Time to stock up

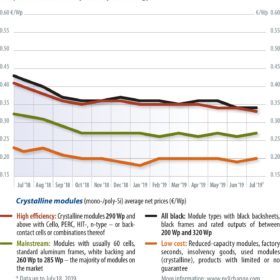

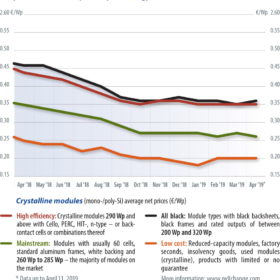

Indications and rumors are mounting that a year-end installation rally is ahead, complete with module shortages. But should we really take these warnings to heart, given that over the past eight to 10 months, supply lines have been flowing just fine? A look at prices shows that everything is still quiet. The price points for all the module technologies have been fluctuating around a support level for months without permanently breaking through it. There is still ample supply of high-efficiency monocrystalline modules on the market, and mainstream multicrystalline products are finding their way to Europe less and less frequently, but demand does not seem to be much higher than supply. So what is the point of forward-looking planning or even stockpiling?

Trade war shadows all but solar

Solar stocks outperformed the broader market in August. The Guggenheim Solar ETF (TAN) increased by 2.0% vs. the S&P 500 and Dow that decreased 0.9% and 1.1% respectively. Canadian Solar (CSIQ), Azure Power (AZRE), First Solar (FSLR), SolarEdge (SEDG) and Enphase (ENPH) all delivered a strong Q2 and strong guidance for Q3.

Solar stocks sink after SPI

What happened in Salt Lake, didn’t stay in Salt Lake, as solar stocks underperformed the broader market in September. The Guggenheim Solar ETF (TAN) decreased 3.9% vs. the S&P 500 and Dow, which gained 1.7% and 1.9%, respectively.

How long?

Solar stocks underperformed the broader market in October. The Guggenheim Solar ETF (TAN) rose 0.2% versus the S&P 500 and the Dow Jones industrial average, which increased 1.9% and 0.7%, respectively.

November blues

Solar stocks underperformed the broader market in November. The Guggenheim Solar ETF (TAN) decreased 1.4% vs. the S&P 500 and Dow, which increased 1.8% and 2.1%, respectively.

The game goes on

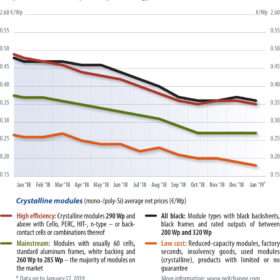

If you want to talk to manufacturers about module prices for 2019 – to submit a binding tender offer, perhaps – prepare to be disappointed. No one knows where the market is headed yet, which is why no one really wants to commit themselves – in other words, planning security is still trending towards zero

The snow keeps falling – module prices do not

After a uniquely pleasant but dry summer and autumn, it has been raining and snowing in central Europe for weeks with no sign of letting up. Judging by sheer volume, the god of precipitation apparently wants to make up for his neglect of last year.

Groundhog Day…

Numerous indicators point to an impending sharp decline in PV installations, at least in Germany, after March 31.

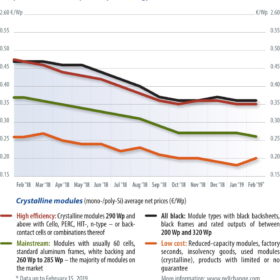

Availability is poor, prices have largely stagnated since the beginning of the year, and manufacturers have postponed or canceled promised deliveries from Asia. As a result of monthly reductions in feed-in tariffs, we are now seeing a full-fledged run on the few lots of modules still available on short notice. With each passing month, anxiety mounts over whether urgently needed components will be delivered on time. When deadlines are broken, installers face harsh contractual penalties, while system operators rack up major losses. Yet module producers seem to be taking all this in stride.

Clash of the titans

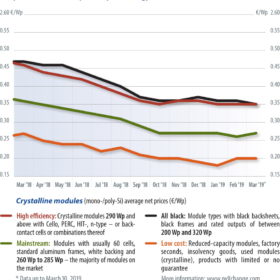

The current market situation, at least for Central Europe, can be summarized as follows: same old story. The price level has neither changed over the past month nor has the general availability of the different module types improved – on the contrary.

Fridays forever

Since the last reduction in the German feed-in tariff for medium-sized PV systems at the beginning of April, not much has changed in terms of module prices. This is down to unchanged demand in the country – at least in the first days of April. What is more, any local lags in the market are outweighed by steadily rising demand throughout Europe.