Plugging in for prosperity

There is little doubt that the need to install solar as quickly as possible is an urgent one. As record-setting gas prices push economies dependent on fossil fuels for electricity generation to the brink, it is consumers and industry that must bear the brunt of the disruption. And since Russia’s invasion of Ukraine is at fault, the need for energy security has never been more widely discussed.

Who gets what?

The Invesco Solar ETF, an exchange-traded fund that tracks the MAC Global Solar Energy Index, outperformed relative to the S&P 500 and Dow Jones Industrial in September. Jesse Pichel of ROTH Capital Partners puts this down to continued expectations of support linked to the US Inflation Reduction Act.

Big profits slow development

Prices for solar modules ticked slightly downward in September for the first time since February, writes Martin Schachinger of pvXchange. One reason for the dip is the shortage of inverters and poor availability of electronic components, which is slowing the pace of expansion. Plant builders have warehouses full of PV panels, but are limited in how many they can install because they lack critical system components. These installers have plenty of modules for the time being, which is why they are trying to delay pending deliveries as much as possible. This has left wholesalers and manufacturers sitting on some of their products, which they then have to try to bring to market elsewhere, sometimes at a discount.

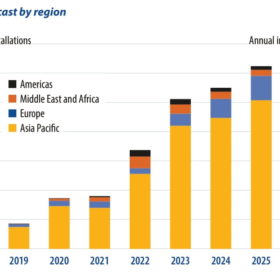

Asia takes the lead on floating PV

Floating PV is consolidating as a growth segment for PV demand, mainly driven by supportive policies and incentives extended by governments across the world. A major reason for this push is the limited land availability in many markets. Despite higher equipment prices compared to ground-mounted installations, developers see the opportunity to save on land and O&M costs. The output can also be as much as 30% higher than a ground-mount PV plant, depending on the site and technology used.

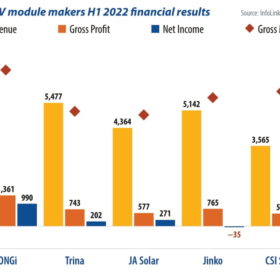

Solar’s big five

The five largest vertically integrated PV manufacturers have seen significant growth in net profit and revenue so far this year. Combined, these five companies shipped a total of 78.6 GW of modules in the first half of 2022, up 48% from the same period last year. Their shipments accounted for 60% to 70% of the market, suggesting increasing consolidation. With first-half financial results filed, InfoLink’s Richard Chen digs into the numbers.

Five strategies for battery procurement

The worst effects of the pandemic may have passed, but supply chain disruptions continue to be felt across the world. The effects of the war in Ukraine are also evident to all of us in our daily lives, from commodities to energy, food supply chains and beyond. The disruption in the battery energy storage system (BESS) supply chain is no different, writes Cormac O’Laoire, senior manager of market intelligence at Clean Energy Associates. Indeed, as the cost of raw materials such as lithium climb, battery prices are being driven materially higher, on some accounts by 20% to 30%, rendering some projects uneconomical.

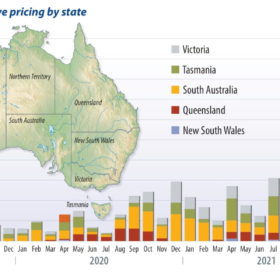

Australia builds big

While the first half of 2022 was one of the busiest periods on record for new wind projects in Australia, with more than 2 GW breaking ground, solar got off to a much slower start with construction on 635 MW of new PV projects getting underway. Rystad Energy’s David Dixon attributes this slowdown to high cost and supply chain challenges and a lack of available power purchase agreements.

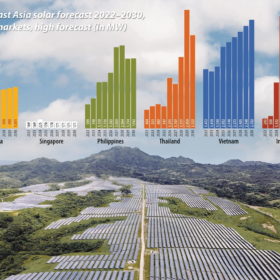

Southeast Asian interconnection

While near neighbors, the electricity generation of the countries of Southeast Asia couldn’t be further apart. Indonesia burns locally mined coal, Malaysia has reserves of oil and gas, while populous Singapore, Vietnam, and the Philippines, depend on fossil fuel imports. They could all benefit from increased solar imports, but higher grid capacities and interconnection are key for an opportunity to unlock the power of the sun.

Central Asia’s solar on the rise

Utility-scale solar is on the rise in Central Asia, with support from development banks. Following a series of competitive auctions, PV projects were commissioned and are under further development in Uzbekistan and Kazakhstan. In Kazakhstan, corporate interest in distributed small-scale renewables is growing, but for further market uptake, additional incentives should be introduced, practitioners say.

Software to serve up more solar

Enabling future energy flows at the lower-voltage distribution level? Unlikely. Wide-scale hardware upgrades would cost billions if not trillions, especially in Australia’s far reaches. Software and digital solutions are identifying new cost-effective ways of letting more sun into the grid.