An evolutionary PV landscape

Solar+storage: A progressive marriage of two technologies is bringing on a new era for the energy sector. The times, and the climate, are changing.

Signs of a strong second half

Solar stocks enjoyed another good month in July, writes ROTH Capital Partners Jesse Pichel. A major acquisition deal is driving investor confidence in the United States, new wafer capacity is coming online, and the temporary loss of some polysilicon manufacturing capacity is pushing prices up slightly.

Clash of the titans reloaded

As early as March 2019, information began to emerge on the patent lawsuit that module manufacturer Hanwha Q Cells filed on three continents against its competitors Longi Solar, Jinko Solar, and REC. At the time, the purpose of the lawsuit was not clear and it was still uncertain whether it would even be admitted. Just over a year later, the first verdicts have now been handed down. In the United States, the rulings were against the plaintiff, but in Germany, they came down in its favor. The Düsseldorf Regional Court confirmed a lower court ruling that the competitors had unlawfully used Hanwha Q Cells patented technology. Judges granted Hanwha Q Cells a remedy in the form of an injunction. But what does this ruling mean for the parties concerned, and in particular for their customers?

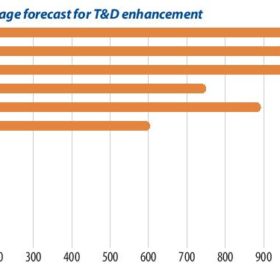

Energy storage and network reinforcement

As renewables penetration increases, transmission and distribution (T&D) infrastructure will require significant reinforcement. Battery storage is becoming a key alternative to traditional ways of reinforcing network infrastructure, because it is fast to deploy, can provide multiple services, and often comes at a lower capital cost. IHS Markit analyst Oliver Forsyth delves into the additional value streams that strengthen the case for grid-connected batteries.

Consolidation continues for polysilicon makers

While mono-grade polysilicon prices did not decrease much in the first quarter owing to stable demand, multi-grade fell to record lows as its market share diminished. During the second quarter, writes PV InfoLink senior analyst Cooper Chen, the market saw excessive supply. Monocrystalline manufacturers have been running at full tilt and bringing new capacities online as scheduled, while the pandemic rages on overseas.

Starting a new industry

As a business prospect, producing hydrogen via sustainable means remains in its infancy. However, analysts appear increasingly certain that we are seeing the dawn of a vital new industry. In Europe, some countries (such as Germany and Portugal) have already adopted national strategies for the production and use of the fuel. And in July, the European Union also published a comprehensive hydrogen strategy as a central part of a climate-neutral Europe.

Europe ramps up policy support for storage

Policy support for battery energy storage is gaining momentum across Europe as national governments remove regulatory barriers and the EU pledges financial support for this emerging technology. In several countries, revised capacity markets now allow energy storage operators to compete for subsidy contracts on a more equal footing with power generators. Support from the European Battery Alliance and €1 billion in loans from the European Investment Bank in 2020 alone should help shore up investor confidence. Battery storage will be a key component to support the growth of solar PV – but the rollout of projects will have to accelerate faster to fulfill this potential.

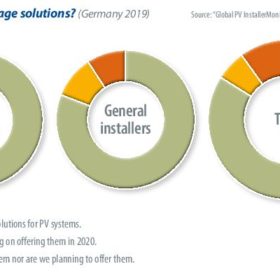

Australia heading for a battery boom

With 82,000 cumulative system installations, Australia ranks among the world’s leading markets for residential energy storage. But uptake is still sluggish, thanks to long payback periods, and market developments are only now beginning to emerge. That said, forecasts are still bullish for batteries Down Under – it is only a question of when.

European storage – Start of a new growth phase?

In general, the tale of photovoltaics in Europe has been a success story, albeit one not completely devoid of obstacles and hurdles. The idea of producing clean energy was pushed by tailwinds when CO2 emissions skyrocketed and the catastrophic Fukushima incident once more made us recognize the hazards of nuclear energy. However, the PV industry still has a long way to go to reach its full potential.

Hydrogen and the energy transition

Researchers are now simulating how the energy transition can be as successful and cost-effective as possible. As part of the simulation, they are also calculating how much hydrogen will be needed and where it could come from. In Germany, a recent study by Fraunhofer ISE showed that the cost is so low that the nation could gift itself the energy transition as a Christmas present.