- Austria

- Belgium

- Bosnia and Herzegovina

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Estonia

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Macedonia

- Malta

- Montenegro

- Netherlands

- Portugal

- Romania

- Serbia

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Ukraine

- United Kingdom

Austria

| Rooftop | BIPV | Term | ||

| Size | Incentive | Size | Incentive | |

| 5-200kWp | €0.115/kWh | 5-200kWp | €0.115/kWh | 13 years |

Rooftop and BIPV installations are also eligible for a 30% investment subsidy up to 200€/kW.

Sources:OeMAG

Belgium

Belgium has a complicated array of incentives, the main two being a FIT and some regions have opted for a Green Certificate (GC) Scheme. There are also investment grants, VAT reductions and beneficial credit terms.

Tax Credits

| Private Residences | Tax reduction of 40% of investment up to 3600€ |

| Companies | 13.5% of installation cost is deductible from profit taxes |

In addition, private residences (owned for more than 5 years) are only required to pay a 6% VAT instead of the usual 21%

Brussels

| Size | Incentive | Term |

| Residential | ∼0.204€/kWh* | 10 years |

| Businesses and public sector <5kV AC | ∼0.204€/kWh* | 10 years |

| Businesses and public sector >5kV AC | ∼0.204€/kWh* | 10 years |

* These rates are based on the average Green Certificate (GC) price in 2011 of 85€. GCs are guaranteed to never fall below 65€. For more information, see the Bruxelles Renouvelable website.

Flanders

No distinction between application types. The planned degressive tariff rates are based on a host of factors. See sources for more information.

Sources: VREG

Flemish Regulator of the Electricity and Gas market (VREG)

Wallonia

| Period | Incentive |

| 1st year after installation | ∼0.520€/kWh* |

| 2nd year after installation | ∼0.455€/kWh* |

| 3rd year after installation | ∼0.455€/kWh* |

| 4th year after installation | ∼0.390€/kWh* |

| 5th year after installation | ∼0.325€/kWh* |

| 6th year after installation | ∼0.325€/kWh* |

| 7th year after installation | ∼0.260€/kWh* |

| 8th year after installation | ∼0.195€/kWh* |

| 9th year after installation | ∼0.195€/kWh* |

| 10th year after installation | ∼0.130€/kWh* |

* These rates are based on the minimum Green Certificate (GC) price of 65€. GCs can sell for more than 65€.

Sources: EPIA, Belgium support schemes report

Bruxelles Renouvelable on Brussels FIT

CWaPE with more detail on Wallonia FIT

RES Legal on Belgian national FIT

Bosnia and Herzegovina

Federation of Bosnia and Herzegovina

| Size | Incentive | Term |

| 2 – 23 kW | BAM 0.61814 | 12 years |

| 23 – 150 kW | BAM 0.47335 | 12 years |

| 150 kW – 1 MW | BAM 0.39326 | 12 years |

Source:RES Legal

Republic of Srpska

| Size | Incentive | Term |

| Residential < 50 kW | BAM 0.3398 | 12 years |

| Residential 50 – 250 kW | BAM 0.2947 | 12 years |

| Residential 250 kW – 1 MW | BAM 0.2358 | 12 years |

| Ground-mounted < 250 kW | BAM 0.2735 | 12 years |

| Ground-mounted 250 kW – 1 MW | BAM 0.2181 | 12 years |

Source:RES Legal

Bulgaria

| Rooftop/BIPV | Ground-mounted | Term | ||

| Size | Incentive | Size | Incentive | |

| <5kWp | BGN 0.21181/kWh | 20 years | ||

| 5-30kWp | BGN 0.20397/kWh | <30kWp | BGN 0.15219/kWh | 20 years |

| 30-200kWp | BGN 0.16912/kWh | 30-200kWp | BGN 0.14335/kWh | 20 years |

| 200kWp-1MWp | BGN 0.14468/kWh | 200kWp-10MWp | BGN 0.13403/kWh | 20 years |

| >10MWp | BGN 0.13136/kWh | 20 years |

Source:Bulgarian FIT table

Croatia

| Rooftop/BIPV | Ground-mounted | Term | ||

| Size | Incentive | Size | Incentive | |

| <10kW | HRK 1.91/kWh | <1MW | HRK 2.002/kWh | 14 years |

| 10-30kW | HRK 1.70/kWh | 1-5MW | Average electricity price* | 14 years |

| 30kW-1MW | HRK 1.54/kWh | 14 years |

* 0.53kn/kWh as of May 31, 2012.

Sources:Croatian FIT legislation

Croenergo article on the Croatian FIT

Cyprus

Cyprus offers a one-time subsidy for the installation of a system at €900 per kW (up to a maximum of €2,700 per installation). Clean energy producers also have access to a net metering scheme.

Sources:RES Legal on Cyprus Net Metering Overview

RES Legal on Cyprus Premium Tariff III Overview

Czech Republic

The Czech Republic cancelled its FITs in September 2013.

Source:pv magazine on Czech Republic cancelling FIT

Estonia

| Size | Incentive | Term |

| Any size | 0.0537€/kWh | 12 years |

Source:RES Legal on Estonian FIT

France

| Rooftop | BIPV | Ground-mounted | Term | |||

| Size | Incentive | Size | Incentive | Size | Incentive | |

| <36kW | €0.1440/kWh | <9kW | €0.2539/kWh | 0-12MW | €0.0612/kWh | 20 years |

| 36-100kW | €0.1368/kWh | 9kW-12MW | €0.0612/kWh | 20 years | ||

| 100kW-12MW | €0.0612/kWh | 20 years |

Sources:French Government FIT outline

photovoltaique.info on French FIT

Germany

Standard Fixed Feed In Tariffs

October-December 2015

| Rooftop/BIPV | Ground-mounted | Term | ||

| Type | Incentive | Type | Incentive | |

| <10kW | €0.1231/kWh | <10MW | €0.0853/kWh | 20 years |

| 10-40kW | €0.1197/kWh | 20 years | ||

| 40kW-500kW | €0.1071/kWh | 20 years |

Market Premium Price

October-December 2015

| Rooftop/BIPV | Ground-mounted | Term | ||

| Type | Incentive | Type | Incentive | |

| <10kW | €0.1270/kWh | <10MW | €0.0891/kWh | 20 years |

| 10-40kW | €0.1236/kWh | 20 years | ||

| 40kW-1MW | €0.1109/kWh | 20 years | ||

| 1-10MW | €0.0891/kWh | 20 years |

Germany’s most recent change to their feed-in tariff (FIT) system was enacted by the German Renewable Energy Act 2014 (EEG 2014). The standard FIT is only available for so-called “small systems” with a capacity under 500 kWp. This ceiling will fall to 100 kWp in 2016. All other plants must market their solar power directly. The owners of “small systems” can also opt to market their generated electricity directly if they so choose. This FIT functions like the previous FIT, in that 100% of the electricity price goes directly to the power producer. The market premium is calculated every month and involves greater risk. In addition, the intermediary that sells the power on the market may also take a percentage of the price received, so 100% will not go to the power producer.

Source:Federal Network Agency Article German FIT details

Greece

On March 7, 2014, the Greek government introduced a raft of measures that significantly reduced incentives for solar power producers retroactively. As a consequence, after the end of the current power purchase agreements (PPAs) all solar PV plants that had been operating for less than 12 years as of January 2014 will be given two options: to sell the generated power to the energy market at whatever price they can get; or to sell the energy they produce to the grid at a set price of €80/MWh (US$110). To make up for the lower FITs, YPEKA has allowed renewable power producers to extend their PPA with Greek electricity market operator LAGIE by five years.

The new measures also mandate that solar photovoltaic energy producers must contribute 35% of their 2013 income to electricity market operator LAGIE, in order to plug a €700 million gap in LAGIE’s fund. However, rooftop solar PV installations are exempt from this measure.

| Region | Size | Incentive | Term |

| Interconnected system (Mainland Greece) | <100MW | €0.115/kWh | 20 years |

| Interconnected system (Mainland Greece) | >100MW | €0.09/kWh | 20 years |

| Non-interconnected system (Greek islands) | Any size | €0.095/kWh | 20 years |

Source:pv magazine article on Greek FIT

Hungary

| Size | Incentive | Term |

| < 50 kW Individuals – Sold energy (net price) | HUF 14.34/kWh | Adjusted yearly |

| < 50 kW Individuals – Self-consumed energy (gross price) | HUF 35.33/kWh | Adjusted yearly |

| < 50 kW Business – Sold energy (net price) | HUF 22.02/kWh | Adjusted yearly |

| < 50 kW Business – Self-consumed energy (gross price) | HUF 37.76/kWh | Adjusted yearly |

| 50 kW – 20 MW | HUF 31.77/kWh | Adjusted yearly |

| 20 – 50 MW | HUF 28.39/kWh | Adjusted yearly |

Source:E.ON Individuals

Ireland

The Small and Micro-Scale Generation Pilot Field Trials quota has been met and the call for proposals is closed.

Italy

As of July 5, 2013, Italy ceased offering FIT payments because its €6.7 billion cap was reached 30 days prior on June 6. The FIT immediately prior to cancellation is shown below.

The Italian feed-in tariff scheme degresses every six months. It last degressed on February 27, 2013 and is next set to degress on August 27, 2013.

Standard feed-in tariff

| Rooftop/BIPV | Ground-mounted | Term | ||

| Size | Incentive | Size | Incentive | |

| 1-3kW | 0.182€/kWh | 1-3kW | 0.176€/kWh | 20 years |

| 3-20kW | 0.171€/kWh | 3-20kW | 0.165€/kWh | 20 years |

| 20-200kW | 0.157€/kWh | 20-200kW | 0.151€/kWh | 20 years |

| 200kW-1MW | 0.130€/kWh | 200kW-1MW | 0.124€/kWh | 20 years |

| 1MW-5MW | 0.118€/kWh | 1MW-5MW | 0.113€/kWh | 20 years |

| 5MW+ | 0.112€/kWh | 5MW+ | 0.106€/kWh | 20 years |

Standard self-consumption tariff

| Rooftop/BIPV | Ground-mounted | Term | ||

| Size | Incentive | Size | Incentive | |

| 1-3kW | 0.100€/kWh | 1-3kW | 0.094€/kWh | 20 years |

| 3-20kW | 0.089€/kWh | 3-20kW | 0.083€/kWh | 20 years |

| 20-200kW | 0.075€/kWh | 20-200kW | 0.069€/kWh | 20 years |

| 200kW-1MW | 0.048€/kWh | 200kW-1MW | 0.042€/kWh | 20 years |

| 1MW-5MW | 0.036€/kWh | 1MW-5MW | 0.031€/kWh | 20 years |

| 5MW+ | 0.030€/kWh | 5MW+ | 0.024€/kWh | 20 years |

PV plants using innovative technology feed-in tariff

| Size | Incentive | Term |

| 1-20kW | 0.242€/kWh | 20 years |

| 20-200kW | 0.231€/kWh | 20 years |

| >200kW* | 0.217€/kWh | 20 years |

PV plants using innovative technology self-consumption tariff

| Size | Incentive | Term |

| 1-20kW | 0.160€/kWh | 20 years |

| 20-200kW | 0.149€/kWh | 20 years |

| >200kW* | 0.135€/kWh | 20 years |

Concentrating PV plants feed-in tariff

| Size | Incentive | Term |

| 1-20kW | 0.215€/kWh | 20 years |

| 20-200kW | 0.201€/kWh | 20 years |

| >200kW* | 0.174€/kWh | 20 years |

Concentrating PV plants self-consumption tariff

| Size | Incentive | Term |

| 1-20kW | 0.133€/kWh | 20 years |

| 20-200kW | 0.119€/kWh | 20 years |

| >200kW* | 0.092€/kWh | 20 years |

* For PV plants with a nominal power over 1MWp, the GSE does not purchase the electricity produced but pays a feed-in premium that is determined as the difference between the feed-in tariff above and the applicable average electricity market price.

The feed-in premiums in the table are further increased by the following increments:

- €0.02/kWh for plants using modules and inverters that were produced in the European Union or European Economic Area if they enter into operation on or before 31 December 2013; €0.01/kWh if they enter into operation on or before 31 December 2014; and €0.005/kWh if they enter into operation after 31 December 2014.

- €0.03/kWh for plants up to 20 kW nominal power installed on rooftops with simultaneous complete removal of asbestos and €0.02/kWh for plants above 20 kW nominal power if they enter into operation on or before 31 December 2013; €0.02/kWh up to 20 kW nominal power and €0.01/kWh above 20 kW nominal power if they enter into operation on or before 31 December 2014; and €0.01/kWh up to 20 kW nominal power and €0.005/kWh above 20 kW nominal power if they enter into operation after 31 December 2014.

Source:McDermott Will & Emery Legal Analysis of Italian FIT

Latvia

| Size | Incentive | Term |

| >1MW | 0.427Ls/kWh | 10 years |

Source:Latvian Government FIT law

Lithuania

| Rooftop/ground-mounted | BIPV | Term | ||

| Size | Incentive | Size | Incentive | |

| <10kW | LTL 0.54/kWh | <10kW | LTL 0.69/kWh | 12 years |

| 10-100kW | LTL 0.49/kWh | 10-100kW | LTL 0.62/kWh | 12 years |

| >100kW | LTL 0.46/kWh | >100kW | LTL 0.58/kWh | 12 years |

Sources:RES Legal on Lithuanian FIT

Luxembourg

| Size | Incentive | Term |

| <30kW | 0.264€/kWh | 15 years |

Source:RES Legal on Luxembourg FIT

Macedonia

| Size | Incentive | Term |

| <50kW | 0.16€/kWh | 20 years |

| 50kW-1MW | 0.12€/kWh | 20 years |

Source:Energy Agency of the Republic of Macedonia

Malta

| Size | Incentive | Term |

| <40 kW | €0.155/kWh | 20 years |

| >40 kW | €0.15/kWh | 20 years |

Sources:Malta Resources Authority

Montenegro

The Montenegro FIT is only available for rooftop or building-integrated photovoltaic installations.

| Size | Incentive | Term |

| Any size | 0.15€/kWh | 12 years |

Source:OIE on Montenegro FIT

Netherlands

The Energy Investment Allowance (EIA) still allows entrepreneurs to deduct 44% of the investment costs for PV equipment (purchase and/or production costs) from their company's fiscal profit, over the calendar year in which the equipment was purchased (up to a maximum of €113 million).

Sources:Dutch FIT table (See under “Procedure” for the dates of each phase.)

Portugal

| Program | Size | Incentive | Term |

| Micro | <3.68kW | First 8 years: €0.066/kWh Last 7 years: €0.145/kWh |

15 years |

| Mini | 3.68-250kW | €0.106/kWh | 15 years |

Sources:RES Legal

Romania

Romania has a Green Certificates scheme, with the certificates selling for between 108€ and 220€ for each MW produced from solar sources for the next 6 years. Currently, the renewable energy sector is overwhelmingly made up of hydropower, with wind struggling to get a foothold.

Source:pv magazine article on Romanian Green Certificates

Serbia

| Rooftop | Ground-mounted | |||

| Size | Incentive | Size | Incentive | Term |

| <30kW | 0.2066€/kWh | Any size | 0.1625€/kWh | 12 years |

| 30-500kW | 0.2066€-0.1625€/kWh | 12 years |

Source:RES-Legal

Slovakia

Slovakia had FITs for larger installations, but as of April 1, 2011, an amendment to Act No. 309/2009 abolished the state aid scheme for PV systems with a capacity of more than 100kW which are not on the roof or exterior walls of a building. Thus, the FIT is only applicable to rooftop or BIPV installations under 100 kW in capacity.

| Size | Incentive | Term |

| <30kW | 0.09894€/kWh | 15 years |

Sources:RES Legal Slovakian FIT analysis

Slovenia

These payments degress by 2% per month. If a building-mounted installation under 5 kW is connected behind a user's meter, the system receives a 5% greater tariff payment.

| On buildings | Ground-mounted | Term | ||

| Size | Incentive | Size | Incentive | |

| <50kW | €0.07105/kWh | <50kW | €0.06675/kWh | 15 years |

| 50kW-1MW | €0.06496/kWh | 50kW-1MW | €0.06149/kWh | 15 years |

Sources:RES Legal on Slovenian FIT

Spain

The new Spanish government, under Prime Minister Mariano Rajoy, has suspended all incentives for photovoltaic systems in response to the current financial situation. They have not made clear when, if ever, any incentives will be reinstated. They did make clear that this will not retroactively affect installations which previously secured feed-in tariffs. In place of the FIT, there is legislation in place that allows small generators of up to 100 kW to connect to the grid and receive the market price for any electricity they feed in. Prior to suspension, the planned tariffs were as follows:

| Rooftop/BIPV | Ground-mounted | Term | ||

| Size | Incentive | Size | Incentive | |

| <20kW | 0.283€/kWh | Any size | 0.121716€/kWh | 30 years |

| >20kW | 0.15675€/kWh | 30 years |

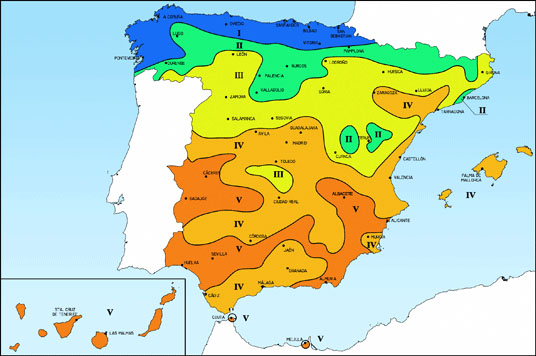

The Spanish tariff is also limited in how many hours per year it will be paid under Royal Decreto (RD) 14/2010. Until 31 December 2013, the number will be fixed across the country, but from 2014, the country will be divided into five climactic zones (shown in image below) with corresponding limits as follows:

| Until 31 Dec, 2013 | Fixed Installation | Installation with 1-axis tracking | Installation with 2-axis tracking |

| 1250 | 1644 | 1707 | |

| From 2014 onward | |||

| Zone I | 1232 | 1602 | 1664 |

| Zone II | 1362 | 1770 | 1838 |

| Zone III | 1492 | 1940 | 2015 |

| Zone IV | 1632 | 2122 | 2204 |

| Zone V | 1753 | 2279 | 2367 |

Sources:Spanish Royal Decreto 14/2010

pv magazine article on Spanish FIT suspension

Suelo Solar information on Spanish FIT

Sweden

Sweden offers a direct capital subsidy for the installation of grid-connected PV systems, which covers 35% of the installation cost. This is available to systems with a cost below SEK 37,000/kWp (excluding value-added tax). For solar power and heating hybrid systems, this maximum is SEK 90,000/kWp (excluding value-added tax). If the system costs more than SEK 1.2 million, then only the part of the system below this value is subsidized.

Sweden also has a green electricity certificate system and shares a joint certificate market with Norway. In 2013 the average price of a certificate was SEK 197/MWh. Currently only about one eighth of all PV-generated electricity receives green electricity certificates, because only surplus exported electricity receives certificates.

Sources:IEA-PVPS

Switzerland

| Rooftop | BIPV | Ground-mounted | Term | |||

| Size | Incentive | Size | Incentive | Size | Incentive | |

| <30kW | CHF 0.204/kWh | <30kW | CHF 0.240/kWh | <30kW | CHF 0.204/kWh | 25 years |

| 30-100kW | CHF 0.177/kWh | 30-100kW | CHF 0.201/kWh | 30-100kW | CHF 0.176/kWh | 25 years |

| 100kW-1MW | CHF 0.176/kWh | 100kW-1MW | CHF 0.177/kWh | 25 years | ||

| 1MW+ | CHF 0.176/kWh | 1MW+ | CHF 0.176/kWh | 25 years |

Source:Swiss Solar 2013 FITs

Ukraine

To prevent exchange risk, the Ukrainian FIT provides a minimum tariff (i.e. a safety net) based on the exchange rate of the Ukrainian Hryvna to the Euro on 1st January, 2009. As of January 1, 2012, the Green Tariff Law will also require that 30% of the value of the materials, works and services used in construction must come from Ukraine. As of January 1, 2014, this increases to 50%.

| Rooftop/BIPV | Ground-mounted | ||||

| Time | Size | Incentive | Size | Incentive | Term |

| <100kW | €0.172/kWh | Any size | €0.160/kWh | Until 2030 | |

| >100kW | €0.190/kWh | Until 2030 |

Sources:Ukrainian FITs law

International Energy Agency on Ukrainian FITs

United Kingdom

| Rooftop/BIPV | Ground-mounted | Term | ||||

| Rate | Size | Incentive | Rate | Size | Incentive | |

| High rate | <4kW | £0.1203/kWh | High rate | Any size | £0.0638/kWh | 25 years |

| Medium rate | <4kW | £0.1083/kWh | Medium rate | Any size | £0.0573/kWh | 25 years |

| Low rate | <4kW | £0.0573/kWh | Low rate | Any size | £0.0573/kWh | 25 years |

| High rate | 4-10kW | £0.1090/kWh | 25 years | |||

| Medium rate | 4-10kW | £0.0981/kWh | 25 years | |||

| Low rate | 4-10kW | £0.0573/kWh | 25 years | |||

| High rate | 10-50kW | £0.1090/kWh | 25 years | |||

| Medium rate | 10-50kW | £0.0981/kWh | 25 years | |||

| Low rate | 10-50kW | £0.0573/kWh | 25 years | |||

| High rate | 50-150kW | £0.0929/kWh | 25 years | |||

| Medium rate | 50-150kW | £0.0836/kWh | 25 years | |||

| Low rate | 50-150kW | £0.0573/kWh | 25 years | |||

| High rate | 150-250kW | £0.0889/kWh | 25 years | |||

| Medium rate | 150-250kW | £0.0800/kWh | 25 years | |||

| Low rate | 150-250kW | £0.0573/kWh | 25 years | |||

| High rate | 250kW+ | £0.0573/kWh | 25 years | |||

| Medium rate | 250kW+ | £0.0573/kWh | 25 years | |||

| Low rate | 250kW+ | £0.0573/kWh | 25 years | |||

In addition to the feed-in tariff, any excess electricity exported into the grid receives an export tariff. This is index-linked to the retail price index and was £0.0477/kWh as of April 1, 2014.

Sources:OFGEM FIT information