Hope beyond COP

The recent COP25 negotiations in Madrid were an ignominious way to close out a decade of climate change (in)action. And on a personal level, it was particularly disappointing to learn of my home country of Australia’s efforts to impede meaningful action. As if by divine climate intervention, a record-setting heat wave and devastating fires subsequently […]

New markets, renewed strength

It has been an exciting year for solar stocks. The Guggenheim Solar ETF (TAN) increased by 64% versus the S&P 500 and Dow, which gained 27% and 21%, respectively. The top-performing sectors were the inverter and module/cell segments, which grew by 168% and 78%, respectively.

A year of change: Part 2

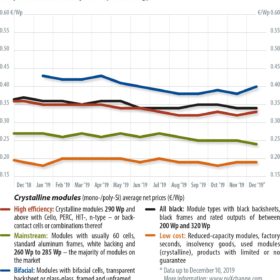

We can look back on an unusually quiet end to 2019, as the final weeks of the year lacked the usual hustle and bustle of the global PV market. As a result, there are no significant price cuts in sight for 2020. Martin Schachinger of pvXchange looks back over the second half of the past year, and what’s to come in the months ahead.

A new era of sustained growth

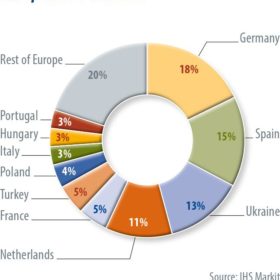

After several years of weak solar demand growth in Europe, compared to the historical highs of 2011, installations are expected to surge by 88% to reach a new installation record of 23 GW in 2019, writes Cormac Gilligan, research manager at IHS Markit. A range of favorable macro conditions have coalesced this year to reignite the market.

Transitioning to larger wafers

Since 2017, 156.75 mm M2 wafers have been the standard. However, improvements in cell efficiency appear to have hit a bottleneck, making wafer size a hot topic among manufacturers once again. In the second half of 2018, 158.75 mm G1 mono wafers were introduced to the market. Corrine Lin of PVInfoLink argues that while G1 will likely become the mainstream format over the next two years, 166 mm M6 wafers and 210 mm M12 wafers are presenting new options for manufacturers.

Your guide to market growth in 2020

Some 15 countries are likely to be able to lay claim to the status of being members of solar’s “gigawatt club” in 2019, according to conservative projections from BloombergNEF. Nonetheless, PV suppliers, developers and service providers are always on the lookout for new pockets of growth. To kick off 2020, pv magazine’s global team of correspondents and editors have highlighted 10 “fast-growing” solar markets to evaluate where the opportunities, and potential risks, lie.

The land of the low tender

Some of the world’s most cost-competitive solar arrays have been built among the rolling dunes of the vast Arabian Desert. While some government policies appear to be targeted at breaking records, nobody expects the oil-rich Gulf region to bring about truly sharp changes in pricing for solar PV plants.

Back to the drawing board

The combined use of trackers and bifacial modules can result in significant power gains, but they are not distributed equally. For single-axis tracking R&D teams, the process of optimizing the output from arrays that use bifacial modules requires experimentation and a steep learning curve in terms of what is going on underneath the module.

Nothing simple about GPS

Changing rules mean that many utility-scale PV projects in Australia are facing long delays in achieving full generation – known as “obtaining GPS.” The consequences can be costly.

All about albedo

With analyst predictions going as high as 40 GW for annual bifacial demand by 2023, it is imperative for stakeholders across the industry to understand the behavior of these modules in the field. Ground albedo and the way that diffuse and reflected light hits the rear side of the modules are the key concerns. A better understanding of these factors, gained from sophisticated yield-modeling simulations and bifacial test installations all over the world, has already helped to identify the challenges and opportunities in optimizing projects to maximize bifacial energy yield.