US states get smart on smart inverters

As residential smart inverters and their grid services continue to offer more capabilities to the grid, U.S. states are going about regulating their installations with the best intentions. But delays in ensuring that smart inverters are active and operating to a common standard will be costly.

PV for biodiversity

PV’s contribution to a cleaner future can go well beyond generating emissions-free energy, but maximizing the opportunity is not always straightforward. Ragna Schmidt-Haupt, partner at Everoze and a board member at Skyray, argues that investors and lenders have to start making decisions today to fulfill the required disclosure regulations and make sure their fleet has a positive impact on biodiversity. The key challenge is to weigh the techno-economic-ecological risks, opportunities, costs and revenues.

Rethinking solar sustainability

There’s more to solar sustainability than recycling, energy intensity, and materials, argues Jan Mastny, a PV industry veteran and the head of global sales, wind and solar, for Studer Cables AG. He argues for the notion of sustainability within PV to be radically expanded.

Bridging the BIPV gap

Architects and construction companies are being offered an ever growing array of Building Integrated Photovoltaics (BIPV) products, with their needs for safety, speed of construction and aesthetics in mind. But can it drag BIPV beyond niche status?

First Solar goes to India

First Solar has announced plans to establish a new 3.3 GW manufacturing facility in India. Representing an investment of $684 million, the move demonstrates the thin-film PV manufacturer’s confidence in India’s solar growth and the increasingly favorable policy environment for domestic solar PV production.

Both sides for C&I

The commercial and industrial sector has been called the underdog of the U.S. solar market, as it usually plays second fiddle to its larger, more visible residential and utility segment siblings. But C&I’s ultimate multi-gigawatt potential has never been in dispute. Aaron Thurlow, general manager at Longi Solar, makes the case for bifacial technology in the C&I segment.

Current affairs

The PV manufacturing industry’s switch to larger wafer formats is already having impacts all the way down the supply chain – some of which are still emerging today. For junction boxes that house bypass diodes and other components that keep the power flowing out of a module, handling the higher currents produced by these larger products has been a challenge requiring a quick response. Meanwhile, a notable number of failures and quality issues with junction boxes new and old suggest that the design and processing of this vital component could be in need of renewed attention.

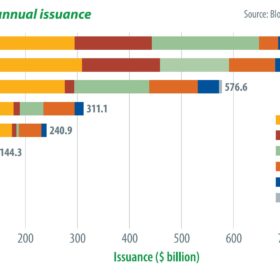

Trends in sustainable debt

While sustainable debt issuance has historically been dominated by the Europe, Middle East and Africa region and mostly driven by green bonds from the energy and financial sectors, it has diversified in recent years and is now a global market with a huge range of issuers, thanks to the variety of instruments that have been created since 2007. As part of pv magazine’s UP Initiative quarterly theme on sustainable electricity and corporates’ critical solar role, Maia Godemer, BloombergNEF (BNEF) research associate, discusses this growth and its implications.

Different shades of green

Most long-term power delivery contracts with renewable energy systems involve the delivery of electricity through the public grid via off-site power purchase agreements. This leads to a key question: “How do I as a customer know when and if I am really using renewable electricity, and how can I prove that?” Simon Göß and Michael Claußner from Energy Brainpool GmbH & Co. KG, a European market research firm focused on energy trading, address these questions. They note how the development of green hydrogen is an opportunity to create more flexible power markets by fostering the adoption of renewables.

Corporate acceleration

With solar declared the cheapest form of power in history, and wind prices following a similar trajectory, corporate energy users are buying renewable power and investing in new capacity at scale. But more companies need to step up. Governments around the world must remove policy barriers and open new markets to competition from renewables if we are to reach the scale of investment needed to achieve a 1.5-degree world, according to Sam Kimmins, the head of RE100.