Time to adjust

With the state of the world in recent months, just the thought of a detailed, reliable, long-term contract brings a certain peace of mind. In the renewable energy space, it’s not hard to see why power purchase agreements (PPAs) have become so popular. These agreements, between all manner of power producers and corporate or […]

Speculation abounds over tax credits

There were mixed fortunes for US solar stocks in February, with the residential segment enduring another month of double-digit decline while utility-scale stocks rallied. Uncertainty looms over key tax credits, says Jesse Pichel, of Roth Capital Partners.

Data centers lead global growth in corporate PPAs

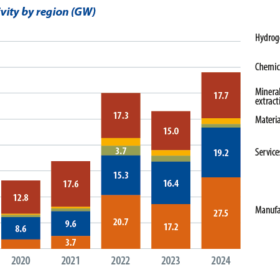

In 2024, the global corporate clean energy procurement market grew strongly, with a record 68 GW of power purchase agreements (PPAs) and other clean energy procurement deals announced. That amounted to 29% growth against the previous year. Caroline Zhu and Bruno Brunetti, of S&P Global Commodity Insights, examine the trends behind these numbers.

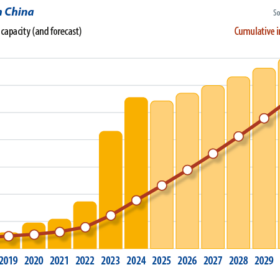

China prepares for market-driven prices

Residential and commercial solar arrays in China are likely to remain overshadowed by utility-scale projects due to new legislation that will shift prices from fully subsidized to market-driven models.

Cautious optimism on module oversupply

Module prices from China have eked out slight gains over the past month amid policy changes in the country’s power market. Overcapacity remains an albatross around the market’s neck, however, obscuring the outlook for the second half of the year.

Tariffs the least of US market’s worries

While President Donald Trump’s sweeping levies on foreign imports have captured global headlines, antidumping and countervailing duty (AD/CVD) investigations into Southeast Asian products, along with a potential expansion of the Uyghur Forced Labor Prevention Act (UFLPA), could pose even greater risks for US solar and energy storage.

India’s next 100 GW

India marked a major milestone in the renewable energy (RE) space in January 2025, when installed solar capacity hit 100 GW. Solar installations show no sign of slowing as the year moves forward, writes Sehul Bhatt, of ratings agency Crisil.

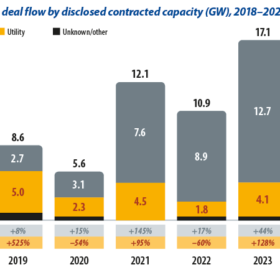

The big adjustment

In Europe, the volume of solar and wind generation capacity signed under power purchase agreements (PPAs) fell in 2024. Energy price volatility receded as a key driver and a new risk emerged, in the form of solar and wind intermittency causing an increase in negative electricity price periods. Market intelligence provider Pexapark expects the European PPA market to return growth in 2025 as project developers and their customers adapt to the new market reality and energy storage plays a growing role in balancing electricity networks.

EU to shore up PPA support

The European Commission has presented ideas on how to boost power purchase agreements (PPAs) to shield corporate and industrial clean electricity buyers from price volatility while decarbonizing their energy supply.

Sharing the knowledge

Sustainability targets and a desire to hedge against energy price volatility mean power purchase agreements (PPAs) are big business for clean energy developers in 2025. pv magazine caught up with Pierre Bartholin, head of power hedging at Nuveen Infrastructure, to discuss the PPA market segment and how the addition of energy storage is set to shake things up.