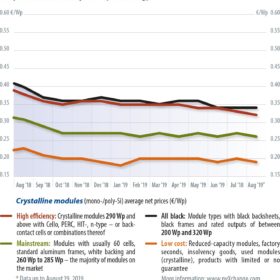

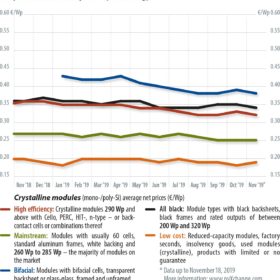

After some short-term price drops at the end of the third quarter to quickly draw down inventories and make room for new goods, the market is now largely back on track. The prices across all panel types have stabilized – only the prices for high-efficiency and bifacial products have seen a slight uptick, but this […]

A year of change: Part 1

To hear our policymakers talk, the energy transition – an unprecedented, radical and rapid transformation of our energy and economic systems – is now in full swing. So much is being reformed and so much is being accomplished – we can’t possibly do more! But reality paints a completely different picture. Even for the big energy companies, which once leaned on the brakes in the face of change, the current pace of the federal government has become too sluggish. The utilities have started to set the pace for change to prepare quickly for a future in which emissions-free energy will be generated exclusively from renewable sources. With or without climate targets, for the utilities it is a matter of developing a survival strategy in a disruptive market.

Outlook for n-type

Among n-type manufacturers, SunPower, Panasonic, and LG had the leading roles in interdigitated back contact (IBC), heterojunction (HJT), and tunnel oxidized passivated contact (TOPCon), respectively. But Chinese cells with low cost and high efficiency trends have been on the rise. In the future expansion of n-type production lines, the power of Chinese cell manufacturers and equipment makers can’t be underestimated.

2019: A year for critical adjustments

Since the PV module market has already witnessed intense industrial concentration over the past few years, the top 10 manufacturers didn’t change significantly as 2018 unfolded, writes PV InfoLink Chief Analyst Corrine Lin. On the cell side, the decline of Taiwanese cell makers has Chinese cell makers filling the top three spots this year.