Pieces of the puzzle

The technology behind solar energy has begun to move quickly in recent years as manufacturers aim for ever higher energy yields. Tunnel oxide passivated contact (TOPCon) solar’s takeover from passivated emitter rear contact (PERC) technology is well under way in 2024, with the latter having quickly risen to dominate the market by around 2018. […]

Trade measures may bring volatility

Potential new antidumping and countervailing duties loom over the United States solar market and there might be more price volatility on the horizon. While there are challenges for United States residential solar, Jesse Pichel, of Roth Capital Partners, also highlights a number of reasons for optimism.

Price collapse protects China’s lead

With solar module oversupply triggering a price freefall in 2023 and no recovery in sight, market consolidation, inventory pile-up, technology shifts, and challenges to reshoring PV manufacturing are set to affect all levels of the solar supply chain.

High inventory, low prices, stiff competition

Global solar demand will continue to grow in 2024 with module demand likely to reach 492 GW to 538 GW. InfoLink predicts that demand growth will begin to slow. Amy Fang, a senior analyst at InfoLink, takes a look at module demand and supply chain inventories in a market still affected by oversupply.

PV players wrestle tariff threat and oversupply

The requirements of measures such as the Uyghur Forced Labor Prevention Act (UFLPA) mean that solar panel prices in the United States can be twice as much as in Europe.

From Mumbai to Bondi

Economic cooperation between India and Australia may open doors for investment in clean energy technology but challenges still abound in a competitive global market. Vibhuti Garg and Shantanu Srivastava, of the Institute for Energy Economics and Financial Analysis (IEEFA), discuss the role that public funding and resource pooling could play in supporting manufacturing ambitions.

Topping up carbon credit knowledge

Renewable energy generation and carbon credit trading are both being used to achieve corporate decarbonization goals. Julia Hung and Sherry Hu, from Reccessary, a market analysis platform for the Asia-Pacific region, explore carbon market developments in Southeast Asia and beyond.

China’s cash conundrum

The Chinese PV industry has benefited from the availability of substantial finance over the past two decades, supporting the development of the renewable, zero-carbon capability essential for meeting the goals of the Paris climate agreement. Easy access to finance has led to unsustainably low prices and unnecessary losses, however, impacting China’s ability to sustain support for renewable energy systems. As the nation expands renewable energy installations and enhances grid-balancing capacity, maintaining consistent financial support has become more challenging.

Déjà vu on the polysilicon market

Haven’t we been here before? The polysilicon industry is shifting from shortage to oversupply but a few things are different from market cycles of the past, as Bernreuter Research founder Johannes Bernreuter explains.

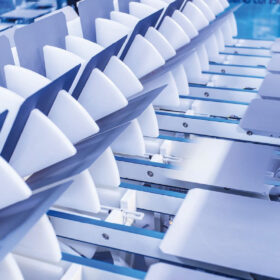

Module makers assemble in Istanbul

The number of module assembly businesses in Türkiye continues to rise but, despite protectionist moves to support domestic manufacturing, consolidation appears likely. Ambitions abroad, expansion at home, and interest from Chinese suppliers, were all on show at the recent SolarEX trade fair in Istanbul.