Playing to natural strengths

PV mega projects catch the eye, demonstrate solar’s ability to scale, and have allowed manufacturers to reach serious volumes. But it’s PV’s versatility that truly sets it apart.

Awaiting intervention

In May, the Invesco Solar ETF (TAN) jumped 11.0%, while the S&P 500 increased by 0.6% and the Dow Jones Industrial Average rose by 0.7%. Jesse Pichel of ROTH Capital Partners sees the impacts of the current anti-circumvention case in the United States as the main reason why solar outperformed broader markets.

The times, they are a changing

In borrowing a headline from Bob Dylan, what we really want to express is the introduction of a “remade” price index based on new price categories. Continued advances in cell technology and format, particularly when it comes to steadily rising efficiencies, have necessitated some reshuffling so that specific price developments can be more accurately reflected in the index – but more about that later. First, Martin Schachinger of pvXchange will shed some light on the dramatic overall market situation for modules, and even more so for inverters and storage systems.

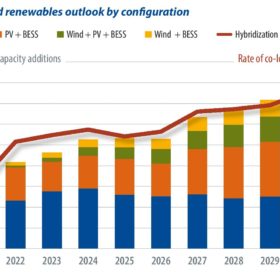

Hybrid systems in demand

The past two decades have seen a boom in solar, driven by falling costs and rising efficiencies, with global capacity additions reaching 176 GW in 2021. Most PV generating capacity added to date has been standalone projects, driven by subsidies, tenders and the drive for the lowest levelized cost of electricity (LCOE). But as the penetration rate of standalone solar increases, so does the potential for a negative impact on power markets and network stability, writes Jason Sheridan of IHS Markit.

Europe and US manufacturing look to localize

Intersolar Europe saw a marked increase in attendance this year, with robust module order requests and excess inverter demand in the European market. The exhibition was abuzz with recent developments in global trade: the US-China trade war, India’s expansion plans, discussions on expanding manufacturing overseas and “made in Europe” came to the fore. PV InfoLink’s Amy Fang sums up the latest developments as Europe, India, and the United States seek independence in PV manufacturing.

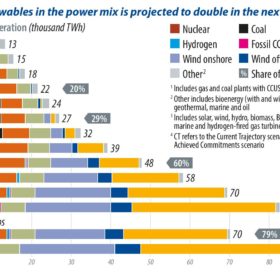

With collaboration comes meteoric growth

The solar industry is heating up, with rapid technological advances and supply chain optimization lowering costs by 50% in the past five years. McKinsey & Company predict that the levelized cost of energy will fall another 65% by 2040. Based on this progress and increasing political will for decarbonization, McKinsey and Company’s Bram Smeets and Jesse Noffsinger point to a period of rapid expansion ahead.

Italy’s super solar rooftops

Despite the lack of timely data on rooftop solar installations in Italy, the general trend seems clear: Subsidies in the country have boosted the installation of rooftop PV arrays, often coupled with battery energy storage systems in the residential segment. Sergio Matalucci looks at the policies behind the strong adoption levels, and what’s in store with central support policies in doubt.

Reforms loom, Cyprus begins to move

Cyprus is a laggard in renewable energy development compared to many of its European neighbors. Given its reliance on oil and gas imports, the consequences are now being felt by electricity consumers on the island. However, as Ilias Tsagas reports, a combination of factors may soon provide the leverage that changes the game fast.

Australia’s green swell

In May, Australia voted out its conservative government, which had held power for almost a decade. Instead, it turned to Labor, female independents, and minor parties with far greater climate ambitions. In short, it shifted to an entirely different approach to politics.

When a spark becomes a fire

In 2021, China installed 21.6 GW of residential PV, which accounted for nearly 40% of the total annual installation figure of 54.9 GW. Spool back to 2018, and the residential segment clocked in at a mere 3 GW – less than 7% of the total for the year. Vincent Shaw in Shanghai reports on how changing market priorities caused a spark that quickly became a fire.